Treasury Yields Leap as Jobs Data Spur Bets on Bigger Fed Hikes

This article from Bloomberg may be of interest to subscribers. Here is a section:

Yields on two-year Treasuries surged in response to the jobs report, a reflection of the expected Fed rates over that period. Market pricing indicated a 75 basis-point increase to the Fed’s key rate is now seen as a more likely outcome in at the central bank’s September meeting than 50 basis points.

Powell has described the labor market as “tight to an unhealthy level,” and has been seeking a moderation to help bring demand for products and services more in line with supplies that have been constrained by Covid-19 disruptions. He and other Fed leaders are worried about the potential for a wage-price spiral, with higher wages feeding into inflation in a cycle that is hard to break.

“This number is so comprehensively strong with a pretty significant uptick in wages,” said Mark Spindel, chief investment officer at MBB Capital Partners LLC in Chicago. “Companies are paying up for labor. Income matters most. When you look at the breadth of the employment report, and the earnings, this is an enormous tailwind for income.”

It has been widely reported that the USA has missed out on 2 million immigrants following the isolationist policies adopted by President Trump’s administration. At least 1 million of those would have been highly educated/skilled individuals.

At present there is a crisis on the southern border because only those policies that stopped unskilled workers from entering, like the remain in Mexico program, have been abandoned. 2 million people walked across the southern border last year and the number could easily be higher in 2022. Here is a section from an article by NBC news:

In the first two weeks of July, the average number of undocumented migrants being stopped at the southern land border every day was 6,800…

Eventually many of these mostly unskilled workers will find their way into the employment of some form. That will do little to mend the mismatch between supply and demand that has resulted in job opening hitting a recent peak of 12 million. That supports the wage/price spiral argument and implies more aggressive action to counter it.

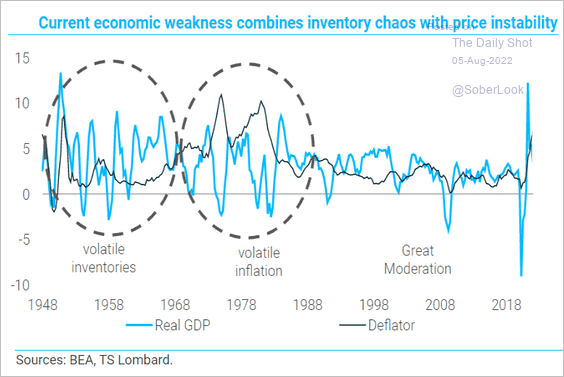

This graphic from TS Lombard may be of interest. If we are moving back into a more volatile period of real GDP growth, similar to the 1940s through 1980s it would imply much shorter cycles and central banks that act quickly to contain any sign of inflation. That’s very different from anything we’ve seen in the last 30 years.

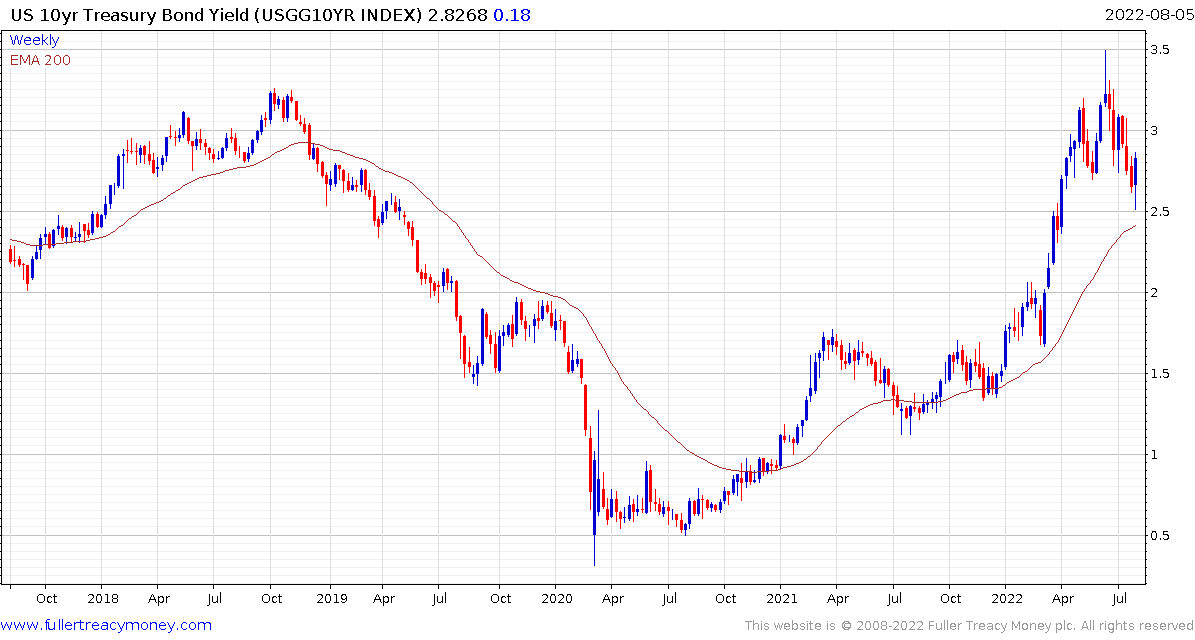

Both Treasury yields and the US Dollar Index posted upside key day reversals on Tuesday and followed through on the upside today. Pricing in more rates hikes that persist for longer could easily act as a catalyst for short-term overbought conditions on stocks to be unwound.