KKR Agrees to Buy Up to $40 Billion of PayPal's Pay-Later Loans

This article from Bloomberg may be of interest. Here is a section:

Buy-now-pay-later loans have become increasingly popular, especially among younger consumers, as a way to split up larger purchases and pay them off in instalments. PayPal joined the fray in 2020 and has since issued more than 200 million of the loans to more than 30 million customers around the world.

With the new deal, KKR’s private credit funds and accounts will acquire “substantially” all of PayPal’s existing European buy-now-pay-later loan portfolio and eligible future loans, according to the statement. PayPal will remain responsible for customer-facing activities such as underwriting and servicing.

PayPal has said for months that it’s been looking to offload a significant portion of its receivables. The deal allows the company to continue offering buy-now-pay-later loans, which it has said entice users to use its services more, without using up large portions of its balance sheet.

Credit has become KKR’s biggest business by assets. The firm just last month elevated Dan Pietrzak to become global head of private credit as it looks to compete in the increasingly heated market where rivals have doubled down.

“Having the ability to work exclusively with a scaled and high-quality strategic partner like PayPal is a testament to the strength and maturity of our asset-based finance business,” Pietrzak said in the statement.

There are two themes converging in this development. The first is buy-now-pay-later (BNPL) grew at an exponential rate during the low interest rate era and exploded during the modern monetary theory experiment. The second is the willingness of private equity groups to expand rapidly in the private credit space.

It’s a heady mix because you have the high growth youth group favouring BNPL who are not particularly credit worthy, being funded by institutions desperate for growth and yield. This is the definition of high yield/junk lending but without the financial regulations that might protect investors in the event of rising defaults.

PayPal’s stock collapsed in 2021/22 as interest costs took a bite out of profitability. Nevertheless, it is still a profitable company and this announcement represents a deleveraging of the balance sheet. The share is attempting to build support around $70. A sustained move above that level would begin to suggest a failed downside break. It probably needs the catalyst of lower rates to reignite demand dominance.

PayPal’s stock collapsed in 2021/22 as interest costs took a bite out of profitability. Nevertheless, it is still a profitable company and this announcement represents a deleveraging of the balance sheet. The share is attempting to build support around $70. A sustained move above that level would begin to suggest a failed downside break. It probably needs the catalyst of lower rates to reignite demand dominance.

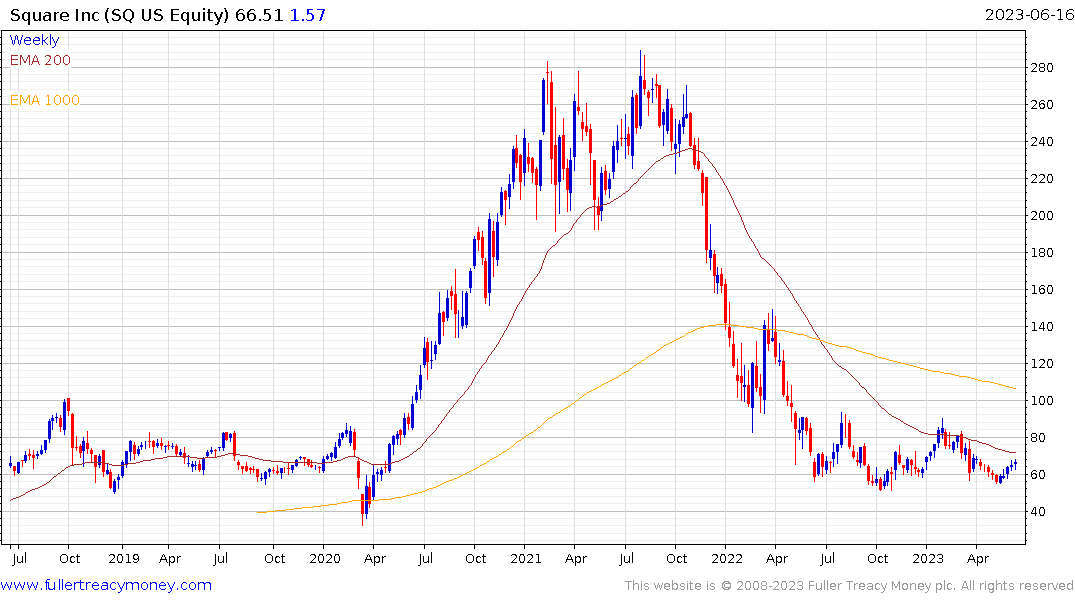

Block relies on CashApp for much of its growth and revenue. The share is building a base formation above $50 and a sustained move above the trend mean would signal a return to demand dominance.

Block relies on CashApp for much of its growth and revenue. The share is building a base formation above $50 and a sustained move above the trend mean would signal a return to demand dominance.

Brazil looks likely to be the first of the major economies to cut rates which should act as a catalyst for high consumer credit demand. StoneCo has first step above the base characteristics and could be one of the bigger beneficiaries of that trend.

Brazil looks likely to be the first of the major economies to cut rates which should act as a catalyst for high consumer credit demand. StoneCo has first step above the base characteristics and could be one of the bigger beneficiaries of that trend.

KKR is testing the upper side of a yearlong range and some consolidation appears likely amid a short-term overbought condition.

KKR is testing the upper side of a yearlong range and some consolidation appears likely amid a short-term overbought condition.