Nike Sinks After Sales Slowdown Suggests It's Losing Share

This article by Matt Townsend for Bloomberg may be of interest to subscribers. Here is a section:

Nike Inc. tumbled the most in 19 months after third-quarter sales missed estimates, renewing concern that the long-dominant athletic brand is losing market share to Adidas AG and Under Armour Inc.

Revenue rose 5 percent to $8.43 billion, the Beaverton, Oregon-based company said after the market closed on Tuesday. Analysts estimated $8.47 billion, on average.

Under Armour and a resurgent Adidas have been grabbing market share from Nike, especially in the U.S. That’s led investors to sour on the stock, which had its first annual decline in eight years last year. And last quarter’s results only reinforced Nike’s woes as North American sales rose just 3 percent. Executives on a conference call didn’t provide much reason for optimism, either. Worldwide futures orders, excluding the effects of currency fluctuations, fell 1 percent, the first drop since 2009. Analysts had predicted a 3.4 percent gain.

Nike produces great products and has a dominant position in the apparel sector which makes it a target. With Adidas moving to a fast fashion model, Nike is under pressure to innovate and most particularly by moving to an online presence. Under Armor might be grabbing market share but it has also struggled to boost its online offering and as a customer of all three, I personally find the online shopping experience far from compelling with all their sites.

Nike pulled back sharply toward to sustain a yearlong progression of lower rally highs.

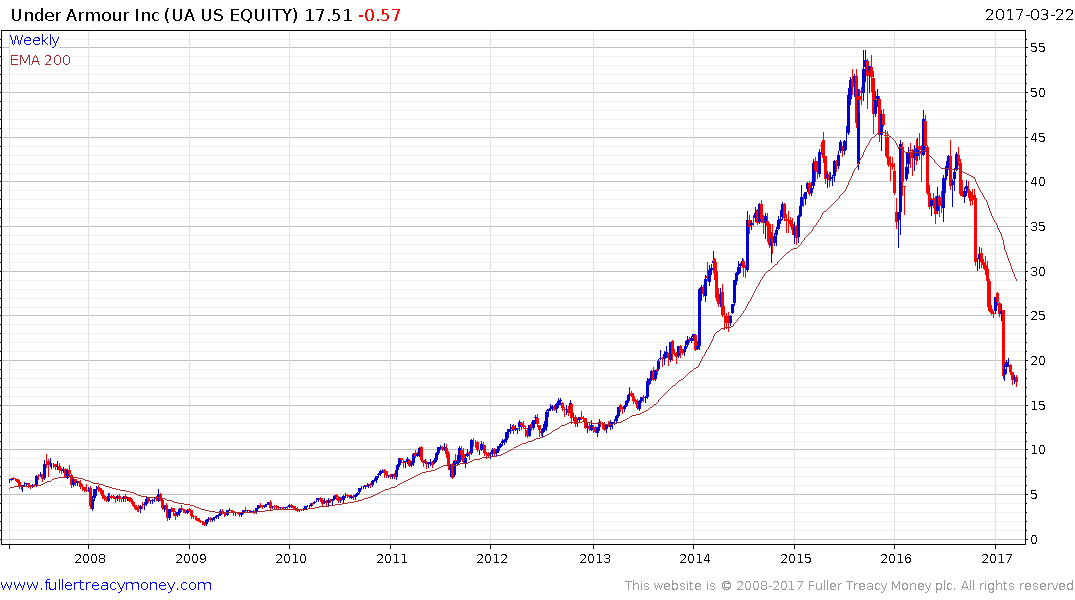

Under Armour remains in a steep but increasingly overextended downtrend.

Adidas has been among the best performers on the DAX over the last year and is now overextended relative to the trend mean following an impressive advance. The risk of a reversionary towards the mean has increased.

Puma has been rallying for more than a year and broke out of a lengthy ranging January to reassert medium-term demand dominance. Some consolidation of that move now appears to be underway.