Late Planting and Projections of 2019 U.S. Corn and Soybean Acreage

This article by Scott Irwin and Todd Hubbs for Farmdocdaily may be of interest to subscribers. Here is a section:

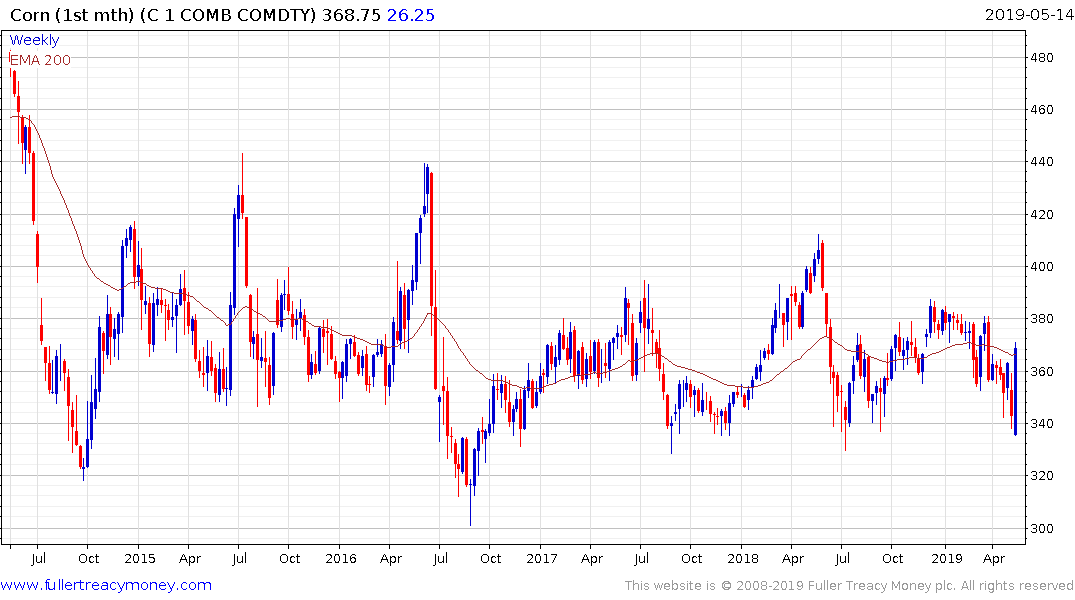

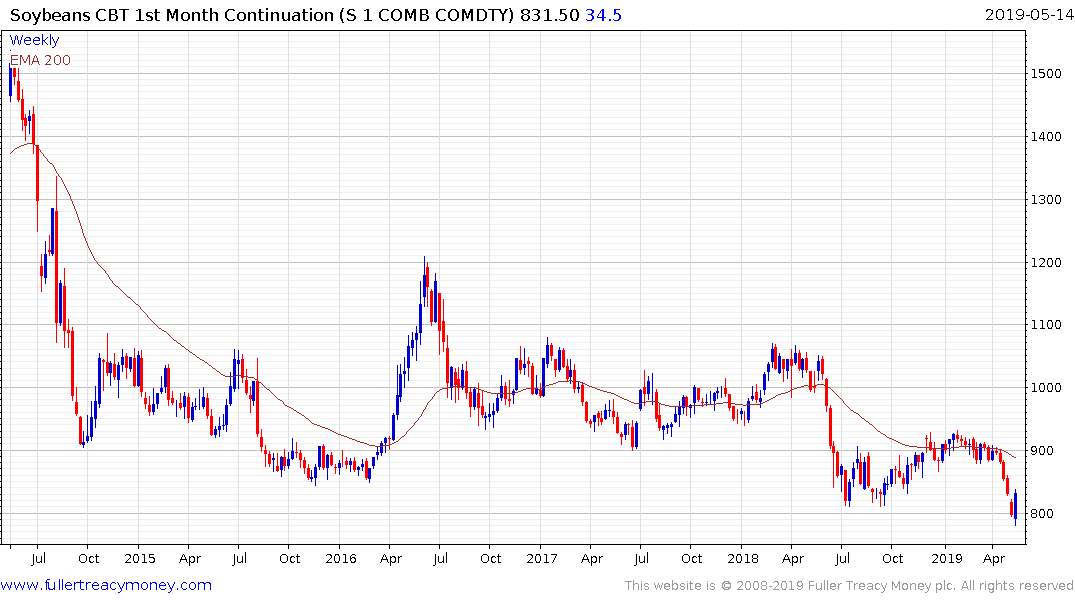

The impact of late planting on projections of the U.S. corn and soybean planted acreage is an important question right now due to the very wet and/or cold conditions so far this spring through much of the Corn Belt. We estimate the relationship of late corn planting to corn and soybean planted acreage and prevented plantings in this article. If late corn planting is 10 percent or more above average, we find that the chance of corn planted acreage decreasing is 83 percent and the average decrease is 1.4 million acres. The level of prevented plantings for corn is about 1.2 million acres larger than average when late planting is near 10 percent or more above average. This indicates that there is a reasonably high chance that planted acreage of corn will decline 2-3 million acres from expectations based on the March 30 USDA Prospective Plantings report. Likewise, we find that when late corn planting is 10 percent or more above average that the chance of soybean planted acreage increasing is 83 percent and the average increase is 0.9 million acres. However, the level of prevented plantings for soybeans also increases, offsetting much of the acreage switch. This indicates there is a reasonably high chance that planted acreage of soybeans will not change much compared to expectations based on the March 30 USDA Prospective Plantings report. It should be noted that changes to corn and soybean planted acreage could be even larger if planting conditions do not improve substantially in the next two weeks. Finally, corn and soybean acreage changes could also be impacted by policy changes made in response to reaching or not reaching a trade deal with China.

