These Are the World's Most Innovative Economies

This article by Michelle Jamrisko and Wei Lu for Bloomberg may be of interest to subscribers. Here is a section:

South Korea remained the big winner, topping the international charts in R&D intensity, value-added manufacturing and patent activity and with top-five rankings in high-tech density, higher education and researcher concentration. Scant progress in improving its productivity score — now No. 32 in the world — helps explain why South Korea’s lead narrowed in the past year.

Silver medal winner Sweden owes most of its rise to improvement in the manufacturing value-added metric, while Nordic neighbor Finland jumped two spots in large part because of the rise of high-tech firms in the country. Norway held its No. 14 spot from last year.

Fresh ideas tend to pay off big in Sweden, even as the current government is less business-friendly and has imposed labor taxes that could crimp business investment, said Magnus Henrekson, director of the Research Institute of Industrial Economics, a private foundation in Stockholm. The Swedes themselves promote an atmosphere of great personal ambition — unlike some European neighbors that emphasize the collective — and that’s a boon to innovation, he said.

“In the culture, people are super individualistic — this means that people have ideas and are very interested in pursuing them in this way in order to become wealthy,” said Henrekson. “The incentives are there and the tax system favors them.”

If the results of the above report are anything to go by then having a relatively small population and an export focus is a common theme for the most innovative countries in the world. Of course being from a small country means companies have to innovate if they are to compete globally. Small countries also can’t afford to slide on education because the pool of available workers is limited and needs to be nimble enough to supply the economy with the skills it requires. Success is therefore multiplied.

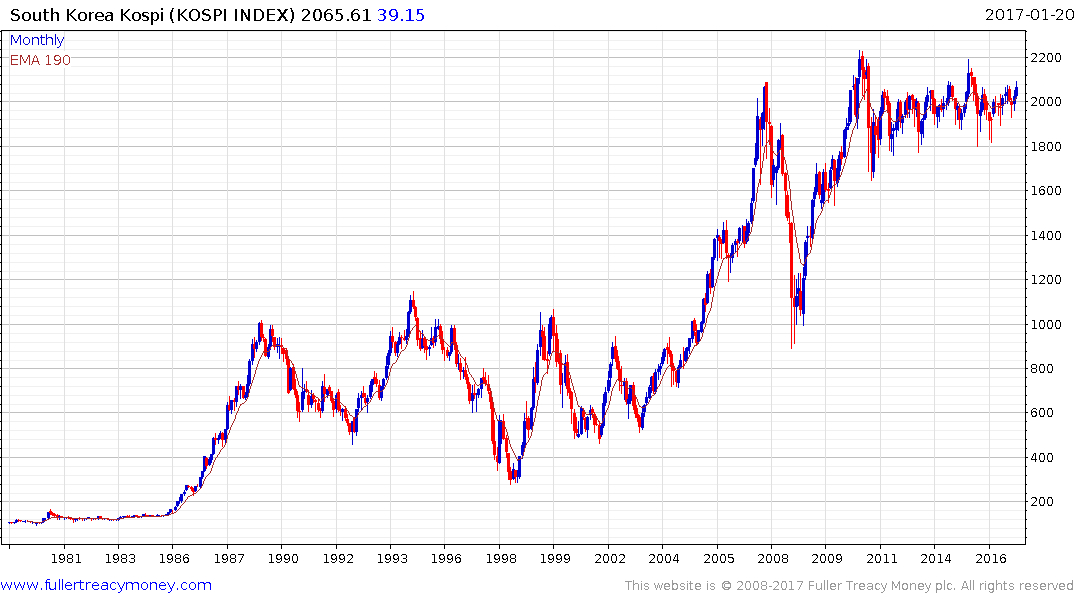

South Korea’s stock market has been largely rangebound since experiencing a steep pullback in 2011. It has rallied over the last couple of months to test the upper side of a lengthy medium-term range and a mild upward bias has been evident since late 2015. A sustained move above 2100 would signal a return to demand dominance beyond the short term.

Sweden’s OMX is performing in line with Germany’s DAX Index and rallied to break an 18-month progression of lower rally highs in June. The Index bounced this week from the round 1500 area and a sustained move below that level would be required to signal a deeper process of mean reversion is unfolding.

The Swedish Krona has rallied over the last few months to challenge the region of the lower side of the overhead range and the 200-day MA against the Euro. A short-term overbought condition is evident but a clear downward dynamic would be required to confirm resistance in this area.

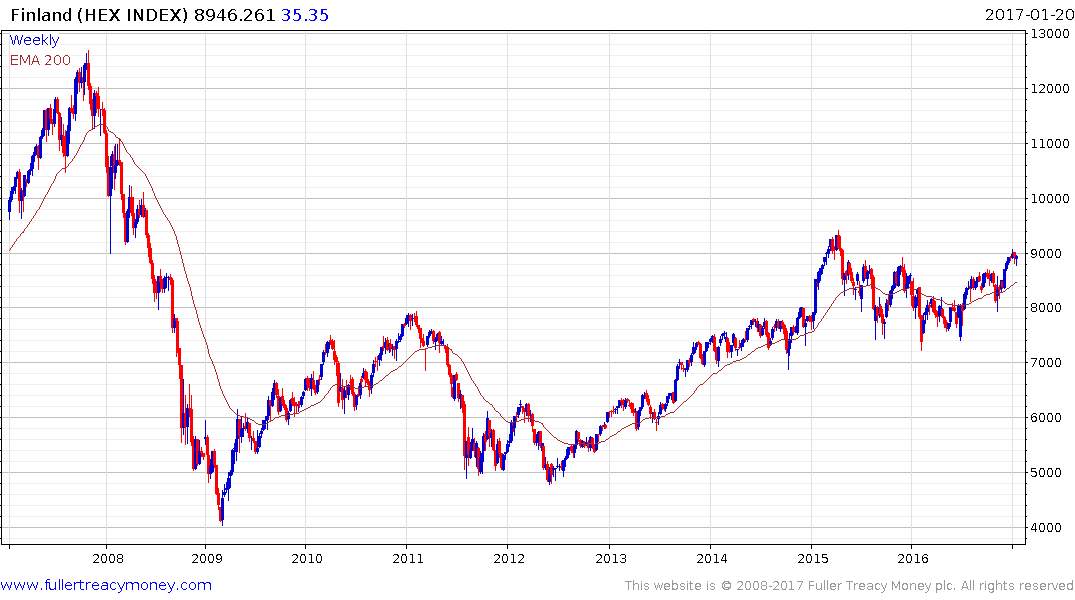

The Finnish HEX Index’s largest weighting is in Nordea Bank and the combined weighting of the paper/forestry sector is now larger than what remains of Nokia. The Index has been ranging mostly above the 8000 area since early 2015 and a rounding characteristic consistent with accumulation is evident over the last year. A sustained move below the 8000 area would be required to question medium-term scope for additional upside.