US Economic Growth Slows to 1.1% While Inflation Accelerates

This article from Bloomberg may be of interest to subscribers. Here is a section:

The outlook depends largely on the resiliency of the job market. Low unemployment and persistent wage gains have so far allowed consumers to weather high inflation and keep spending.

The personal consumption expenditures price index grew at an 4.2% annualized pace in the January to March period. Excluding food and energy, the index rose 4.9%, faster than forecast and the most in a year. March data will be released Friday. Services inflation remained hot while prices of non-durable goods accelerated.

The inflation and consumer spending figures likely keep the Fed on track to raise interest rates by a quarter percentage point next week. First Republic Bank’s continuing struggles, however, do raise the possibility that the central bank could pause.

Consumer demand surged in the early part of the first quarter and eased back in the later part of the quarter. At the same time economic growth eased and inflation increased.

This is what an inflationary boom looks like. When people fear the price of what they want will be higher in future, they pull forward the buying decision.

That implies buying the luxury item now because it will certainly be higher in future. Buying non-perishable food items in bulk, buying the new car at the beginning of the year rather than waiting, or prepaying for the holiday now. The risk is this kind of activity will not be repeated or will be volatile depending on need and perceptions of inflation.

Services providers have also been flexing their pricing power and that has a more durable impact on inflation. That is the primary rationale for why the Fed would continue to raise rates.

2-year yields have paused around the 4% level which suggests traders are not quite yet willing to give up on the possibility the terminal rate will be higher.

When inflation is running above 4% and economic growth is expected to decline to 1.1%, the economy is contracting in real terms. That’s not good news.

There are many people talking about the risk of stagflation, but the missing ingredient is high unemployment. So far, the trend of retirements and inactive potential workers is holding jobless figures down but that is not a permanent condition.

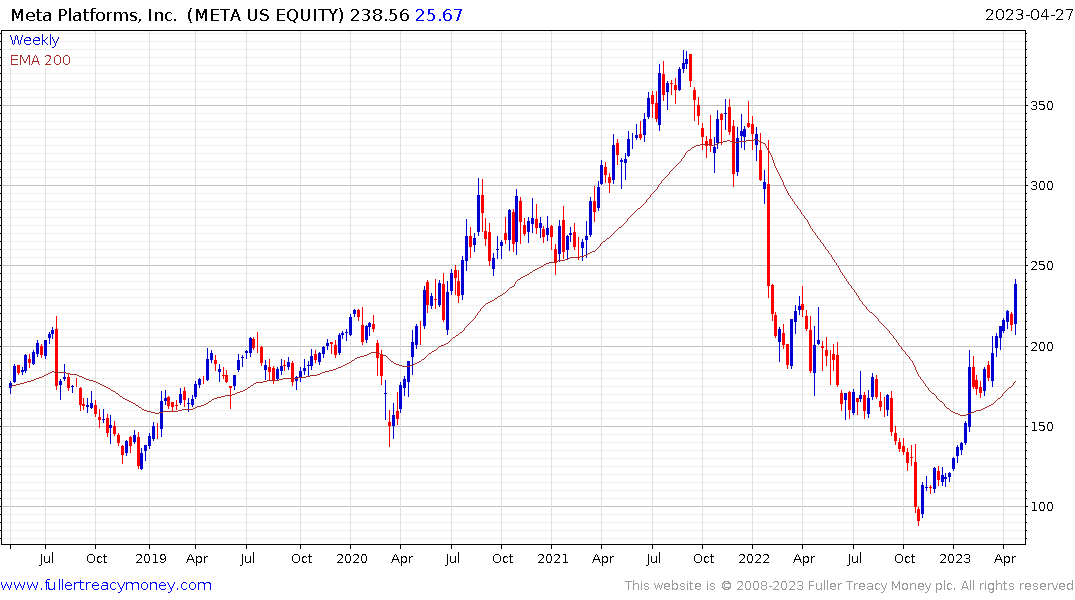

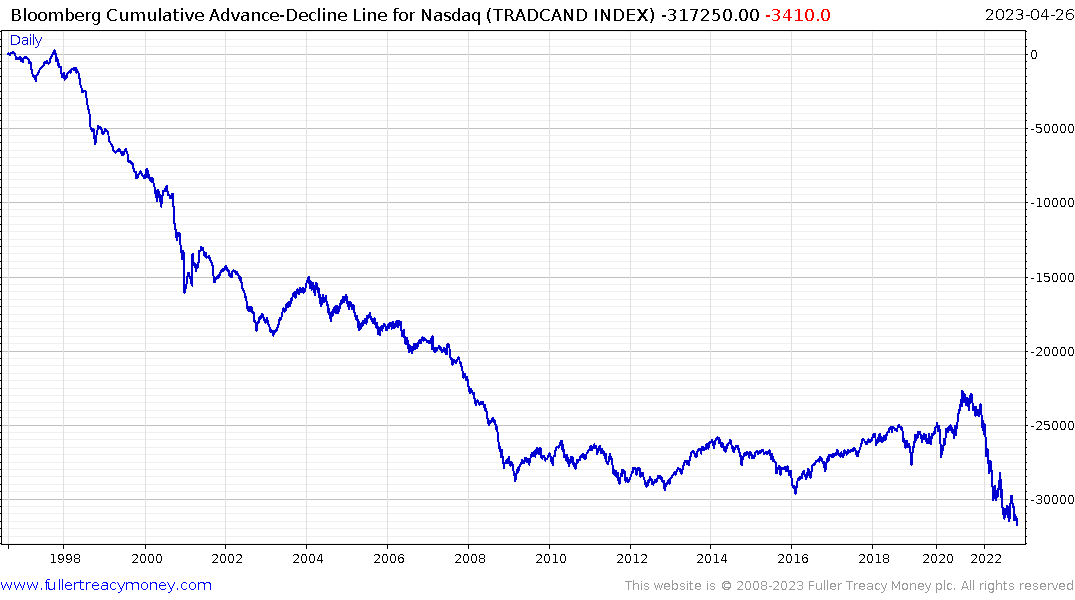

Meta’s strong earnings, following Microsoft’s surge are spurring the stock market in the short term. The dismal performance of the Nasdaq Composite’s Advance-Decline Line highlights how narrow the breadth in the Index has become.

That suggests there will be a lot of single stock volatility even as the primary indices remain quite steady.