Jeremy Siegel Why Long-term Investors Should Own Stocks: Bonds are 'Dangerous'

Thanks to a subscriber for this common sense article which may be of interest. Here is a section:

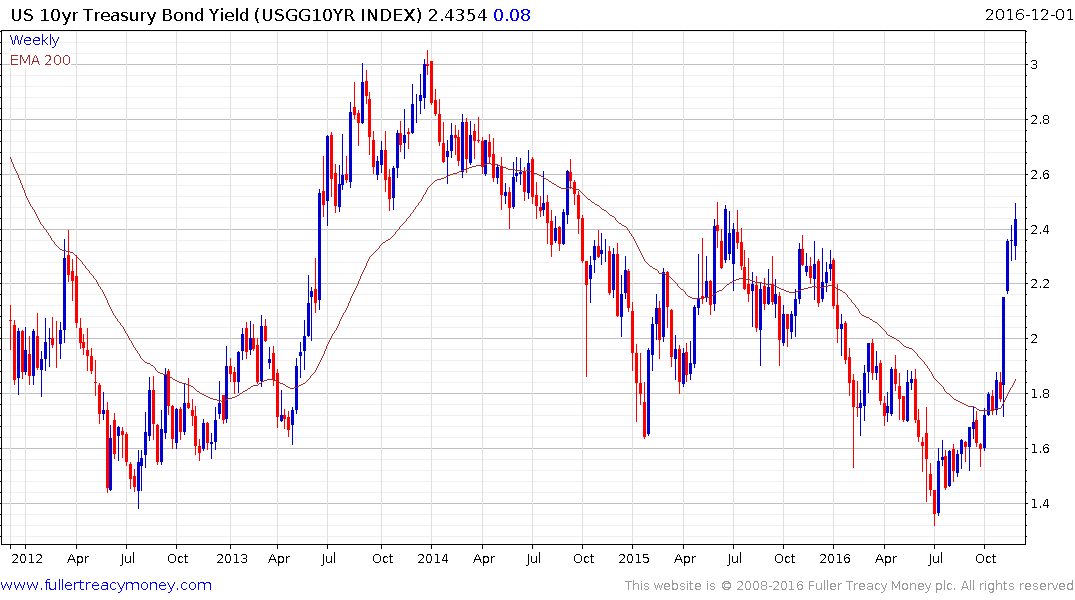

Last year you expected “some increase” in the 10-year Treasury yield. On November 30 of last year it was at 2.21% and on Friday it closed at 2.34%, so your forecast was accurate. What is your forecast now for interest rates? Have we finally seen the end of the 35-year secular downtrend in rates?

Rates took a huge jump after the Trump election. They are going to work their way higher. Again, there is a lot of uncertainty about what policies will be enacted, but I would not be surprised to see the ten year between 2.5% and 3% by the end of next year. That is a rate that should not be threatening for equities. If rates move well above 3% without a corresponding big increase in economic growth, it’s a problem. If there’s a big increase in economic growth, a move above 3% could still be all right. But if there is an inflation problem, the Fed will fight by increasing rates even more. That certainly would be a challenge to the equity market.

President-elect Trump has criticized the Fed for being too dovish. Would he be wise to appoint a new chairperson or governors who are more hawkish?

Janet Yellen’s term doesn’t end until January 2018. Vice Chair Stan Fischer’s term ends about six months after that. Trump has given no indication that he’ll ask either to step down now, although he has definitely said that he wants to replace Yellen when he becomes president.

Yes, Trump has criticized the Fed for keeping interest rates down too much. After accusing the Fed of trying to help Clinton and Obama by keeping rates low, Trump might have to welcome low rates if he wants to implement the infrastructure program that he desires. In fact, I believe the Fed is going to move with the 10-year rate next year. If the 10-year Treasury continues to rise to 2.5%, 2.75% or 3% or more, you are going to see two or three Fed rate hikes. We are certainly going to see one in December. That’s a slam dunk. But there could be anywhere from two to three hikes next year depending on how high that 10-year rate goes.

