Nobody ever pressed "Stop" before

Thanks to Iain Little and Bruce Albrecht for this insightful report which may be of interest to subscribers. Here is a section:

Here is a link to the full report.

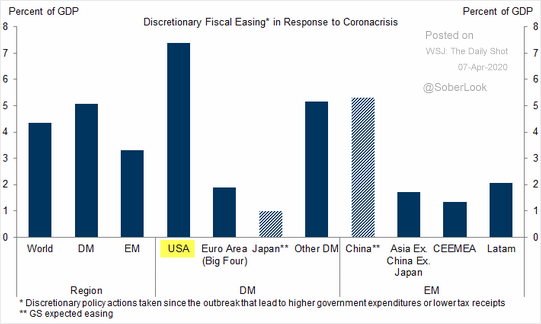

The global political or social effect of Corona will be to sanction further intrusion of public sector governance into our ordinary lives. Governments have stepped up to fill the economic cavity caused by Corona 1, so the consensus will be that they can be trusted to keep us safe from Corona 2, 3, 4 or 5.

The private sector, or investment, effect of Corona is a variation of this. It is to accelerate economic trends that have been in place for years, if not decades. It will accelerate the further intrusion of technology into our ordinary lives. The investment challenge therefore is to select trends that are permanent, and to avoid those that are merely temporary. Food retailers are having a bumper season now that restaurants and hotels are closed. But will food retail continue to boom once quarantine restrictions are removed and people emerge, blinking, into the sunlight of a post Corona dawn? What chance of a replay of the 1661 English Restoration, when the public forsook a 12-year puritan lockdown, courtesy of Oliver Cromwell, and then adopted the ways of a more gaudy, colourful and distinctly party-loving monarch?

These, we think, are the more permanent behavioural, social and economic changes accelerated by the Corona Crisis:

> Greater use of internet, computer hardware/ software at home and “on the go “

> Greater use of e-commerce and e-retail

> Greater desire for personal care and hygiene at home

> Greater demand for healthcare provision

> Greater demand for security and risk control

> Greater acceptance of remote working

> Greater need for business software that permits remote working

> Greater use of entertainment software for home use

> Greater need for data management, IT etc

> Greater faith in and use of branded consumer staples

> Greater use of e-learning and self-education

> Greater use of modern financial businesses (“fin- & insure-tech”)

Widespread adoption of 5G technology will facilitate many of these changes. And quality is the watchword, as companies with balance sheet stress are at risk. Our readers know that for over a decade we have avoided banks and Old Economy financial businesses. Increased use of cashless, informal and internet-based payment services will only accelerate this trend. Investors should be wary of new loan impairments in connection with such innovative and adolescent businesses due to the Corona Crisis.

Let’s set aside for the moment questions of timing and think about what changes we can expect to be durable from the virus-induced recession.

The first thing that springs to mind is a loss of income which will take a while to recover. For some that will be quite soon, for others who need to find a new job it will take longer. As we go from full employment in many countries to something less that necessarily represents lower growth overall and by extension lower corporate earnings.

