Yum! Brands to Split China Division Into Separate Company

This article by Kevin Orland may be of interest to subscribers. Here it is in full:

Yum! Brands Inc., whose restaurants have been selling crispy chicken in Beijing since 1987, plans to split its China business off into a separate publicly traded company following pressure from activist investor Keith Meister.

The new company will be led by Micky Pant, who was named the China unit’s chief executive officer in August, the Louisville, Kentucky-based company said Tuesday in a statement. Greg Creed will continue to lead Yum.

Yum is hiving off the China business after a prolonged sales slump caused by food-safety scandals and increasing competition from local fast-food chains. Meister, a protege of billionaire Carl Icahn, has said the company’s Asian market could be better served with a more focused business and that the move could boost Yum’s value by $7 billion. The company said Tuesday that it is committed to returning "substantial capital" to shareholders in connection with the split.

Yum shares rose 4.2 percent to $74.75 at 7:09 a.m. in early trading in New York. The stock had slid 1.6 percent this year through Monday.

Splitting up the company is a big decision which was probably precipitated by the large profit miss earlier this month. KFC has been enormously successful in China but the question now is whether it has reached capacity. It is certainly ubiquitous in the larger cities so the company’s Chinese growth will depend on incomes rising, for what is a premium product, in tertiary cities particularly in the west.

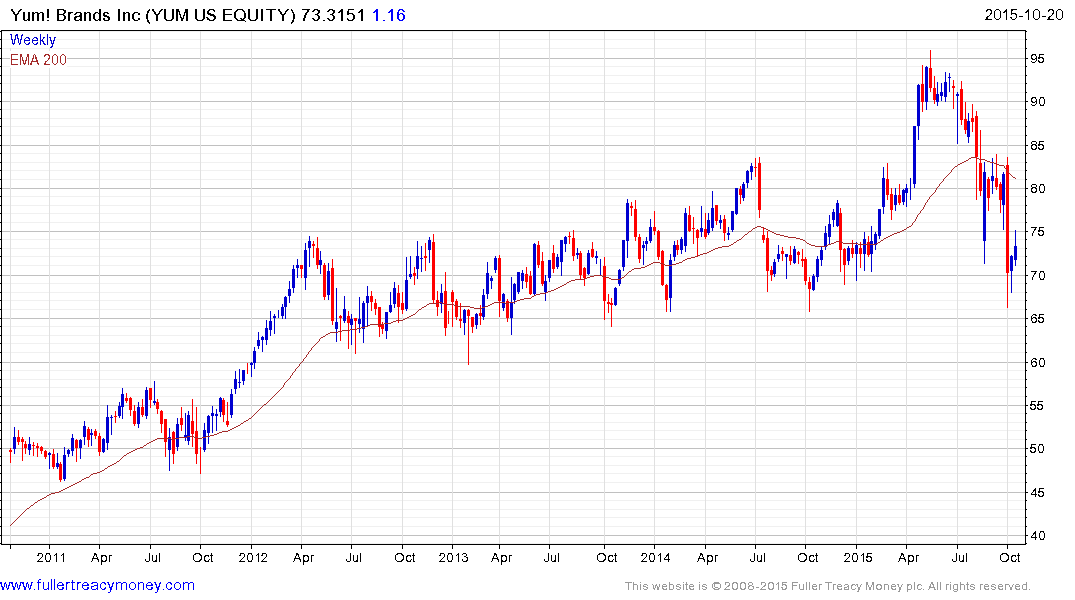

The share (Est P/E 23.21, DY 2.5%) extended its bounce on the news but will need to hold the low near $65 on any pullback if the medium-term uptrend is to hold.

