Musings from the Oil Patch August 24th 2016

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB which may be of interest. Here is a section:

The Obama administration’s Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) released their Phase II fuel efficiency and greenhouse gas emissions regulations for heavy-duty trucks. This group includes the largest pickup trucks sold as well as the traditional 18-wheelers on the highways. The standards are to be phased in between the 2021 and 2027 model years. The existing standards, which were designed for the 2014 through 2018 model years, will remain in place until the new standards take effect.

The heavy-duty truck standards come as the government has just begun negotiations with auto manufacturers over the final fuel efficiency ratings for light-duty vehicles where the industry is lagging behind the targets in the standards. Heavy-duty trucks are the second largest and fastest growing segment of the U.S. transportation system measured by their emissions and energy use. They currently account for about 20% of carbon emissions, yet only account for about 5% of the vehicle population.

Carbon emissions from transportation is now the largest contributor to overall greenhouse gas emissions. Three charts showing annualized sector shares of total emissions confirm this conclusion. It should be noted that the country’s total carbon emissions peaked in January 2008 and have declined steadily since. On an absolute basis, over the past 8 1/3 years there are 1,410.1 million metric tons of less carbon emissions, or a decline of 16.2%. The transportation sector contributed about 9.1% of that decline. The significance is that transportation’s emissions dropped 6.4% over that time span while overall emissions declined 16.2%. The overall figure reflects the sharp decline from coal’s use due to the shale revolution and low natural gas prices along with static electricity consumption. At the same time, the decline and then flat trend in vehicle miles driven coupled with more fuel-efficient autos also helped reduce the transportation sector’s emissions. One can see these trends at work by looking at the sector shares in 1973, 2008 and 2016.

The United States has done well in reducing its carbon emissions by 16.2% since the start of 2008. The weak economy and energy revolution have been primarily responsible. Going forward, the energy policies targeting the transportation sector, coupled with technological improvements in overall energy use, will become more important in driving down carbon emissions. Thus, the reason for the heavy-duty truck standards. They have support from the industry and truck manufacturers who see economic opportunities from more efficient engines. The Independent Truck Owners Association estimates the new standards will add $12,000-$14,000 to the cost of new tractors, which often cost upwards of a quarter of a million dollars, but they hope to recover those higher costs through improved fuel efficiency.

Here is a link to the full report.

The surge in supply of natural gas coupled with the fact it is both cleaner than other fossil fuels and domestically available is supporting a revolution in developing new sources of demand. Toyota is now marketing is hydrogen fuelled Mirai automobile in the USA where the hydrogen will be sourced from natural gas. Improving the efficiency of the heavy vehicle fleet is a laudable goal and will also improve the environment so it can be viewed as a win win which is dependent on natural gas prices staying competitive.

Natural gas has struggled to sustain a move above $5 since 2009 but is now rallying from the lower side of a long-term range and found support this week from the region of the trend mean. A sustained move below $2.50 would be required to question potential for additional upside.

Cummins (Est P/E 15.25, DY 3.28%) is among the largest providers of engines to the haulage sector. The share has been ranging in the region of the trend mean from April but reasserted demand dominance earlier this month. Some unwinding of the short-term overbought condition is now underway but a sustained move below the $115 area would be required to question the recovery trajectory.

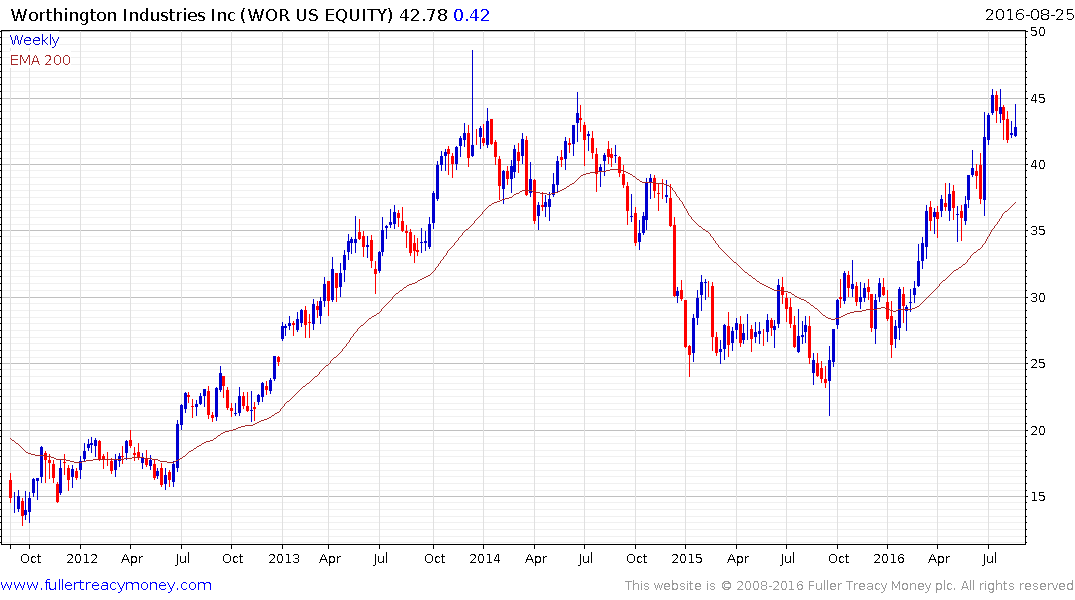

Worthington Industries (Est P/E 15.01, DY 1.87%) which produces gas cylinders and automotive body panels has surged from its late 2015 lows and has returned to test the 2013/14 peak. Some consolidation is underway but a break in the progression of higher reaction lows would be required to question medium-term scope for additional upside.