Pound Jumps Most in 17 Months as Traders Eye Tight Labor Market

This article from Bloomberg may be of interest to subscribers. Here is a section:

“People don’t need too strong an excuse to buy sterling right now,” said Geoffrey Yu, a strategist at BNY Mellon. “Even a modicum of good data or even data that isn’t as bad as previously expected can see them coming back because of valuations.”

The move accompanies a broader dollar decline, with the greenback underperforming all Group-of-10 currencies bar the Japanese yen as risk sentiment rebounded. The Bloomberg Dollar Spot Index slid 0.5%, a third day of declines and the longest losing streak since March.

The Pound is rebounding from the lower side of a lengthy medium-term range just as the Dollar Index is encountering some resistance at the upper side of its range. As risk appetite returns there is scope for both to unwind their respective overextensions.

The UK stock market continues to trade a significant valuation discount to the USA and its European neighbours. Sentiment about the wisdom of Brexit is at a low ebb as the Northern Ireland question continues to befuddle politicians.

There is no easy answer. Putting the border down the middle of the Irish Sea was never going to pass muster with the unionist community. Now that Sinn Fein is the largest party in Northern Ireland, that issue is only going to create even greater friction around the question of the integrity of the union.

The FTSE-250 continues to hold the higher reaction low above the March nadir. Potential for further recovery can be given the benefit of the doubt provided last week’s low holds.

The FTSE-250 continues to hold the higher reaction low above the March nadir. Potential for further recovery can be given the benefit of the doubt provided last week’s low holds.

Petrofac continues to trend towards the upper side of its base formation.

Tesco is also in a long-term base formation and will need to sustain a move above 300p to confirm a return to demand dominance.

Tesco is also in a long-term base formation and will need to sustain a move above 300p to confirm a return to demand dominance.

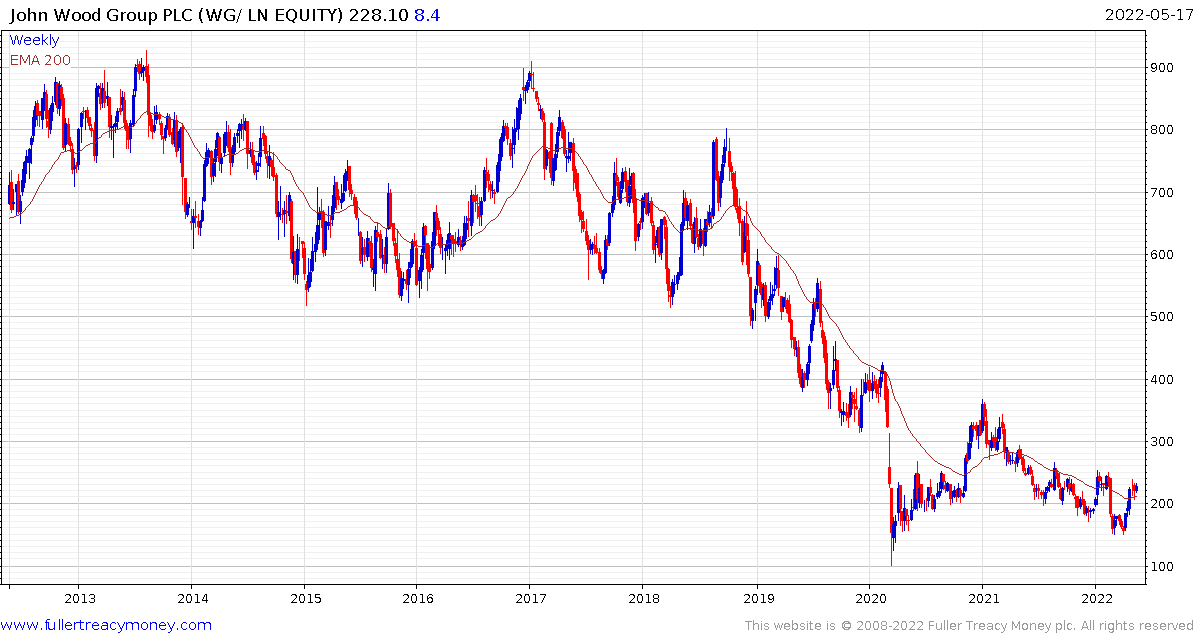

John Wood Group is firming to test the more that yearlong sequence of lower rally highs.