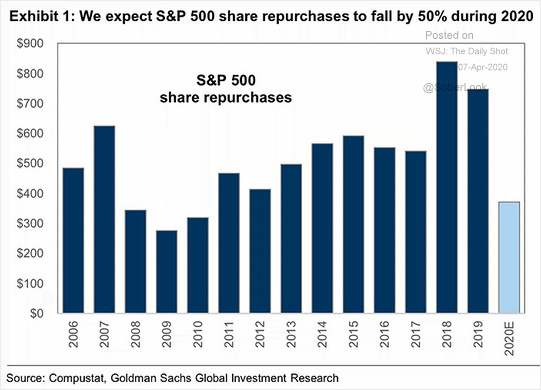

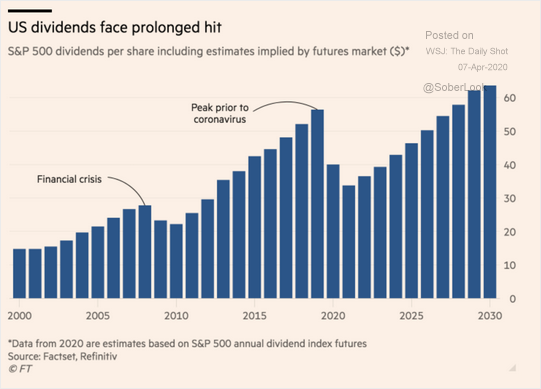

The immediate knock-on effect from this episode will be at least a halving of stock buying backs in 2020 relative to the all-time peak posted in 2019. On average the dividend pay-outs for the S&P500 are expected to be half of what they were last year as well. It is reasonable to assume if corporate fortunes improve these figures will also get better. It is reasonable but they represent short-term headwinds.

The world was awash in oil before the recession. The price war between Saudi Arabia and Russia only confirms that fact. Supply is a volatile metric but demand growth is a secular threat because it is no longer rising at the same rate and may even contract. That pretty much ensures the highest cost producers will be shut out of the market. Brazil’s pre-salt deep water reserves, Canada’s tar sands and less efficient unconventional supplies are all at acute risk.

The fragility of the global supply chain has been clearly exposed during the virus-scare in a way the populist upheaval never succeeded in doing. Countries and companies are now having significant discussions about the what components they need to have control over manufacturing and what can be outsourced. At the very minimum diversifying geographic risk, away from China, seems to be an obvious conclusion. That alone represents a significant global infrastructure build before we even begin to think about the public projects which will a green light from stimulus.

The relative strength of the technology sector is a clear example of the growing fact that data is both money and power. The mega-cap technology shares were not immune from the sell-off but the NYSE FANG+ Index is the only major global index still trading above its 200-day MA and it is comprised of only 10 shares. As we look around the world the more shares an Index has the worse the consistency of the trend looks. Therefore, I am in 100% agreement with Iain. This is a stock pickers market.

In a period of uncertainty cash is a prized asset. Therefore, companies that can avoid cutting dividends deserve to trade at a premium. That should favour dividend aristocrats. Companies that survive the oil market purge and can moreover sustain dividends all deserve to trade at a premium. The impending infrastructure spending spree is likely to strongly favour renewable energy assets. The other side of that argument is a substantial number of companies are going to be downgraded into junk and that will cause some issues in the credit market.

The technology sector is betting heavily on the evolution of virtual reality systems and the rollout of 5G will allow for seamless connectivity. That means real-time remote access to all machinery everywhere. It also means real-time access to supercomputer computing power at our fingertips.

Artificial intelligence and machine learning are already being woven into every aspect of our lives. It is not at all unreasonable to expect automated diagnostic tools built into our devices within the next few years. My Garmin smartwatch is a crude version of that today where the body battery feature tells me when to take a rest and when is a good time to work out.

The other side of that argument is start-ups are rapidly shedding workers and adapting to a new reality. That will represent a hit to the larger companies that depend on their cash burns

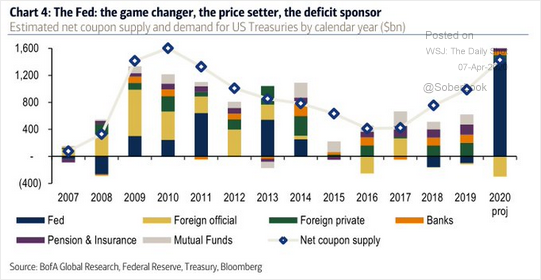

The other side of the coin is government deficits are likely to run amok under the assumption inflation is never again going to become an issue. However, the outperformance of gold, in all currencies, is a sign investors are unwilling to give that opinion full credence.

With its massive intervention in the repo markets, the Fed is now the de facto central banker to the world. The supply of Dollars is now growing out of all relation to the size of the US economy. That cements the Dollar’s role as the reserve currency but I do wonder whether it has bitten off more than it can chew.

The Dollar looks like an overvalued currency today. While the peak of coronavirus infections is more likely to arrive later in emerging markets, they are still likely to be engines of global growth for the foreseeable futures and are the only countries with clear tailwinds from demographics. International investors like to have the currency, interest rates and market on their side before committing to emerging markets. If the Dollar is in fact turning, that is positive for gold but also positive for emerging and commodity related markets.