It’s one thing to finance infrastructure at a near-zero rate, which is where short-term rates are. But if short rates rise to 1.5% and the long rates approach 3%, it is going to be more of a challenge. Trump may not appoint someone who is very hawkish, such as John Taylor, and maybe we’ll find that Yellen’s dovishness will be welcome at a later date.

I should mention that for quite a while there have been two openings on the Board of Governors of the Federal Reserve and the Board wants them filled. They want to be at full strength. There are only five governors now and there should be seven. Trump will have the opportunity to appoint two new governors very early in his term.

US 10-year Treasury yields surged again today and have now comfortably broken the progression of lower rally highs evident since the yield peak that accompanied the taper tantrum. This move is amicably being referred to as the Trump tantrum. There is some weight to the argument it will be temporary since many investors have been conditioned to buy-the-dip and the Presidential inauguration will not be until January 20th.

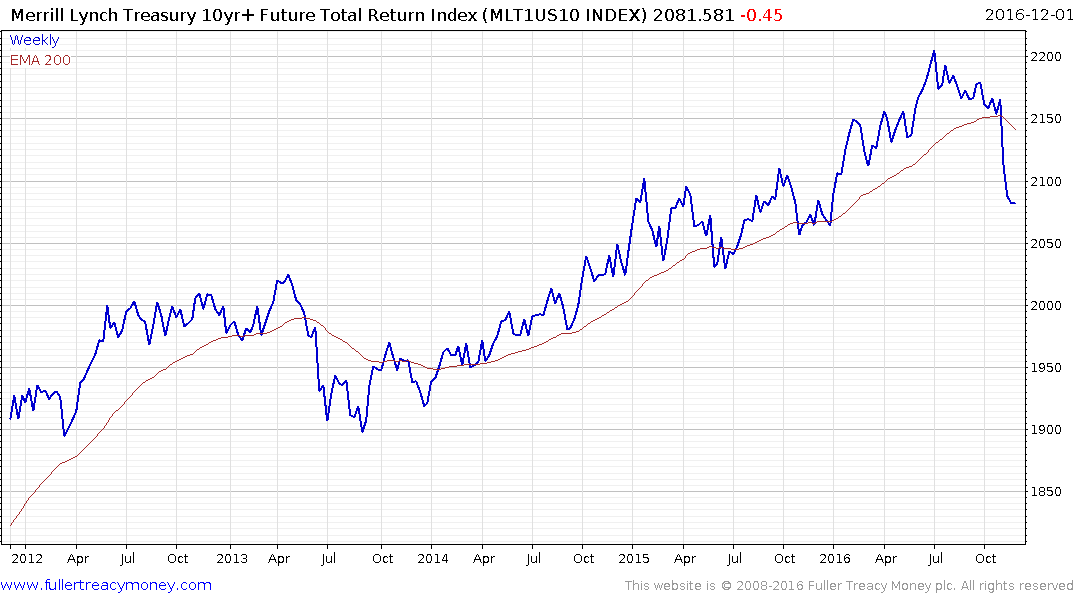

The difference now is that rates are expected to rise compared to what was expected during the taper tantrum. The discount rate represented by LIBOR is rising. As a result the total return on bonds has now experienced a deeper pullback than during the Taper Tantrum. The question then is will the yield find support in the region of the trend mean following any buy-the-dip rally that might take place especially since inflationary expectations are being priced in before they actually appear.

The banking sector is the clearest beneficiary of the expectation of a steeper yield curve. This is not just evident in the USA where the banking and diversified financials sectors have staged impressive rallies. Eurozone, UK and Japanese banks are all now trading above their respective trend means following lengthy downtrends. The majority of Asian banking sectors are also back on recovery trajectories and the Singapore Financials Index broke to new recovery highs today.