Global Macro Outlook: Virus curve flattening, markets stabilizing, slow recovery

Thanks to a subscriber for this report from Deutsch Bank by Torsten Slok. It is loaded with thought provoking charts which may be of interest.

Here is a link to the full report.

I found the chart comparing the Swedish and US COVID-19 infection rate to be particularly interesting. It suggests that anything less than total adherence to social distancing, effective testing and contact tracing is ineffectual. That’s a challenge because while some Asian countries have been able to implement these types of protocols swiftly, not least because of their prior experience with SARS, it seems beyond the ability of most countries to do. With cases in Hong Kong and Australia rising it is looking increasingly likely this is going to be a long hard slog until a vaccine is widely available.

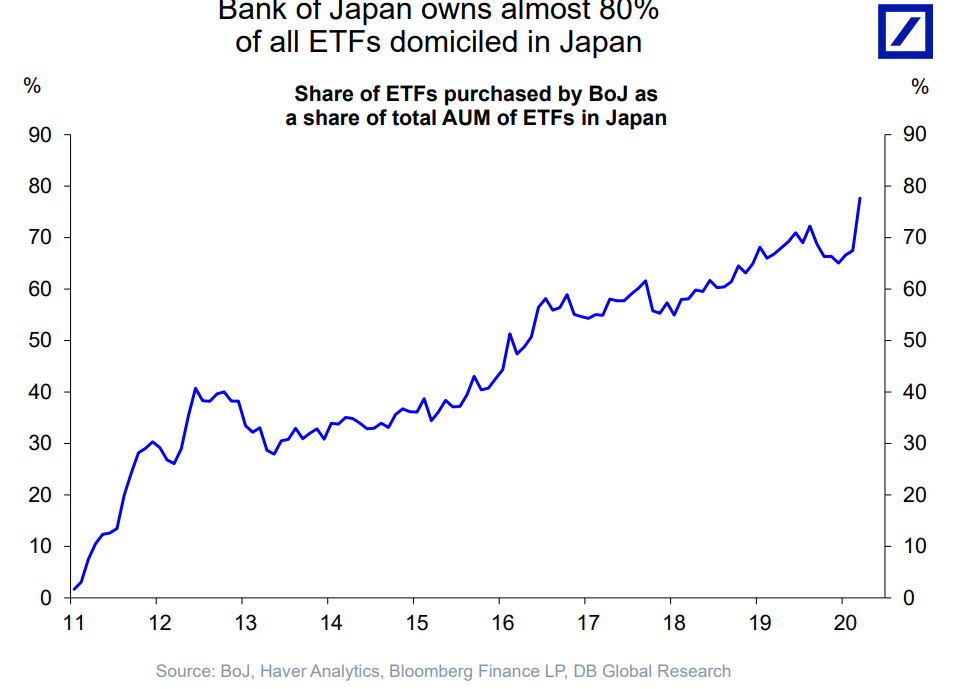

Turning to Japan, the Bank of Japan now owns almost 80% of all domestic equity ETFs. It is harder to find data on how much of the Japanese market ETFs occupy. However, since they can issue units as long as there is demand, this is a sector that continue to grow aggressively.

The Nikkei-225 Index continues to range its trend mean and below the recovery peaks near 24,000. A sustained move below 20,000 would be required to begin to question medium-term scope for continued upside.

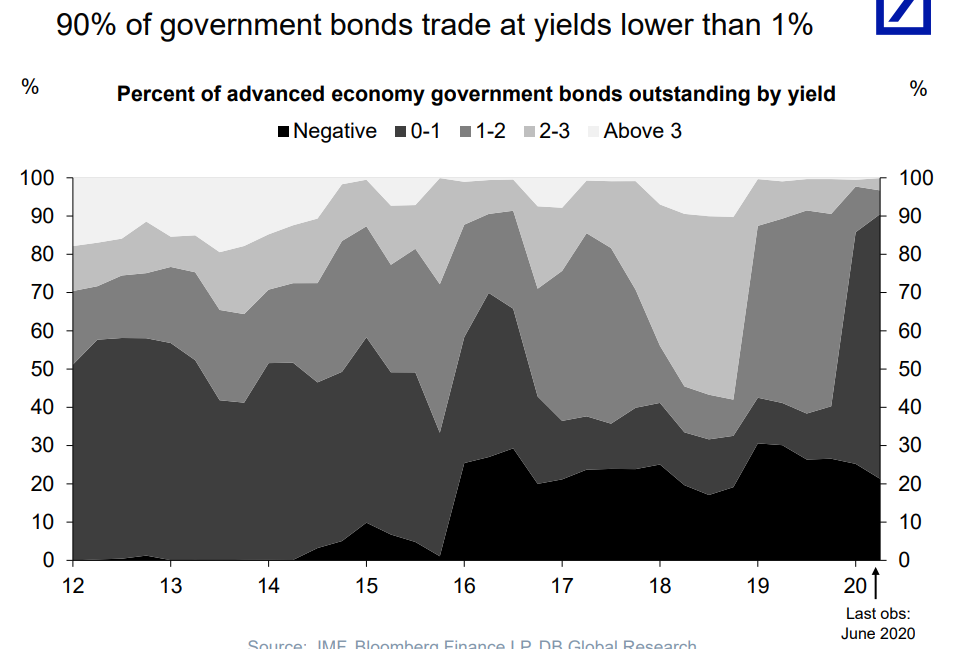

The only limits on the size of a central bank’s balance sheet is on the size of the markets it is investing it. Central banks already own substantial proportions of their respective domestic bond markets so, the next natural extension of stimulative measures is to buy equities. Japan and Switzerland continue to lead the way on that front.

The fact 90% of all government bonds trade at yields below 1% is an additional indication that the scope for central banks to buy positive yielding securities is relatively limited if the current status quo is sustained.