The flooding which left much of the USA’s midwest under water for much of February has had an effect on planting has represents a catalyst for short covering as a number of grains and beans are in the region of multi-year lows.

Meanwhile the spread of the armyworm moth in Southern China is a threat to soybean, wheat and rice production and there is not much that can be done about it. Here is a section from a press release from the USDA:

The Fall Armyworm (FAW; Spodoptera frugiperda) – a crop-eating pest – first detected in China in January 2019 has spread across China’s southern border and currently impacts about 8,500 hectares (127,000 mu) of grain production in Yunnan, Guangxi, Guangdong, Guizhou, Hunan, and Hainan provinces. Officially, Chinese authorities have employed an emergency action plan to monitor and respond to the pest. FAW has no natural predators in China and its presence may result in lower production and crop quality of corn, rice, wheat, sorghum, sugarcane, cotton, soybean, and peanuts among other cash crops. Experts report that there is a high probability that the pest will spread across all of China’s grain production area within the next 12 months.

China has imposed tariffs on US grain but it does appear likely they are going to need supply from somewhere to meet domestic demand. That represents an additional catalyst for short covering.

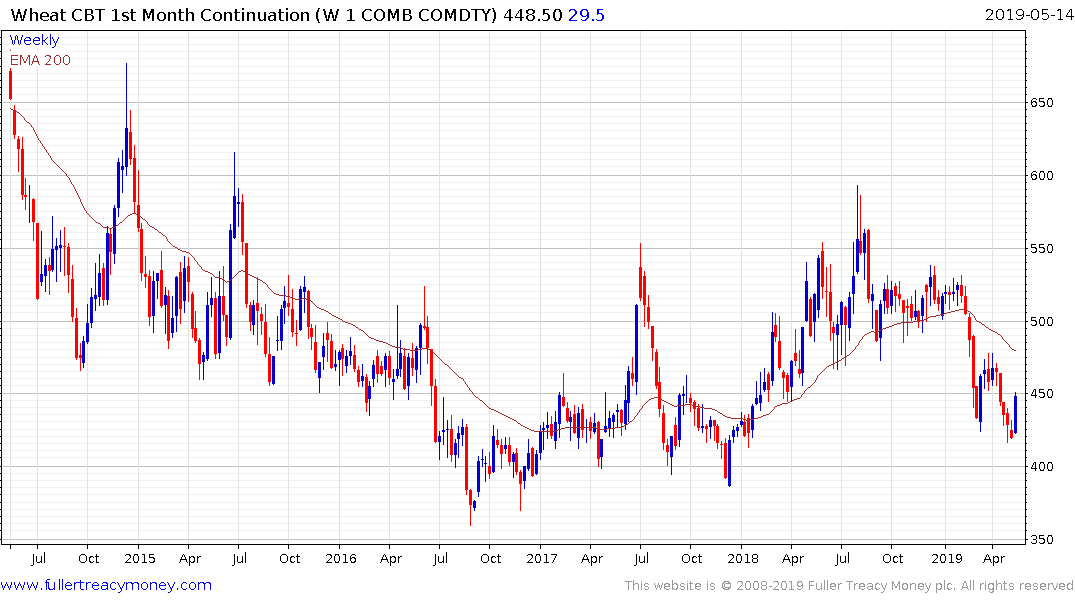

Wheat and corn followed through on the upside today after yesterday’s upside key day reversals. Soybeans also firmed.

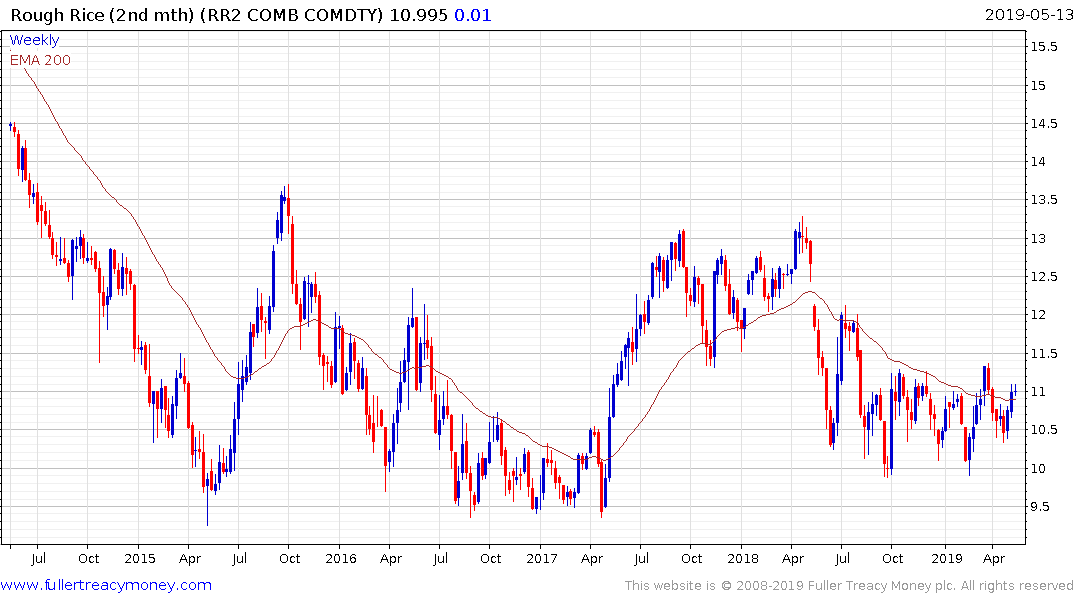

Rough rice is right at the upper side of a developing 10-month range but has not yet mustered the wherewithal to sustain an upward break.