Reality check

Thanks to a subscriber for this report from Deutsche Bank focusing on the outlook for Veolia Environnement and Suez Environnement taking a cautious view. Here is an outline of the bullish case:

Bulls on the stocks are arguing that the combination of cost cutting; a cyclical rebound in waste volumes; and growth investments should drive a rapid rebound in earning for Veolia and strong double digit earnings growth for Suez.

?Despite years of earnings disappointments, a stablisation of the economic outlook and self help could enable rapid earnings growth, with Veolia outlining a clear ambition to increase profits by 2015 and Suez targeting more measured by attractive growth profile. Furthermore, scope for structural growth in global water and waste markets combined with the status of the two companies as the two main global players could provide a robust long-run growth proposition.

Suez and Veolia trade significantly above sector multiples, trading on one year forward P/E multiples of c.17x and c.18x based on consensus. However implied multiples could decline rapidly if the companies deliver on growth expectations, providing a potential re-rating opportunity if multiples hold.

Here is a link to the full report.

Both Veolia and Suez have substantial operations outside their native France and both have embarked on reorganisations of their corporate structures in an effort to stem the deterioration of their respective balance sheets. It remains an open question as to whether they can achieve growth but the migration from infrastructure intensity to a knowledge based structure may help.

.png)

Veolia Environnement continues to form a first step above its two-year base and a sustained move below €12 would be required to question medium-term scope for additional upside.

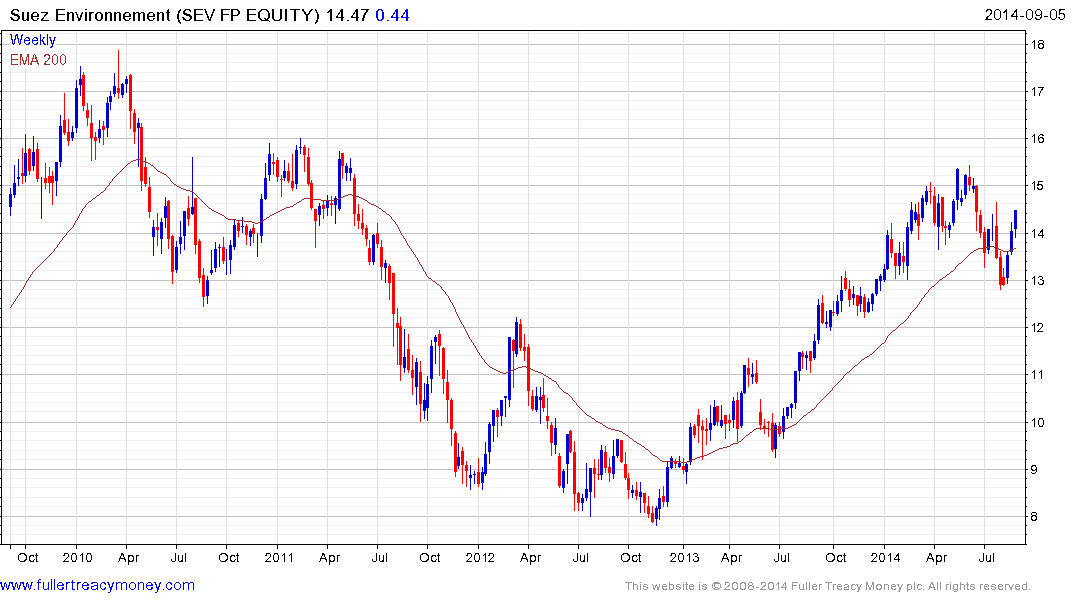

Suez Environnement rallied consistently from late 2012 to complete its base but experienced a large reaction from the June peak to challenge the medium-term uptrend. It has rallied impressively over the last three weeks to push back above the 200-day MA, and will need to hold the €13 area on the next pullback to confirm the return to medium-term demand dominance.

The weakness of the Euro is likely a factor in the nominal price improvement experienced by many Eurozone equities of late.

Back to top