'There's No Plan B': Oil Chiefs Sound Alarm on Refining Woes

Thanks to a subscriber for this article which may be of interest.

Low stockpiles are driving an “incredibly strong” diesel structure, signaling market tightness, said Ben Luckock, co-head of oil trading at Trafigura Group.

It’s becoming more expensive to fund normal refining projects, Alex Grant, senior vice president for crude, products, and liquids at Equinor SA, said in an interview. Existing refineries will operate at the highest rates they can, with refining margins staying high, he said.

The refining system is “crying out” for fresh investment with oil demand still growing, especially in Asia, said Sri Paravaikkarasu, director of market analysis at Phillips 66. Refiners need to cater to it, while also accounting for the green energy transition, she added.

It is almost impossible to raise funding for new refineries. These are long-life assets that depend on secure order flow to justify the enormous capital expense of construction. Since investors are often precluded from investing in emerging infrastructure that cuts off a potential source of capital. The additional concern is oil demand has peaked in China so why take the risk of building additional supply capacity.

This is a classic supply inelasticity meets rising demand environment. Prices for refined products are rising not because of a lack of inputs but refining capacity is tight and unlikely to be improved.

This is a classic supply inelasticity meets rising demand environment. Prices for refined products are rising not because of a lack of inputs but refining capacity is tight and unlikely to be improved.

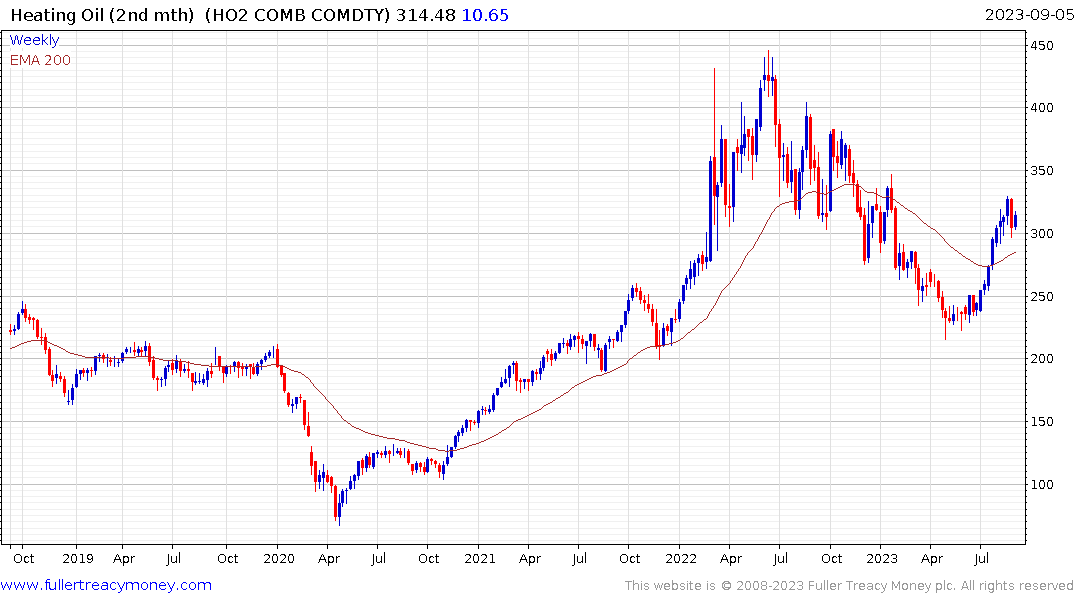

Heating oil has been outperforming crude oil since the pandemic began and remains on an upward trajectory.

Heating oil has been outperforming crude oil since the pandemic began and remains on an upward trajectory.

Gasoline’s continuation chart has been perforated by gaps because of the wide backwardation during contract rolls. The October contract has found support at $2.50 and continues to hold the breakout.

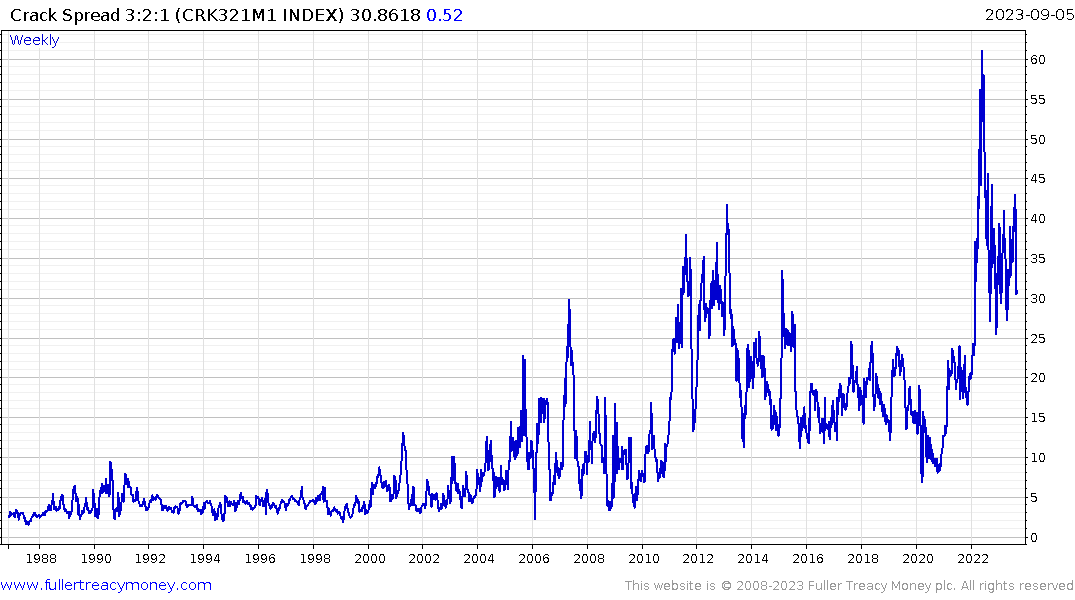

The 321-crack spread has been ranging above 30 since early 2022. That’s the upper side of the long-term base and is the primary support for more refining shares to follow Marathon Petroleum Corp and Valero higher.