The Next Industrial Revolution: Computational Biology & Bioplatforms

Thanks to a subscriber for this article by James Currier at NFX, a private equity company focusing on biotech. Here is a section:

It bears mentioning that computational biology is objectively important. We’re talking about life itself: human DNA; the food we eat; infectious diseases; the evolution of species, and so on. "Biology is the only technology that can directly address fundamental problems facing the world like planetary and human health," says Arvind Gupta, Managing director & Founder of IndieBio and partner at SOSV. "These are world scale problems looking for technological solutions that will be developed in the next 20 years and those that do stand to create trillions of dollars of value". Rather than manufacturing tools for us to use, like cars or software, we’re now beginning to manufacture life itself.

Jennifer Doudna, co-inventor of CRISPR and co-Founder of Mammoth Biosciences(an NFX portfolio company) told us, "Scientists have spent centuries carefully studying how living things work. We have now entered into a new era of biology where it is possible to move beyond observation and towards rewriting the underlying code of living things, creating countless opportunities to improve the world we live in, from diagnosing and treating human disease to restoring the environment around us."

Further, something that has become clearer to us at NFX in the last three years: computational biology touches every industry. There are at least 90 companies worth over $20BN that are eyeing the CompBio space: agriculture; industrial; pharma; energy companies; plus all the big tech companies, like AWS, Google, and Microsoft. (Microsoft, for example, DNA that it hopes can replace cumbersome tape drives).

All of these industries are looking deeper at computational biology, trying to see how it is going to impact them.

Healthcare represents virgin territory for big data because it throws off so much data. The human brain has yet to be mapped, and one of the primary reasons is because the quantity of data required to be processed is in the order of petaflops. Colloquially, that is the computing capacity of all of Google’s programming power.

The speed with which big data is being applied to the big questions in both biotechnology and physics is speeding the up the pace of innovation because it allows the time between iterations to fall from weeks to hours. Coupled with innovative editing tools such as CRISPR the ability to put theory into action is also increasing. This is most evident today in the pace of drug discovery accelerating because more compounds can be tested in computer models to discover likely candidates. It is also evident in the ex vivo creation of customised solutions for cancer which is driving innovation in the immuno-oncology sector.

One of the challenges for investors is that the larger companies are buying up the smaller companies so one is forced into merger speculation. The companies focusing on the most exciting research are either small or privately held and the bigger companies are primarily focused on treating, rather than curing, chronic diseases, so innovation tends to be diluted

Illumina, the leader in genetic sequencing machines, pulled back sharply over the last four sessions and will need to confirm support in the $280 area if support building is to be given the benefit of the doubt.

Oxford Biomedica, with is patented lentiviral deliver vector has been announcing collaborations with numerous large companies. The share has rallied over the last week to test its sequence of lower rally highs.

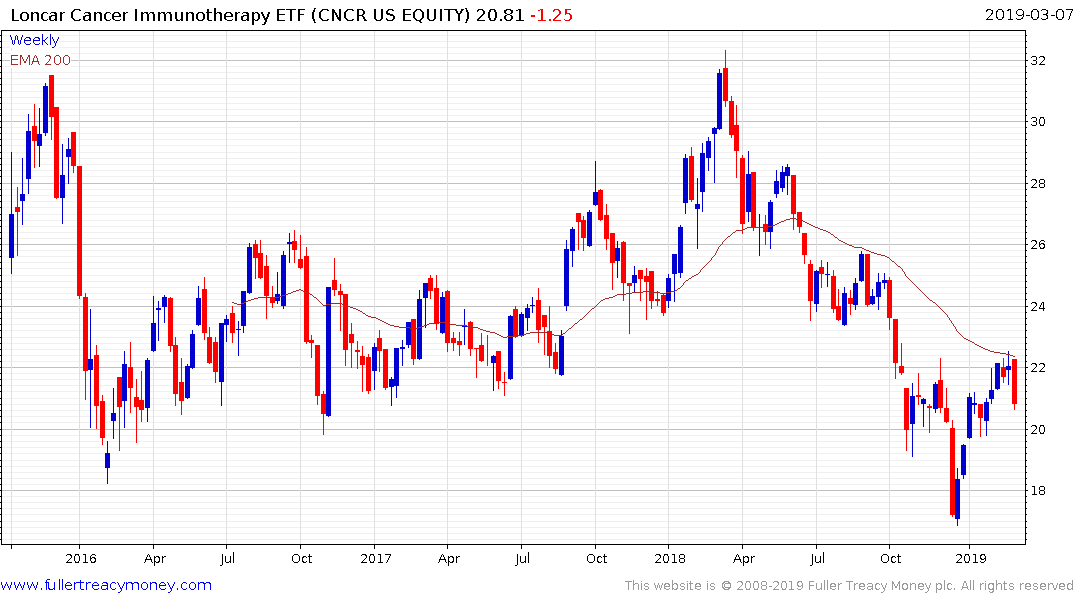

The Loncar Cancer Immunotherapy ETF pulled back sharply from the region of the trend mean today and needs to sustain a move above $22 to confirm a return to medium-term demand dominance.