Iron Ore Seen at $50 in Last Quarter as Majors Gain Control

This article by Jasmine Ng for Bloomberg may be of interest to subscribers. Here is a section:

Iron ore may average about $50 a metric ton in the final quarter of the year after low prices forced many high-cost producers to quit the market and the world’s biggest mining companies completed a round of expansions, according to UBS Group AG.

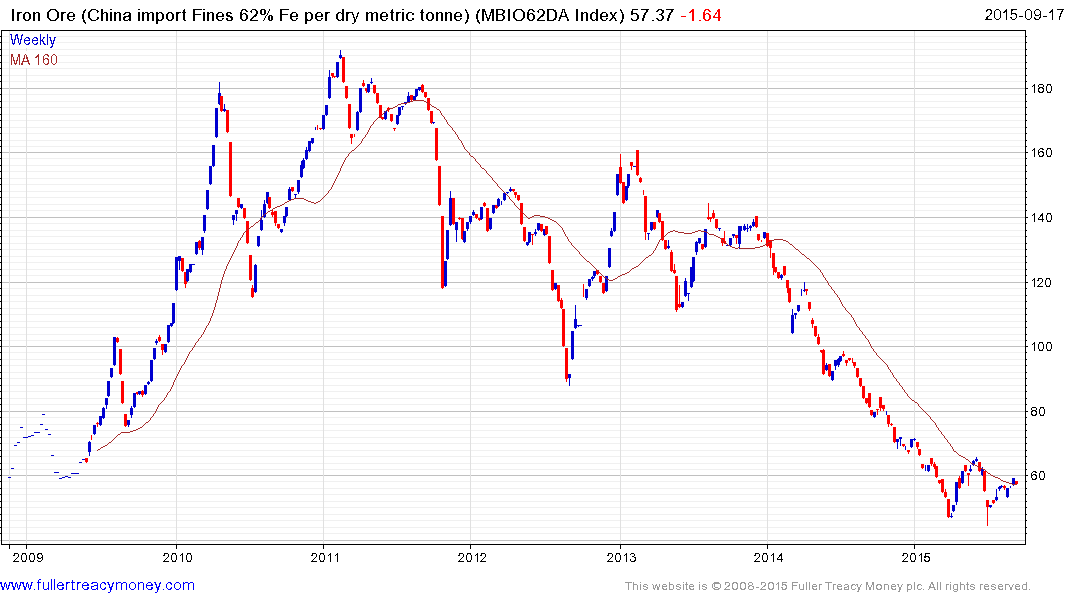

The supply surge from the largest producers has been delivered, with output stable for several months now, and there’s been a widespread exit of smaller players, Daniel Morgan, an analyst in Sydney, said in an e-mailed response to questions. Benchmark prices in Qingdao were at $57.37 a dry ton on Thursday, and averaged $54.69 so far this quarter.

