Buy H-shares to position for macro improvement ahead

Thanks to a subscriber for this report which may be of interest. Here is a section:

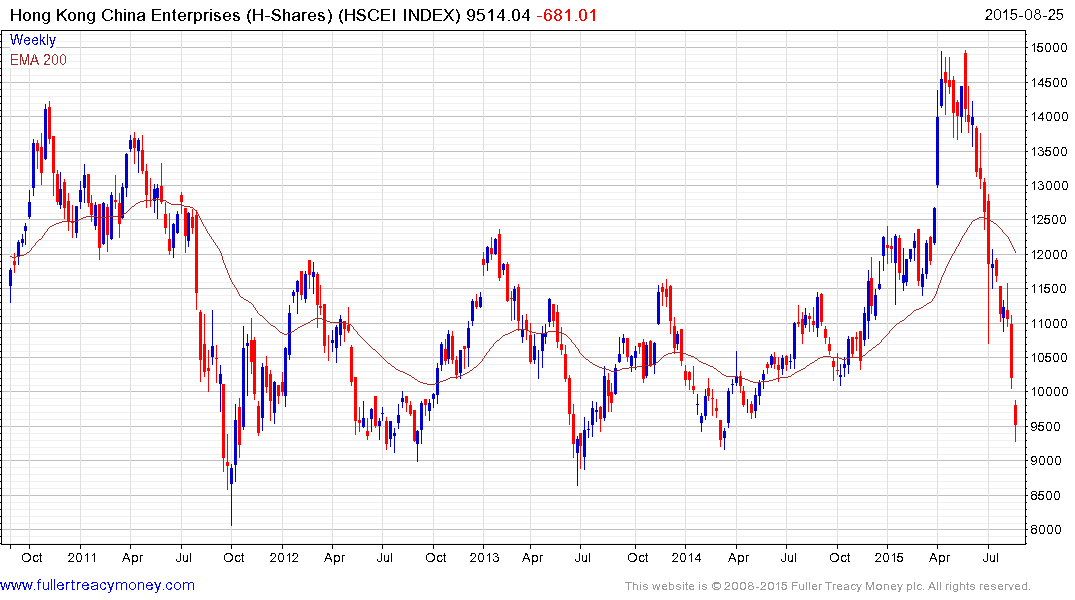

H-shares dropped below the earlier index bottom on 8 July and reached a two-year low. Currently, the MSCI China index trades at 8.4x 12-month forward P/E, at a 28% discount to the 10-year average (Figure 3). The non-financial MSCI China is now at 11.8x; if we exclude the 26x valued Tencent, non-financials would be at only 10.4x. Based on current index levels, the implied H-share equity risk premium stands at an elevated 8.3% vs. a 10-year average of 5.4% (Figure 4), suggesting that investors may have priced in some pretty bad scenarios; in other words, for market valuations to slide further, the actual situation would need to be a lot worse than investors thought.

Apart from low valuations and low investor expectations, H-shares also look oversold technically speaking, with the 14-day RSI of the HSCEI falling to 16 (Figure 5), implying that selling pressure may have been exhausted in the near term. In addition, based on empirical observations since the Global Financial Crisis (Figure 6), current valuations of 8.4x may provide visible valuation support to the MSCI China index. We note that today is the second day with more than Rmb8bn net inflows (> 60% of daily quota) to buy A-shares via the northbound Shanghai-HK Stock Connect (Figure 2).

Here is a link to the full report.

The Chinese government has stopped intervening to support the mainland stock market but has cut interest rates and the reserve requirement at banks which suggests they are taking a more broad-based approach to supporting the wider economy than the simply the stock market. This is a positive development for the banking sector in particular. The stock market extended its decline today, and while the removal of artificial supports have increased volatility the market will also return to a status quo quicker as a result.

The H-Shares Index has some of the most attractive valuations of any market globally but has also been the vehicle foreign investors have used to express a bearish view on the mainland indices. It is now back to test the lower of its six-year range. A deep short-term oversold condition is evident as the Index trades in the region of the psychological 10,000 level. The first clear upward dynamic will confirm a low of at least near-term significance but a succession of higher reaction lows will be needed to signal a return to demand dominance beyond scope for a bounce.

Among some of the higher profile Chinese shares:

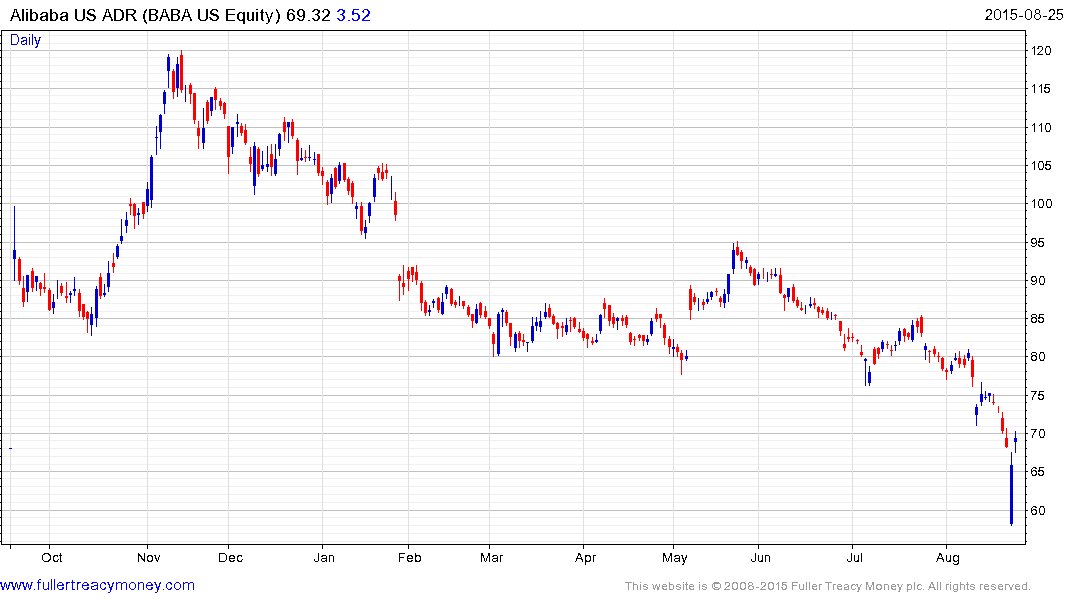

Alibaba continues to unwind a short-term oversold condition but a break in the medium-term progression of lower rally highs will be required to signal a return to demand dominance beyond short-term steadying.

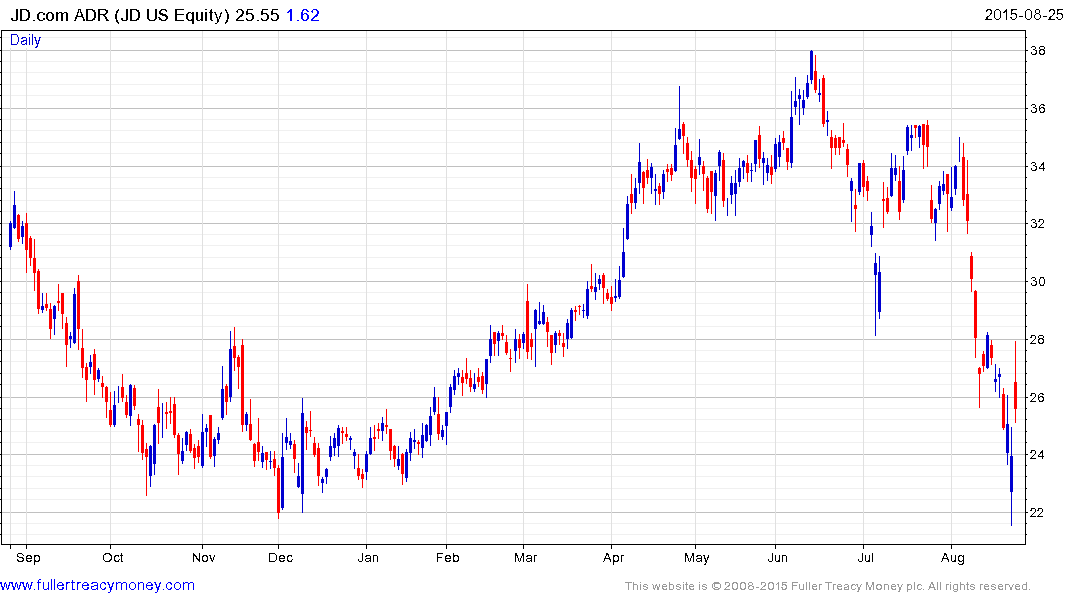

JD.com almost halved from its June peak but has found at least short-term support in the region of October lows.

VIPshop also dropped by 50% from its peak but has at least paused in the region of $15.

Hong Kong listed AIA Group dropped earlier this month to break the medium-term uptrend and a relief rally is now underway. A sustained move back above the trend mean will be required to signal a return to demand dominance beyond the short term.

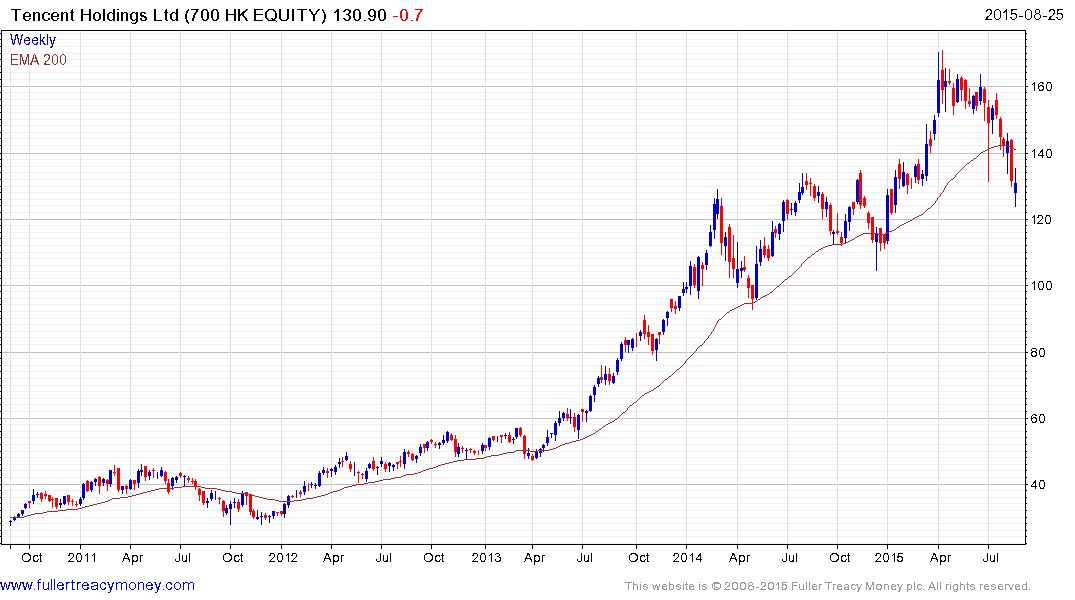

Tencent Holdings has also dropped below its MA and will need to hold the HK$120 area if potential for higher to lateral ranging is to be given the benefit of the doubt.