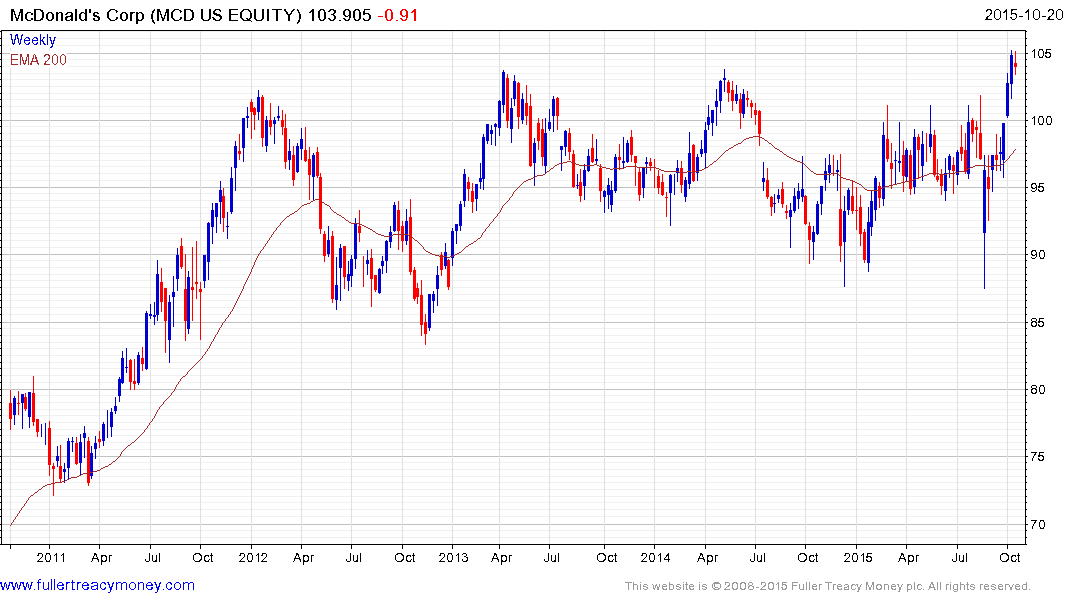

McDonalds (Est P/E 22.12, DY 3.27%) on the other hand moved to a new all-time high this week. It is somewhat overbought in the very short-term following a swift rally from the lower side of its almost 4-year range. Its all-day breakfast offering has been warmly received and there is speculation the company is considering sales from its massive real estate holdings. A sustained move below the trend mean, currently near $98 would be required to question potential for additional upside.

Starbucks (Est P/E 38.29, DY 1.06%) has a world class management team and a great franchise with loyal customers but is trading on a racy multiple. The pace of the trend is accelerating and the first clear downward dynamic is likely to signal mean reversion is underway.

Coca Cola (Est P/E 21.04, DY 3.13%) has rallied from the late August low to break a yearlong progression of lower rally highs and while somewhat overbought in the short term, a sustained move below $40 would be required to question medium-term scope for additional higher to lateral ranging.

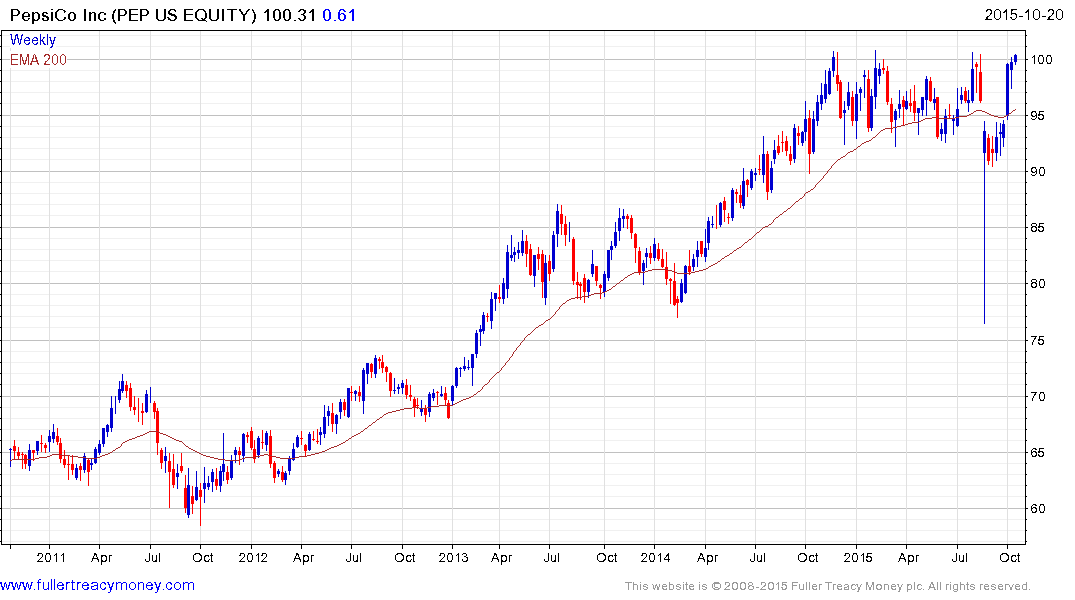

PepsiCo (Est P/E 22.01, DY 2.8%) is now testing the upper side of an 18-month range and a clear downward dynamic would be required to question current scope for a successful upward break.

Fast food and fast service aren’t the only things these companies have in common. Impressive dividend growth rates, long records of paying dividends and attractive yields following lengthy ranges are also a common factor. This suggests the sector may be returning to favour among investors.

Back to top