Long-End Yields Surge in Biggest Treasury Selloff Since January

This article from Bloomberg may be of interest to subscribers. Here is a section:

The selloff in Treasuries sent the yield on the 30-year bond surging on Wednesday, putting the long-end

benchmark on track for its biggest one-day advance since early January.

Rates climbed across notes and bonds, with the long-end increasing most and the curve steepening. The 30-year yield jumped by around 11 basis points at one stage, hitting a one-year high of 2.29%, while the 10-year rate rose as much as 9 basis points to 1.43%.

Global bond markets are suffering this year amid the prospects for U.S. stimulus and a surging reflationary narrative, with volatility gauges climbing to multi-month highs. That’s prompted fears over a potential tantrum in havens, such as Treasuries and German bonds. While Federal Reserve Chairman

Jerome Powell this week called the recent run-up in bond yields “a statement of confidence” in the economic outlook, the move raises pressure on central banks to keep financing conditions easy.

“The market is nervous about additional stimulus, worried about the risks of higher inflation, and concerned about QE tapering,” said Gennadiy Goldberg, senior U.S. rates strategist at TD Securities. “The selloff is likely being exacerbated by convexity hedging and positioning stop-outs.”

Demand for save havens is waning. That’s perhaps the easiest way to explain the run-up in yields; globally. The scale of the flight to quantity because of angst at the lockdowns drove yields down to historic lows almost everywhere.

Investors are now pricing in recovery. In between, debt loads have exploded and no one has a plan for how to pay them back. All central banks are doing is saying this is not the time to worry about that question.

US 30-year yields have broken on the upside and continue to push back up into the overhead trading range.

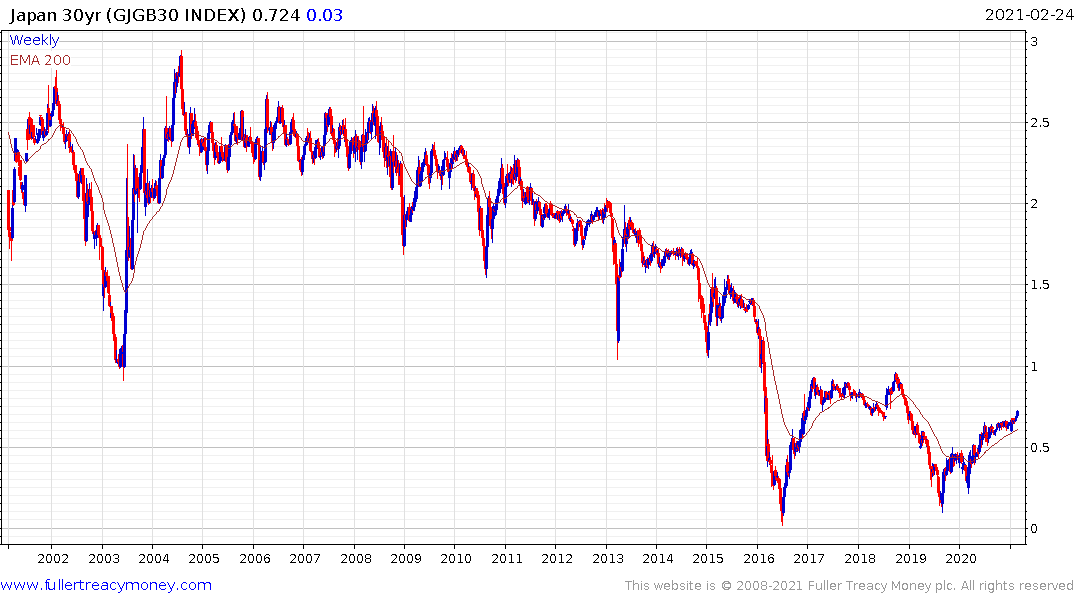

Japanese 30-year yields continue to trend higher and the 10-year is trading 2 basis points above the 10-basis point threshold for BoJ intervention.

UK 30-year yield have completely unwound the 2020 compression.

German 30-year remains in a positive territory and is trending back towards the upper side of an almost two-year base formation.

The 30-year Swiss yield is completing a two-year base formation.

The Australian 30-year is a relatively new addition to the market but its yield is also trending higher.

One of the hallmarks of the end of any bull market is a massive increase in supply at historic highs for the asset class. With so much supply the market is completely dependent on central banks back stopping the price. Without generous new additional assistance, on top of what is already underway, yields will continue to rise. Meanwhile supply is set to continue to increase.

The only way these competing narratives can be resolved is with Modern Monetary Theory, so that is what we are likely to continue to see. Whenever governments need cash, central banks will have to buy the debt.

.png)

Gold resides in a conflicted position because of this argument. It certainly benefitted from safe haven buying and some of that interest is now waning. At the same time the increasing efforts to devalue fiat currencies is a medium-term tailwind. That suggests any additional weakness will likely provide a favourable entry point.