Is It Time to Cancel the Recession Altogether?

This article from Bloomberg may be of interest. Here is a section:

Yet the forecasting consensus still sees a 64% probability of recession in the next 12 months. They’re not giving up on the downturn thesis, just pushing it back.

At some point during a long streak of consistently underestimating month-to-month data, shouldn’t we all reconsider whether economists’ overarching narrative may simply be wrong, not just early? For the past 15 months or so, economists and strategists have been obsessed with Federal Reserve history and the yield curve. The historical record, of course, showed that Fed increases and inverted yield curves tend to signal a recession not so far down the road, and that may have blinded some analysts to the signs of strength that were right in right in front of them.

Households and businesses emerged from the pandemic with strong cash balances and modest debt burdens that have made them extremely resilient to higher interest rates. The jump in mortgage rates cooled housing activity, but it didn’t sink prices because homeowners — many with mortgages below 3% that they were in a fine position to keep servicing — were in no rush to sell. Meanwhile, the job market remained strong thanks to a pent-up demand for labor that has continued to buoy US consumption.

Can this continue?

If the pessimists have one thing working in their favor, it’s resilient core inflation and a Fed that’s determined — perhaps overly so — to bring it back to its 2% target. If you believe that demand is keeping inflation high (and there’s some evidence to that effect), then all of this economic strength will simply poke the bear (in this case Fed Chair Jerome Powell). Powell has the tools to break the economy’s back if he decides he wants to. But at the moment, the outlook looks remarkably sunny. And recent history has shown we should pay attention to the economic reality before us and not get overly fixated on history and hypotheticals.

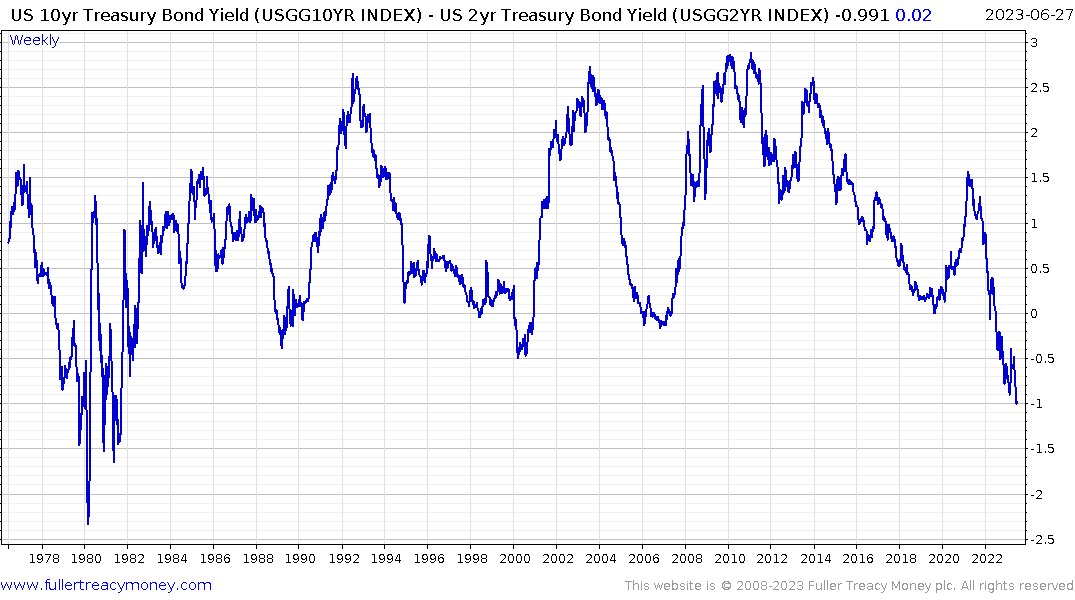

The Inversion of the yield curve is the most reliable lead indicator for a US recession. However, it is worth reminding ourselves, that the initial inversion starts the countdown for a recession, but the lead can be anything from six to eighteen months into the future. By the time a recession is actually confirmed most people have forgotten about the initial signal.

There is a clear incentive to ignore the threat of recession until it is a pressing reality. The most important is prices tend to rise following the inversion because investors cheer at the prospect of the Fed doing something about inflation.

On this occasion, the monetary excess and the subsequent inflation scare are both larger than anything seen in forty years so the impact of tightening is also taking longer to be felt. The initial round of hikes greatly reduced the fortunes of the most interest rate sensitive portion of the market and focused attention on the seven largest tech companies. Then the advent of AI has inspired investors to ignore the endgame of monetary tightening in the hope their investments will be immune from future trouble.

None of that avoids the potential for liquidity issues to arise in future. The most important thing is to monitor the consistency of trends one is invested in. The time to be particularly cautious is following the first interest rate cut. That does not generally happen until there is a clear growth scare.

Back to top