U.K. Pollsters See May Upping Majority Even as Lead Shrinks

This article by Tim Ross for Bloomberg may be of interest to subscribers. Here is a section:

May is set for a healthy majority of at least 50 seats which could become a landslide of as many as 200. “In this type of election, which has switched back to two-party politics, once you start polling in the 40s you can win big.” Tony Blair won his landslide in 1997 with 43 percent of the vote. The "numbers behind the polls” -- such as the relative ratings of the leaders and who’s best to manage the economy -- all still favor May.

Joe Twyman, head of political polling at YouGov

May should get a majority of 40 to 60 seats. “A lot could still happen. The Tories have not had a good campaign. Labour have had a better one, but started from a low base. Turnout will be crucial given how age is now such an important social cleavage in Britain.”Adam Drummond, senior research manager at Opinium

May is on course to win a majority of 72, based on the latest data. Even if the Tory lead narrows further, she should still have a majority of 50 to 70, partly because the party’s so far ahead of Labour among older voters "who always go out to vote."

Flip flopping on policy initiatives in the middle of an election campaign does not make for good optics. Unfortunately when a party goes into an election as the presumed leader it is hard to campaign with the same ferocity and leaves open the potential for opposing parties to improve on their position. That still won’t result in Jeremy Corbyn becoming Prime Minister but is has created uncertainty.

.png)

The Euro is currently testing the upper side of its range against the Pound and a sustained move above 88p would be required to question potential for at least a pause in this area.

Meanwhile the FTSE-100 continues to hold the break above the psychological 7000 level and a sustained move below it would be required to begin to question medium-term scope for additional upside.

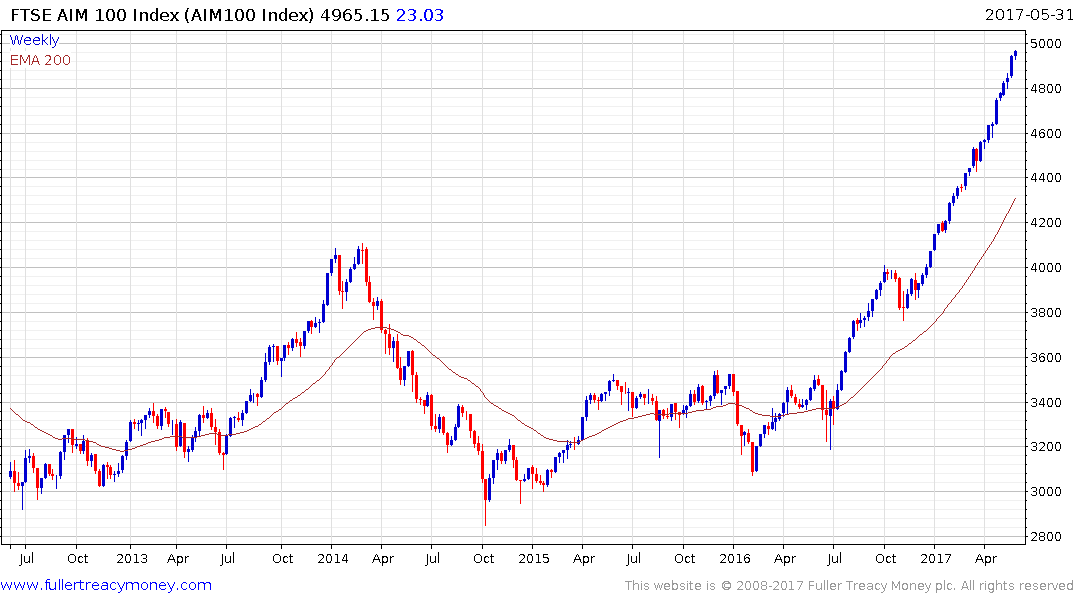

The AIM100 Index, which is much more heavily influenced by the impact of currency weakness and the health of the domestic economy, continues to extend what has been an impressive yearlong uptrend. It is now testing the psychological 5000 area so there is scope for consolidation of these gains, but a sustained move below the trend mean would be required to question medium-term uptrend consistency.