Leveraged loans: how much do credit ratings understate the risks?

Thanks to a subscriber for this report from UBS which may be of interest. Here is a section:

The race to secure a competitive yield has resulted in large quantities of debt being issued and the quality of issuers declining relative to the yield on offer. If a rising tide lifts all boats then the potential for shipwrecks to be revealed when the tide goes out is also a risk. Warren Buffett’s swimming naked remark comes to mind.

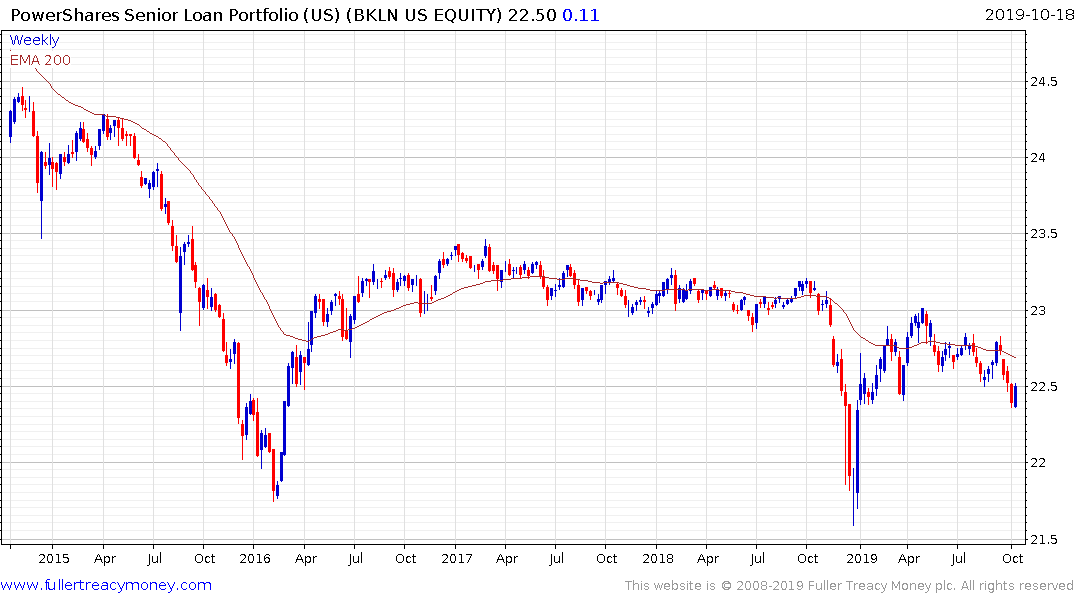

The Invesco Senior Loan ETF steadied last week following its breakdown to new lows but will need to follow through on the upside and sustain a move above the trend mean to confirm a return to demand dominance.

Medium-term the risk is a high number of issuers do not survive a further turn down in the global economy. However, High yield CDS spread do not suggest a great deal of urgency to the issue and remain well contained.