Snowflake Melts Investor Hearts Like Most Tech IPOs This Year

This article by Deniz Besiroglu and Dimitri Quemard for Bloomberg may be of interest to subscribers. Here is a section:

All 12 companies have increased in value since they started trading. The largest increase was Schrodinger Inc. (229.7%), followed by BigCommerce Holdings Inc. (212.3%) and nCino Inc. (143.7%). Shares in Snowflake, the year’s largest U.S. technology IPO, has doubled from its offer price of $120 per share.

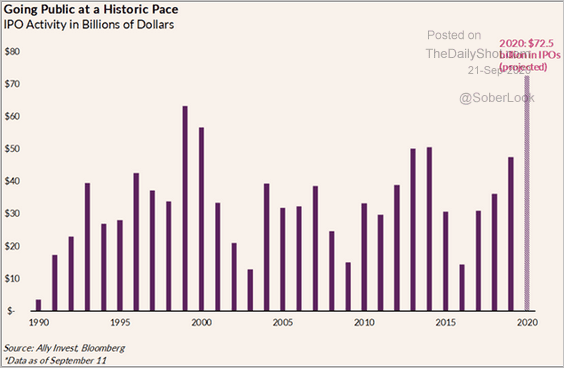

The dollar value of IPOs hit a new all-time high this year. That tells us a lot about the ability of low interest rates and abundant liquidity to boost asset prices. That’s particularly true for private assets since there is no mark to market value. Profitability is habitually somewhere out in the future for many new companies so the early investors are taking the opportunity to sell in IPOs before that issue becomes pressing.

There has been a surge in IPO activity of late with Snowflake making headlines last week and the impending ANT Financial sale in Hong Kong representing an additional draw on available capital. This eagerness of list is a symptom of panicky decisions made during the pandemic and potentially because of fears about what shape the recovery will take and the trajectory of interest rates.

For now, the Renaissance IPO ETF remains in a strong uptrend and was in positive territory today despite weakness in other areas of the market.