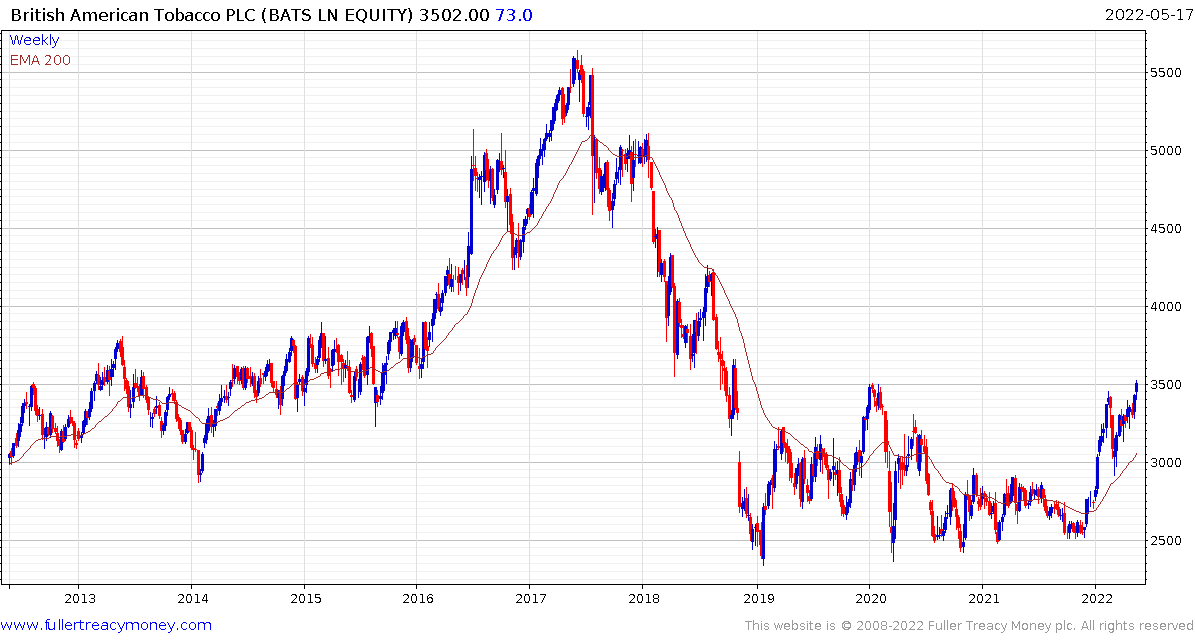

British American Tobacco is on the cusp of completing a more than 3-year range.

Centrica has been trending higher from depressed levels for more than a year.

Centrica has been trending higher from depressed levels for more than a year.

Aviva announced a more than 100p special dividend today as well as a share consolidation of 19 for 25. That took a lump out of the share price but the stock is still expected to have a 9.2% afterwards.

Aviva announced a more than 100p special dividend today as well as a share consolidation of 19 for 25. That took a lump out of the share price but the stock is still expected to have a 9.2% afterwards.

Scottish & Southern Energy completed a 14-year range this month.

Scottish & Southern Energy completed a 14-year range this month.

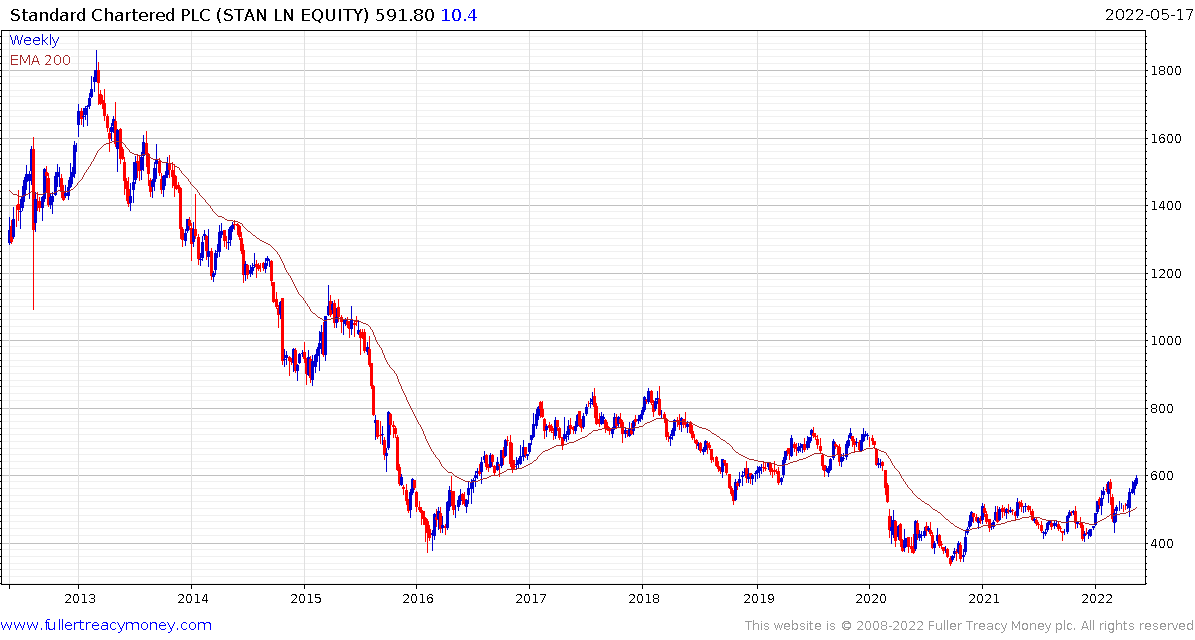

Standard Chartered is firming nicely within its base formation.

The UK market is performing in line with the value sector and not least because the currency is depressed and many companies are paying globally competitive dividends. Provided the currency’s volatility abates, the market will be attractive for globally oriented investors keen to capture yield.

Back to top