Range Bound Market as Margins Rebound; Earnings Driven Breakouts

Thanks to a subscriber for this report from Morgan Stanley by Michael Wilson and colleagues. Here is a section:

Here is a link to the full report and here is a section from it:

3Q Earnings & the Margin Rebound. Aggregate S&P 500 revenues/earnings are expected to be down 3%/17% in 3Q20. As with 2Q20 results, concentrated losses skew aggregate results - Energy, Transportation, Capital Goods, and Consumer Services (hotels/restaurants) are contributing 13 pp of the 17.3% expected drop in earnings Exhibit 5. At the median company level for companies reporting to date, revenues are down 1.9% y/y and operating earnings are actually up 3.4% y/y. The upside surprise in operating profits stems from margins where cost cuts have actually led to a bounce back in median company operating margins above 3Q19 levels. Our thesis on earnings into next year has been playing out and our $166 bull case looks to be the base case. With bottom up estimates starting to embed this dynamic though, we see a temporary peak in revisions as one limiting factor supporting our near-term range bound thesis.

There have been some notable earnings beats announced over the last week but SAP’s very disappointing results today raised important questions about the sustainability of tech earnings. There is a clear continued divergence between the winners and losers from the pandemic but the outlook for 2021 may be see some reallocation towards a recovery.

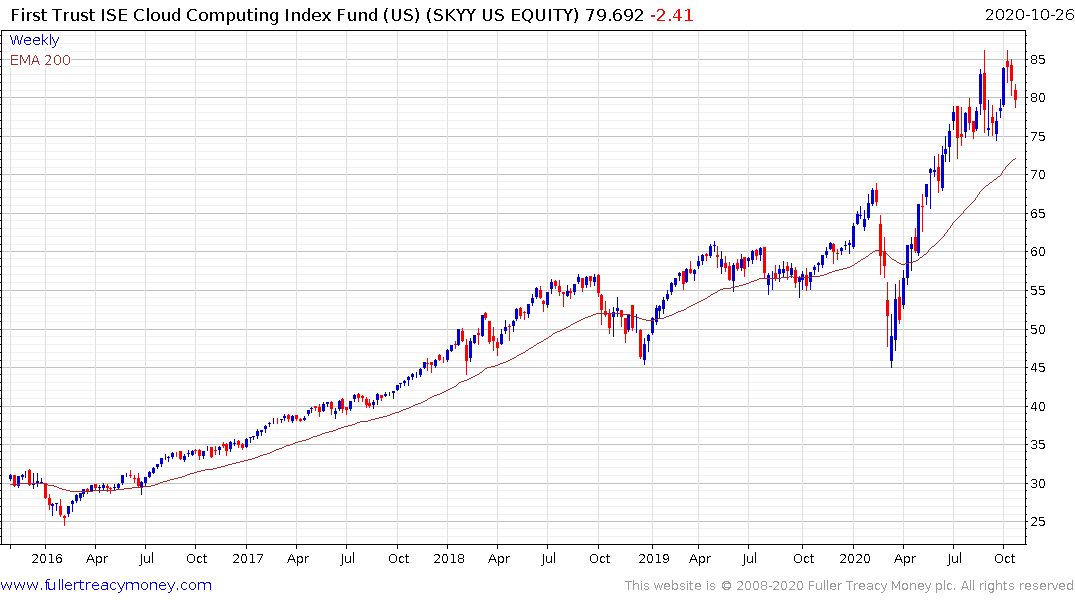

The risk with cloud-dependent businesses is that the pandemic pulled earnings forward from next year and the year after. The lockdowns have been a one-time boon that forced companies to make a transition. It is reasonable to assume that any company which has not made the transition to cloud and software as a service this year is unlikely to do so. Therefore, the logical question is where will growth come over the coming 12 months.

Meanwhile, the potential for recovery, driven by the determination to fund reflation suggest industrials, materials and agriculture businesses will benefit from this rotation. The steep declines experienced by many shares in these sectors over the last few years will make it easier for them to outperform in a recovery scenario simple because of the base effect.