Rio Tinto CEO Says Chinese Steel Demand Is Close to Peaking

This article may be of interest to subscribers. Here is a section:

“We are foreseeing that the peak steel demand in China is about to be reached,” he said during an interview at Bloomberg headquarters in New York. “Not because the Chinese economy is not growing, but just because of the maturity it has reached.”

The notion that China’s steel market is poised to contract this decade — after many years of breakneck growth — is widely held across the industry. Rio’s rival BHP Group reckons annual output has reached a plateau just above a billion tons each year that will stretch into 2024. Analysts at Capital Economics Ltd.

said demand and supply probably peaked in 2020.

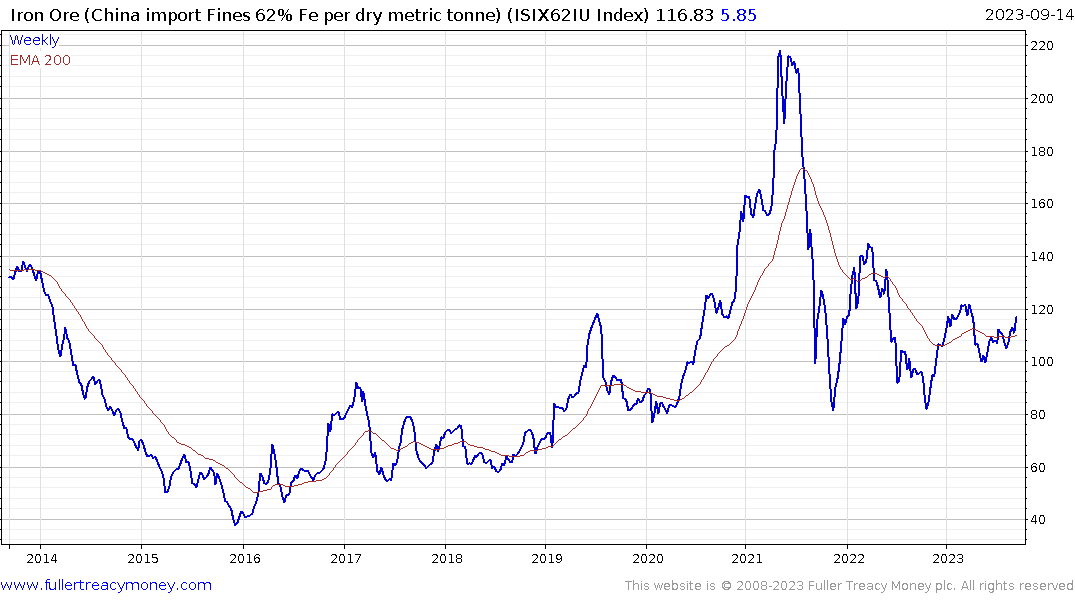

China is currently restocking iron-ore inventories as demand increased following the end of lockdowns. However, the medium-term risk is that uncompetitive steel mills will shut down as the property sector goes through a downshift in new construction.

China has more steel production capacity than the rest of the world combined. Maybe they will repurpose that into production of military equipment which would support iron-ore demand.

China has more steel production capacity than the rest of the world combined. Maybe they will repurpose that into production of military equipment which would support iron-ore demand.

Rio Tinto has been ranging, mostly above the 1000-day MA, for three years. It is currently rebounding from the lower boundary and will need to hold the 4500p level if higher to lateral ranging is to be given the benefit of the doubt.

Rio Tinto has been ranging, mostly above the 1000-day MA, for three years. It is currently rebounding from the lower boundary and will need to hold the 4500p level if higher to lateral ranging is to be given the benefit of the doubt.

BHP exhibits more of an upward bias and is currently steadying from the region of the 1000-day MA, as it holds the sequence of higher major reaction lows.

Vale is also steadying at the lower side of its range.