Incredible markets

Thanks to a subscriber for this thought-provoking article by Charles Gave. Here is an English translation:

What are these risks?

There is one and only one: that the dividends paid by the companies that make up the S&P 500 index do not collapse, as happened from 1929 to 1934.

And so, for those who think that capitalism is finally going to experience its great final crisis, it is better to have gold.

But in the event that this dear system of exploitation of man by man were to survive as it has always done throughout history, well, I could live to be two hundred years old without any problem, my capital remaining mine.

Which is not nothing.

But the value of my capital can vary very greatly, which I don't care about as only the dividend payments matter to me.

Today, transforming my gold into shares is almost indifferent to me.

Let's imagine that in the coming months, the stock market falls by 50%, that gold stays where it is, that the yield therefore increases from 1.7% to 3.4% and that the ratio goes from 1 to 1.5.

At that point, I can sell half of my gold and buy the equivalent in shares, which allows me to double my annual income.

If the ratio passes, after a fall in gold from 1 to 0.5, on the other hand, I must sell my shares to buy gold.

And this is undoubtedly why the ratio has oscillated between 1.5 and 0.5 for a century and a half.

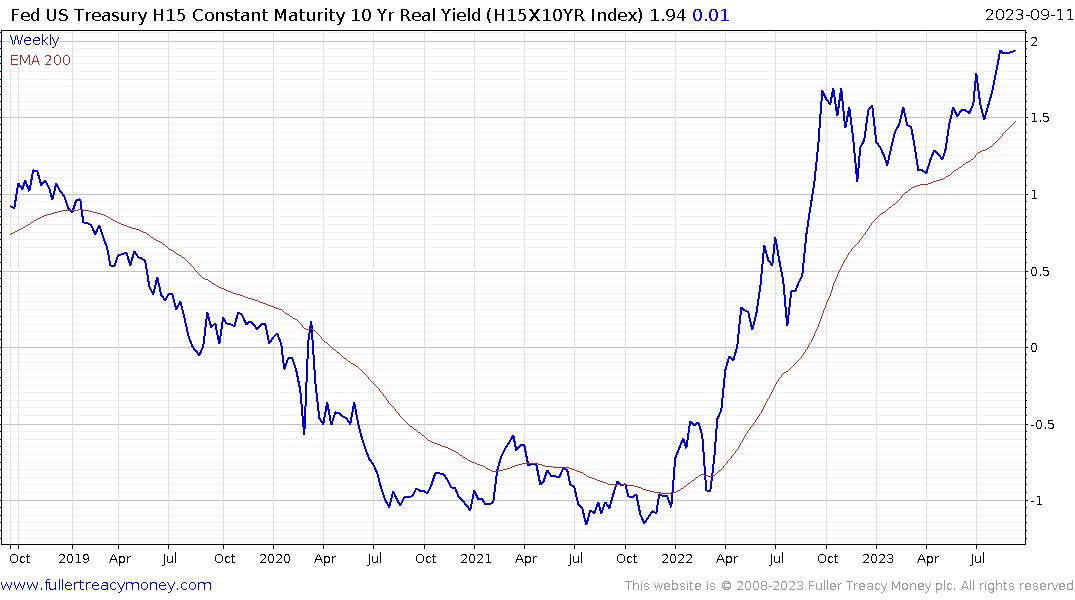

Gold does best when the stock market’s performance is nondescript, real rates are trending lower and the US dollar is weak. That is not generally the best time for the earnings yields to grow because secular bears generally mean excesses from the previous stock market bull cycle are being unwound.

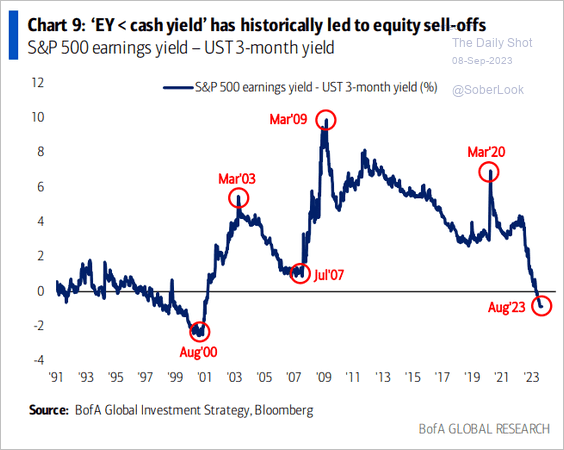

The other way of thinking about the relative attraction of an asset class is to think about the security of the dividend yield versus the surety of the Treasury yield. There have not been many occasions when the 3-month yield has exceeded the earnings yield of the S&P500. Before 2023, the last time was in the late 1990s.

When we look at the underperformance of the Ex-US versus US, commodities versus tech, or value versus growth they all tell the same story. Everything looks undervalued compared to the incredible outperformance of the mega-cap sector.

The Nasdaq-100 is still trading in the region of its peak. The consolidation in this region has been underway for two months. The relative attraction of other markets will not be convincing enough to attractive significant flows until the mega cap sector rolls over relative to the wider market.