Premiumization is the ultimate Challenge

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

Amidst a macro slowdown, Chinese consumer upgrades continued in 1H15, illustrated by the sustainable outperformance of high-end beer, high-quality infant formula, natural water, new premium beverages, high-end diapers, etc. This favours foreign brands, and we view premiumization as the most challenging trend for local brands.

?1H15 review: volumes down, prices up, input costs down

In 1H15, the combined revenue/NPAT of HK-listed FMCG stocks under DB coverage (ex-meat) were down 4%/up 2% yoy, largely as volumes were down, prices were up and input costs were down. In the midst of the macro slowdown we saw premiumization, continuous channel destocking and channel shifts. After the completion of destocking, the revenue/NPAT of the major A-share baijiu companies rose 5%/3% in 1H15, Nestle (NESN VX, Hold) recorded mid-single-digit growth in 2Q15, and Unilever (ULVR LN, Buy) returned to modest growth in 1H15 in China. Premium foreign infant milk formula, high-end diapers and beer continued to outperform.2H15 outlook: de-stocking to ease, yet no signs of macro bottoming out

After 12 months of channel destocking, we expect pressure to ease in 2H15, while the input cost inflation risk remains low. However, headwinds from the macro slowdown and channel shifts remain strong. Longer term, we think the most challenging trend for local brands is premiumization (both branding and product), as foreign brands are more experienced.

The wealth gap is China has created a challenge for domestic brands because the lower middle class has not yet achieved the disposable income levels required to afford many consumer goods while the upper middle class demand premium products and the security of quality that comes with foreign brands.

At the Saturday morning Mandarin school my daughters attend, Mrs Treacy was talking with one of the parents last week who has been involved in importing jeans to the USA for the last 20 years. They have moved some of their factories to Bangladesh and are now diversifying their business by wholesaling US sourced processed food products to Chinese supermarkets. Lax regulation of food goods in China has created a situation where well-heeled consumers are willing to pay for security of quality. At the same time rising wages mean coastal Chinese locations are no longer competitive with other emerging markets for low cost clothing production.

Global Autonomies such as Nestle, Unilever and Kimberly Clark have long records of successfully introducing new brands to emerging markets as incomes rise. As such they represent stiff competition for local brands as middle class markets evolve.

Unilever found support in late August in the region of the medium-term progression of higher reaction lows and a sustained move below 2400p would be required to question potential for continued higher to lateral ranging.

