India Spending Bonanza Powers Stocks as Valuations Take Backseat

This article by Subhadip Sircar and Kartik Goyal for Bloomberg may be of interest to subscribers. Here is a section:

Stock-market sentiment has also been buoyed by the absence of new taxes on the wealthy and corporations in the budget. Traders expect the government’s growth push to boost corporate profits, which are already showing signs of a recovery. As the results season continues, 21 of the 29 NSE Nifty 50 firms that have reported earnings so far have beaten analyst estimates.

If the budget measures are executed properly, they have the potential to increase the share of corporate profits in GDP, and help bring about a new private investment cycle, recovery in domestic equity flows and earnings growth, analysts at Morgan Stanley wrote in a note.

The time to go big on fiscal spending is during a recession. It will mean the economy moves back into expansion mode quicker than might otherwise be case. Pushing out the ambition to contract the fiscal deficit by another few years was unavoidable and the stability of the Rupee suggests investors are reasonably comfortable with that idea.

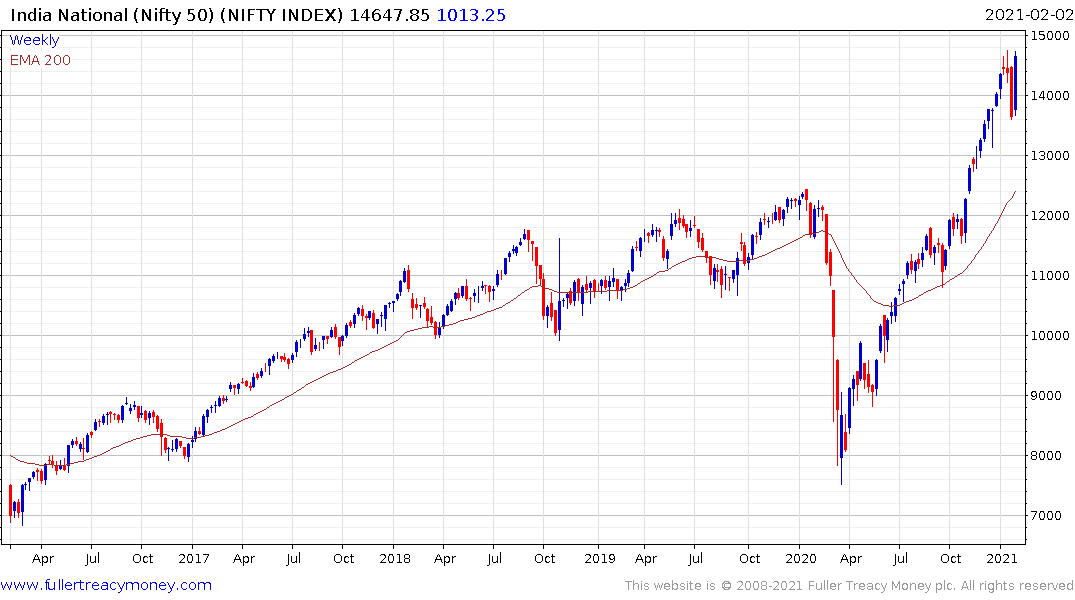

Meanwhile fiscal spending is boosting the outlook for the economic recovery and the stock market is responding. The Nifty Index rebounded impressively over the last two days. While overextended in the short term, a break in the short-term sequence of higher reaction lows would be required to check momentum.

India’s bond yields popped on the upside today to break back above the trend mean. It remains to be seen how accommodative the RBI will be to this fiscal push. If they agree to act to contain the rise in government borrowing costs it would multiply the stimulant currently being provided.

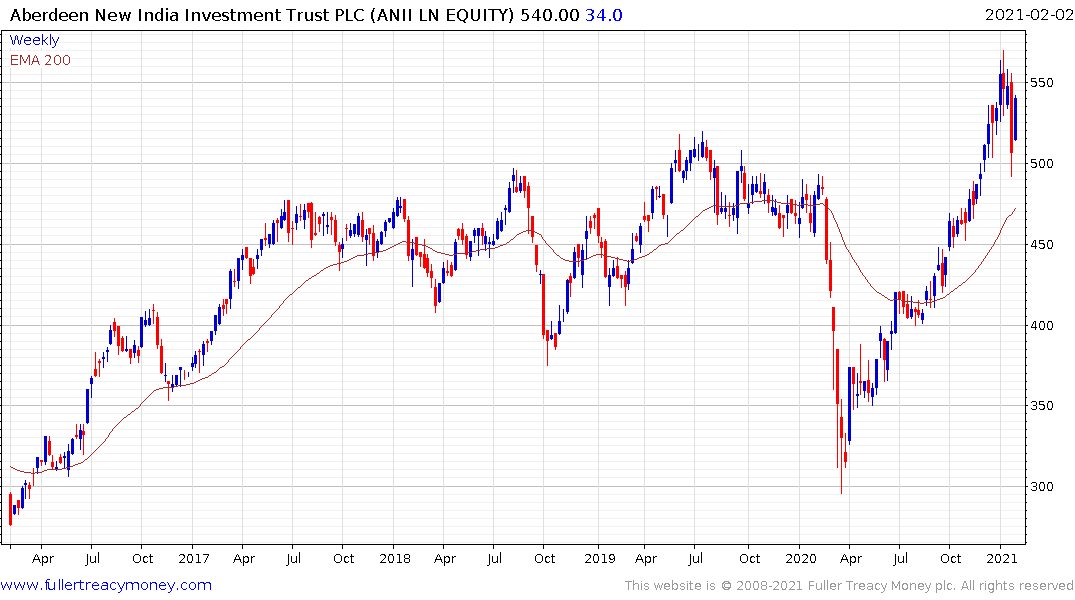

The Aberdeen New India Investment Trust bounced today from the region of the upper side of the underlying three-year range.