Tech's Perfect Profit Record Fails to Impress Spoiled Bulls

This article by Sarah Ponczek for Bloomberg may be of interest to subscribers. Here is a section:

For a view of just how high the bar is set for technology stocks, consider this: Every single one of their earnings reports this season has topped forecasts. Yet the sector has recently gone from being 2020’s best performer to one of its biggest laggards.

Not that beloved tech companies have crumbled. Since the reporting season began July 14, the S&P 500 technology sector is up 0.7% while the Nasdaq 100 is virtually unchanged. But both have trailed the broader S&P 500 over the period, and tech’s performance is the second-worst of S&P’s 11 main sector groups.

That’s a change from earlier in 2020 -- a year in which megacaps and tech firms have been viewed as coronavirus havens because of their strong balance sheets, healthy profit pictures and the fact that some have actually benefited from the stay-at-home economy. Still, with the tech-heavy Nasdaq 100 up 22% this year, investors want proof that those stocks are worth the high prices they’re fetching.

“On the positive side, there are so many reasons why tech should be okay,” said Gene Goldman, chief investment officer at Cetera Financial Group. “But on the negative side, it’s just valuations and earnings. It’s a high bar that companies are going to have to beat.”

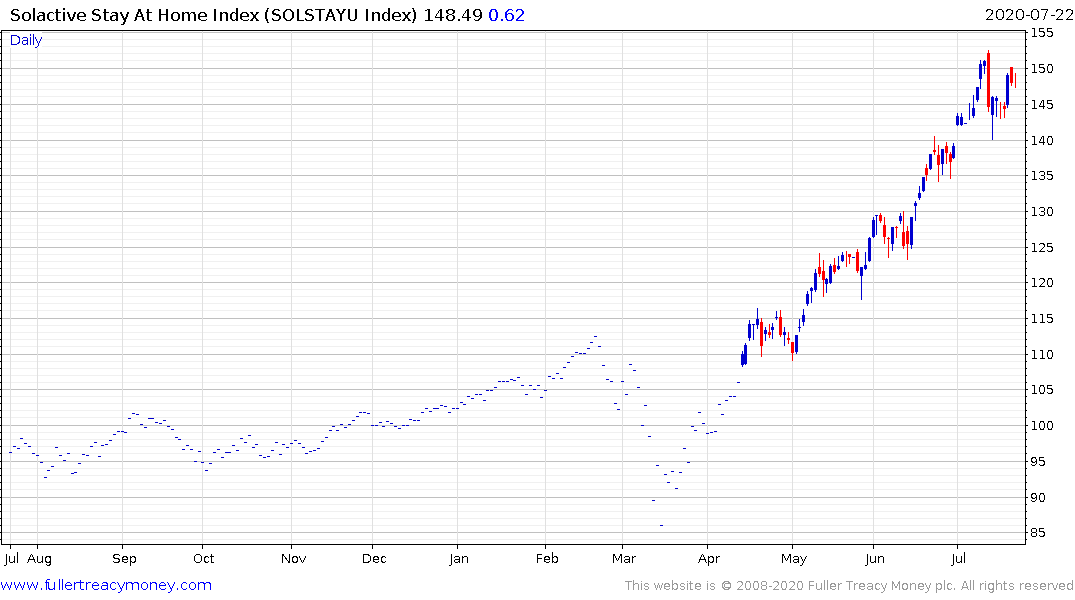

Stay-At-Home stocks have been the clear winners from the lockdowns. The concentrated number of winners coupled with a surge in liquidity and punters eager to participate resulted massive outperformance over the last few months.

The big question now is how sustainable that outperformance is as the wider global economy begins to recovery. There are obviously still significant issues with attempts to control the spread of the virus across much of the USA, but Europe and China are coming out of the other end of the ordeal. That is helping to turn attention to what a recovery might look like.

.png)

The S&P500’s Advance Decline Line moved to a new all-time high last week. That suggests the recovery in the stock market is gaining traction and that more shares are participating. That’s a positive development but it robs the concentrated Stay-At-Home winners of attention. It also questions whether their impressive earnings outperformance is sustainable for future quarters.

.png)

There Russell 2000/Nasdaq-100 ratio continues to trend lower but it accelerated to the March low and if it extends this week’s rebound it will exhibit increasing Type-2 bottoming characteristics.

In nominal terms, the Nasdaq-100 has paused below 9,000, 10,000 and now 11,000. So far, the reaction is relatively similar sized to the others posted since March. A sustained move below 10,350 would represent a larger reaction and would increase scope for a swifter process of mean reversion.

The Russell 2000 continues to pause in the region of the trend mean and the upper side of the six-week range.