Ryanair Touts Lower Fares to Fill Planes as Costs Start to Bite

This article from Bloomberg may be of interest. Here is a section:

Chief Executive Officer Michael O’Leary previously said that ticket prices would remain elevated for the next five years because of higher oil prices and environmental charges. Ryanair, which has built its business model around ultra-cheap flights, said in May the typical €9.99 ($11) fare could double in price as summer demand skyrockets and because of a supply backlog caused by a shortage of planes.

The proposed fare stimulus comes as Ryanair expands its fleet with plans to take on an additional 173 aircraft by the end of March. Ryanair, which had 558 aircraft on June 30, announced a deal this year for as many as 300 Boeing 737 Max jets worth $40 billion. It comes as the Irish firm targets 30% of the European air-travel market by 2034.

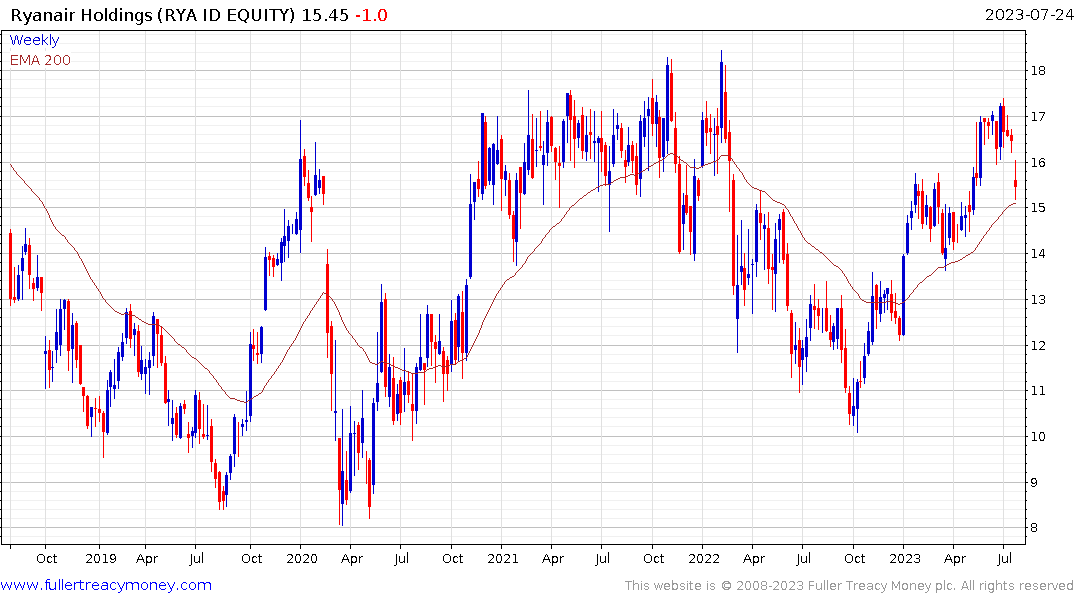

Will post-pandemic demand return to the pre-pandemic norm? Most estimates suggest the triumph of linear thinking is unchallenged. When business is poor, they suggest it will continue lower. When it rebounds, they think higher prices are sustainable indefinitely. The truth is a lot more cyclical.

The entire pandemic era is best considered as a pendulum. The massive decline in 2020 was followed by a massive rebound fuelled by stimulus on a truly unprecedented scale. The global trend of rising interest rates, quantitative tightening and eroding consumer balance sheets is driving the pendulum back in the opposite direction.

Disappointing earnings reported by Tesla and Netflix on Friday are a reflection of that trend. Ryanair’s return to bargain basement pricing is an additional reflection of the trend of declining spending power. At least Ryanair is accustomed to a low pricing environment. Older airlines dealing with staff shortages and pensions issues will be in a much worse position.

This is the thin end of the wedge because many companies are still reporting solid earnings. That suggests the time when a broad-based retrenchment may occur is still in the future. Costco Wholesale for example has broken higher from the triangular pattern it had been forming. That’s a bullish signal even if the share is trading on a forward P/E of 40.