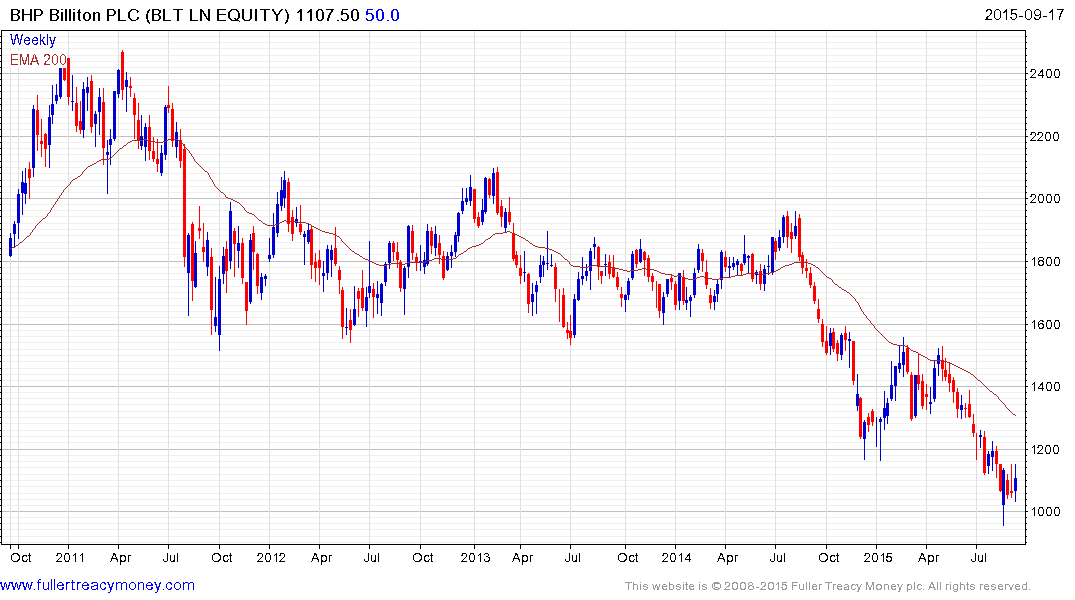

Expansions by BHP Billiton Ltd. and Rio Tinto Group in Australia and Brazil’s Vale SA helped to drag prices to the lowest level in at least six years in July, prompting the closure of less efficient miners while increasing the clout of the largest producers. Brazil and Australia were gaining market share in China, the world’s biggest consumer, Vale Chief Executive Officer Murilo Ferreira told reporters this week.

“The majors have just regained control of the iron ore market and can, if they wish, curtail supply to support the price,” said Morgan. “Under $50, we look for supply factors to support the price.”

The iron-ore oligarchy have been flexing their muscles over the last couple of years by increasing supply into a falling market. More than a few UK and Australian listed juniors have gone to the wall and Chinese domestic supply has been heavily impacted.

Iron-ore prices have stabilised following an accelerated decline and are currently testing the region of the 200-day MA. A sustained move above $60 would begin to suggest a return to demand dominance beyond short-term steadying.

Among miners, majors such as BHP Billiton, Rio Tinto and Vale have all stabilised over the last few weeks but will need to hold their lows on the first pullback to indicate demand is capable of returning at progressively higher levels.

FerrExpo has some of the clearest potential base formation characteristics and has been ranging mostly above 50p since December 2014.

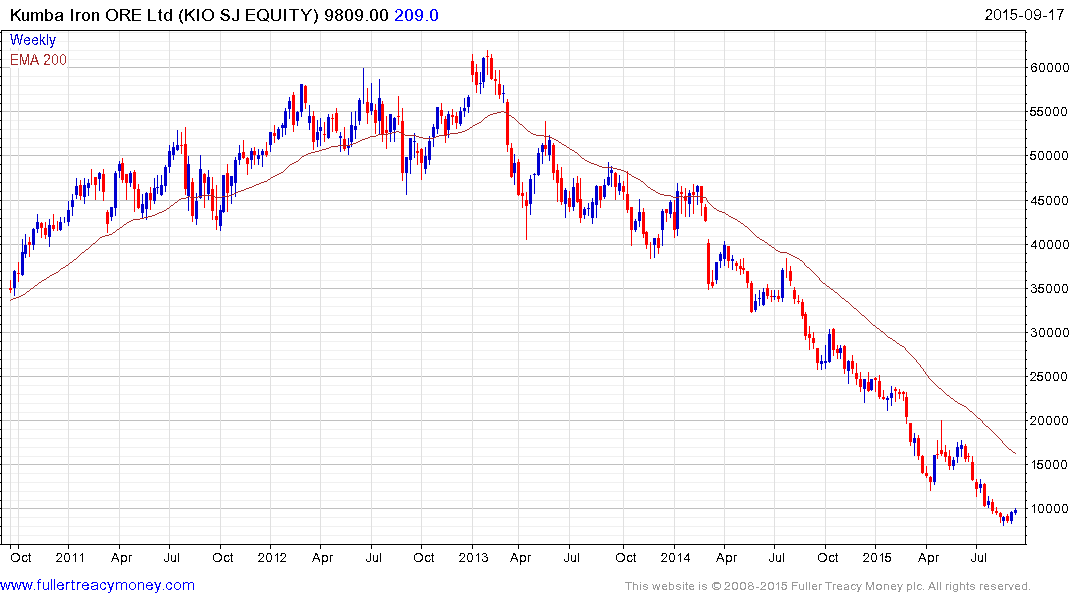

Kumba Iron Ore is more than 50% overextended relative to the trend mean following an accelerated decline and potential for a reversionary rally can be given the benefit of the doubt provided the late August lows hold.

Back to top