Trump Gives Americans the Gift of High Lumber Prices

This article by Justin Fox for Bloomberg may be of interest to subscribers. Here is a section:

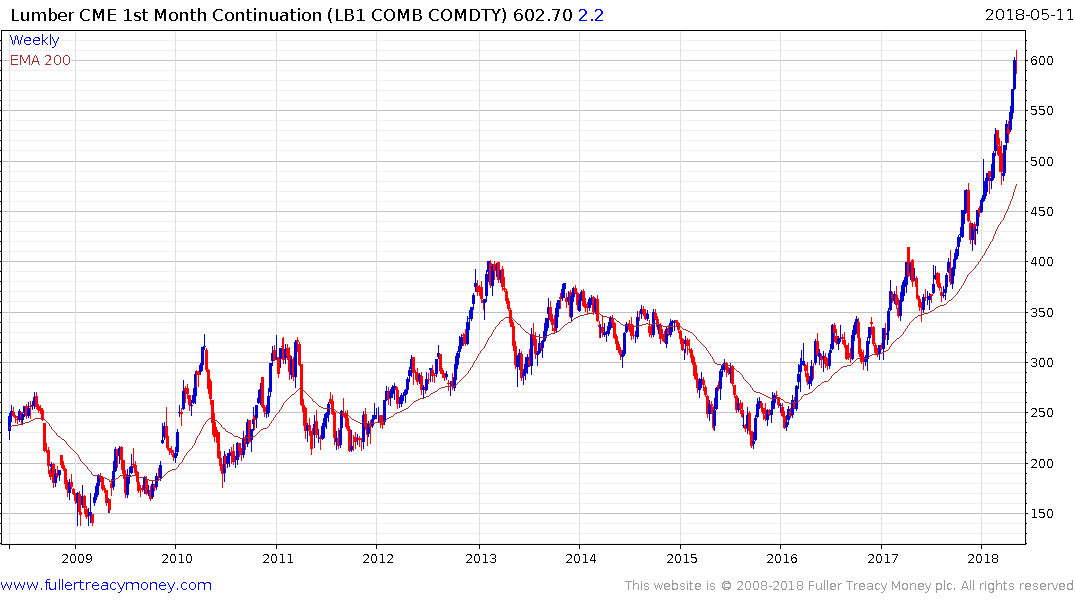

Lumber prices are really high right now! The Chicago Mercantile Exchange futures contract for the softwood two-by-fours used in framing houses closed at its highest price ever on Tuesday, in fact.

If one adjusts for inflation, current prices are no longer record-setting. But an interesting pattern does appear if one adds in a few other key data points.

It appears that every time the U.S. picks a fight with Canada over its alleged subsidies of softwood lumber — which comes from coniferous trees such as pines, firs and cedars — U.S. lumber prices go up. The match is likely even closer than the chart above indicates, given that threats of tariffs (“countervailing duties,” to be precise) and follow-up tariff increases also affected prices.

The U.S.-Canada softwood lumber war first flared up in the early 1980s. Imports of lumber from Canada had been on the rise as environmental restrictions cut back on logging in U.S. National Forests, and the U.S. timber industry began to complain that Canadian local, provincial and national governments, which own almost all of the country’s forest land, were charging such low prices for timber that it amounted to an unfair subsidy.

How long before the homebuilding lobby starts to complain about an inability to pass on higher input costs to the end consumer? So far, the rising real estate market has meant that hasn’t been an issue, but it is inevitable at some stage. When that happens the reduction in tariffs on Canadian timber will represent a significant headwind for lumber prices. After all, the oldest adage in the commodity markets is “the cure for high prices is high prices”.

Lumber continues to accelerate following the breakout from a 24-year range last year. It has been limit-up on multiple occasions over the last few weeks. At some stage the exchange will either widen the limits or increase margins. Either, or indeed both, of these measures is likely to act as a catalyst for a peak. There have been reactions of approximately $60 on two occasions since September and a reaction of more than that will be required to check momentum beyond a pause.