Mexico Bonds Slump as AMLO's Spending Plan Spooks Traders

This article may be of interest to subscribers. Here is a section:

The government presented a draft 2024 budget late on Friday that boosts support for state oil giant Petroleos Mexicanos and social programs to consolidate Lopez Obrador’s legacy before the presidential election next June. Officials also proposed an $18 billion dollar-debt ceiling in the 2024 budget, triple the $5.5 billion set for this year.

The increased spending will result in a fiscal deficit equivalent to 4.9% of gross domestic product — the largest since 1988. It’s a reversal of the president’s penny-pinching ways, which had won him favor with investors in past years as other countries boosted spending to cope with the fallout from the coronavirus pandemic.

Mexican presidents are limited to a single six-year term so AMLO is currently priming the pump for his anointed successor. The Mexican electorate is spoiled for choice for the June 2024 election. Both candidates have impressive CVs with engineering and computer science degrees respectively, as well as some entrepreneurial experience. That represents a significant upgrade in technocratic experience for the Presidency regardless of who wins.

The greatest attribute a politician can have is to be lucky. Mexico was probably not happy to renegotiate NAFTA when Donald Trump was president, but it certainly removed any boundary to significantly boosting exports and allowing the country to surpass China as the primary provider of goods to the USA.

Having a president who prioritised fiscal responsibility when inflation surged globally was also a stroke of good luck. The next president will inherit a strong economy and inflation that is trending meaningfully lower.

However, in the short term, the 10-year yield is marching back towards 10% which suggests bond investors are not happy with the plan to run a wide deficit.

However, in the short term, the 10-year yield is marching back towards 10% which suggests bond investors are not happy with the plan to run a wide deficit.

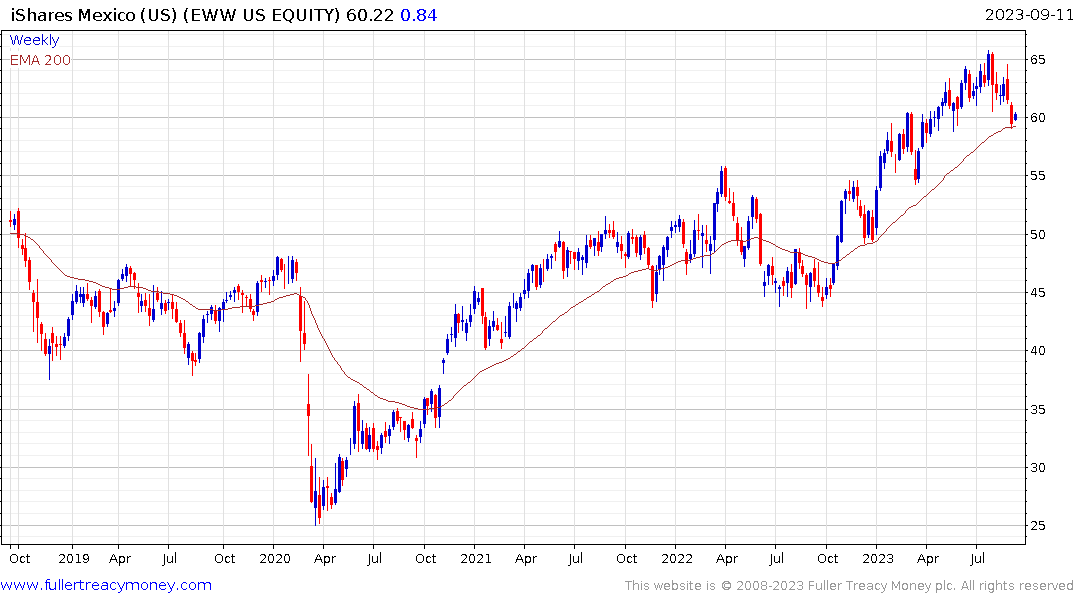

The Peso found at least near-term support this week and that has supported the stock market. The iShares MSCI Mexico ETF is bouncing from the region of the 200-day MA. I expect some additional consolidation because the local currency Index is breaking lower.