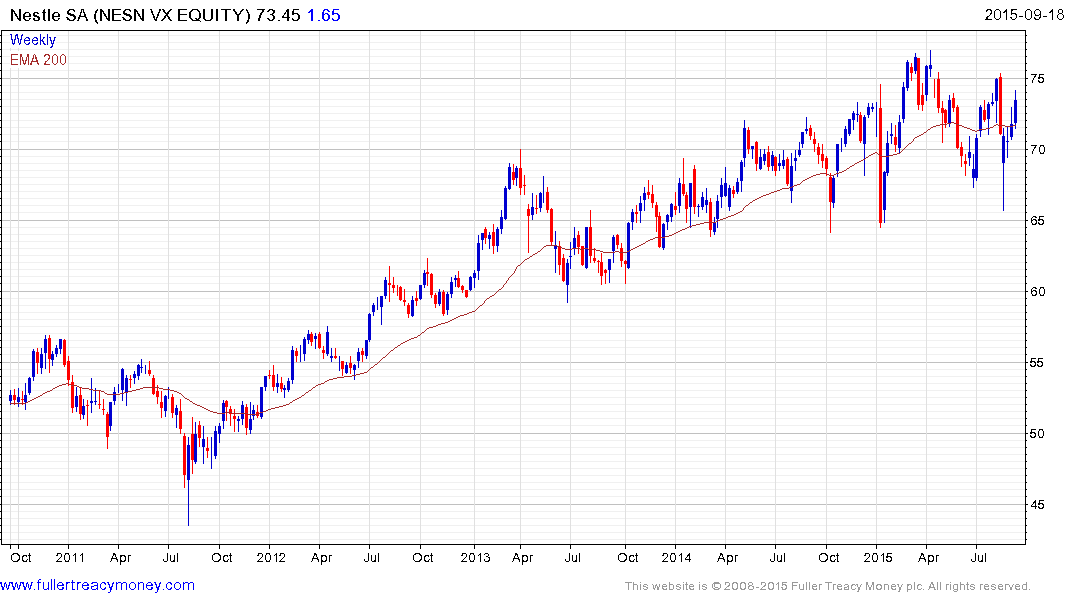

Nestle has returned to test the upper side of its range so some consolidation of recent gains is looking increasingly likely. However a sustained move below CHF65 would be required to question medium-term scope for additional higher to lateral ranging.

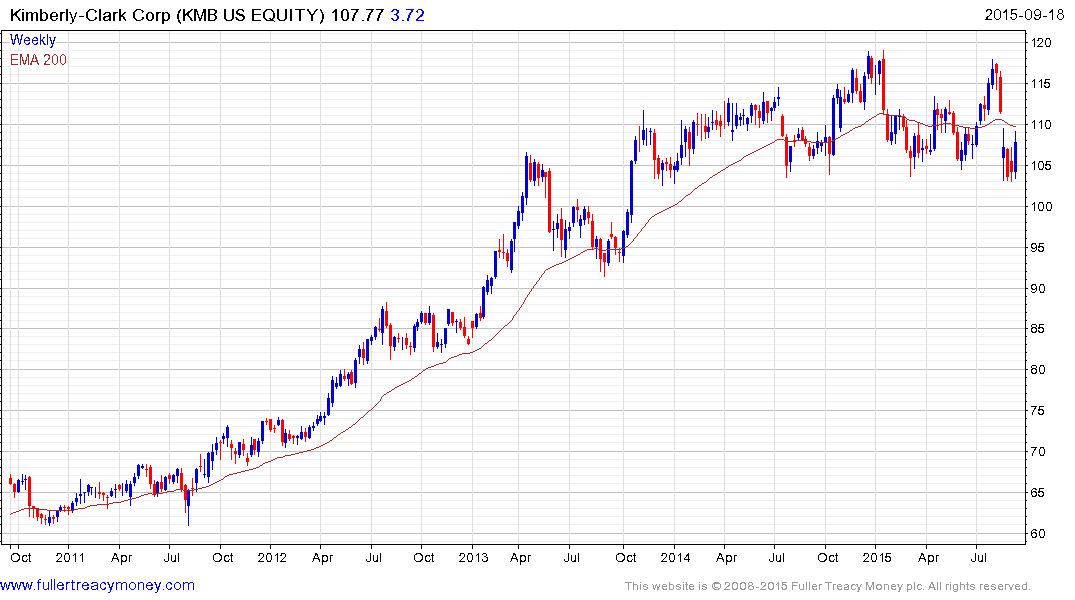

Kimberly Clark has a relatively similar pattern and is currently bouncing from the lower side of its range.

The majority of Hong Kong listed packaged food and consumer staples companies experienced the same steep declines as the H-Share Index and have found at least near-term support over the last couple of weeks. Biostime International Holdings is clear example. It gave up more than it gained from the rally earlier this year but found support last week above HK$10 and a reversionary rally remains in evidence.

Uni-President bucks that trend somewhat and has been confined to a relatively tight range since May. It continues to find support in the region of the 200-day MA and a sustained move above HK$8 would confirm a return to demand dominance beyond the short term.

China Foods found support above its July low in August and a sustained move below HK$3 would be required to question potential for additional higher to lateral ranging.

China Resources Enterprise popped to the upside in April following the payment of a special dividend in tandem with the announcement of a transition to a focus on beer sales. It has sustained its position of relative strength since and moved to a new closing recovery high today.

Back to top