Pimco Sells Australia Banks, Property Bonds as Risks Climb

This article by Ruth Carson and Andreea Papuc for Bloomberg market be of interest to subscribers. Here is a section:

Risk assets are vulnerable to a correction as valuations approach fair value, Thakur and John Dwyer, vice president and credit research analyst, wrote in a report.

“This risk becomes more important as we transition to a period of gradual tightening of monetary policy by global central banks,” according to the report. Asset prices offer little buffer to the risk of possible shocks resulting from negative growth surprises or higher-than-expected inflation, they said.

Australian government yields share a high degree of commonality with those of other developed market nations. The 10-year has been ranging below 3% since 2015 and over the course of the last month has pulled back to test the region of the trend mean. With inflationary pressures being more of a fear than a reality at present there is scope for some further steadying in the market.

That short-term sanguine attitude towards the bonds market is now being mirrored by the S&P/ASX 300 Banks Index which continues to hold a progression of lower rally highs, following the sharp pullback witnessed in May.

Westpac, for example, has a gross yield of 9.05% but the share price has developing Type-3 top formation characteristics. In the event that the dividend is cut, for whatever reason, the share could fall sharply. It is currently testing the lower side of its five-year range and will need to sustain a move above A$31.50 to confirm a return to demand dominance beyond short-term steadying.

The S&P/ASX 300 Resources Index has pulled back over the last few months to close its overextension relative to the trend mean but a sustained move below it would be required to question medium-term scope for continued medium-term upside.

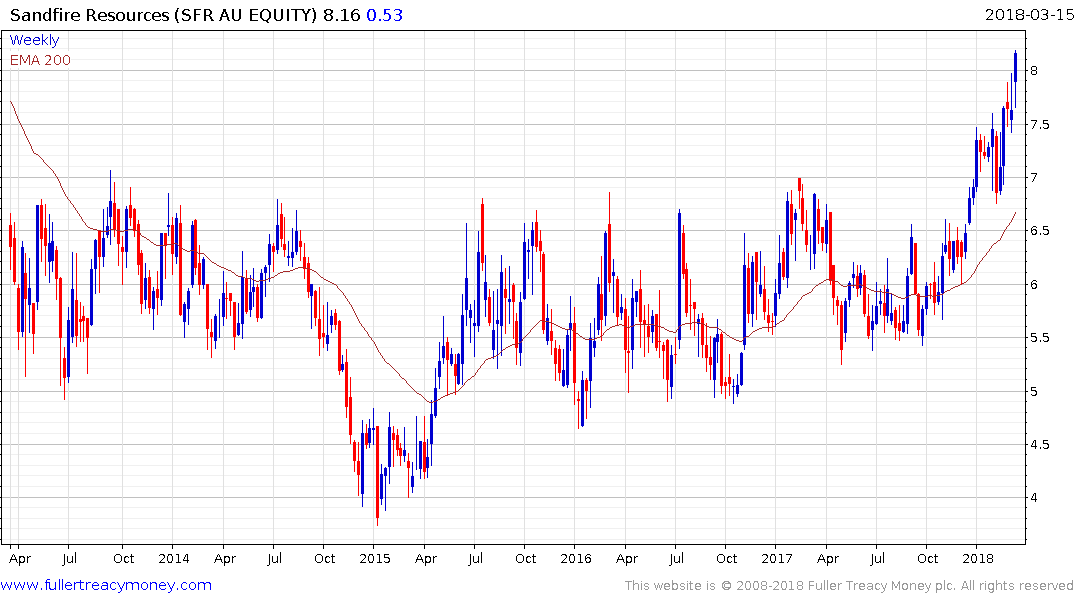

Sandfire Resources produces both copper and gold has an estimated P/E of 10.88 and yields 3.68%. The share broke out of a five-year range in January, consolidated for six weeks and reasserted on the upside a month ago.

The S&P/ASX200 Healthcare Index is now the benchmark’s third largest constituent. It remains on a steep but still consistent medium-term uptrend.

CSL, Resmed and Cochlear represent almost 70% of the sector’s market cap.

Ramsay Healthcare which had been an early leader has lost momentum over last three years following major investment in international expansion. It needs to hold the A$60 if top formation completion is to be avoided.