How To Diversify Your Portfolio and Transfer Wealth Across Generations Without Financial Advisory

Thanks to Bernard Tan for this note which offers an interesting perspective on why truly global companies, that dominate their respective niches, with long track records, tend to outperform over time. Here is a section:

I’m going to use 3M to illustrate the following points.

1. Equities as an asset class is often perceived as riskier than others but there is one sector within equities that I will argue is safer than everything else including fixed income and real estate.

2. If you invest in a world class, global scale company that is from this sector, you are already fully diversified, hedged and all the macro economic issues and challenges taken care of.

3. This sector is resilient in the face of even a global financial crisis because frequently, these companies do not have high financial leverage. (Caveat: In recent years, it has become less true in the US and Europe)

What is 3M really? It is a deep physics, chemistry and material science company. Everything they do is about manipulating the atoms and molecules of nature to create functional materials that we can use in our daily lives.

With each passing year, 3M piles on more patents, a bigger library of chemicals and processes, more knowhow. All this knowledge is cumulative. The company is now 115 years old. All that accumulated intellectual property is practically unassailable. There will never be another company like 3M anywhere else in the world. Certain segments of their business can be separately attacked but there will never be another company that can challenge 3M on most fronts simultaneously.

This is the nature of science and intellectual property. The strength is cumulative over time. In contrast, for real estate companies and banks, big or small has no bearing on vulnerability to debt crisis storms, as we all learnt in 2008. The underlying strength is not cumulative over time, not the way it is for a science and intellectual property company.

Here is a link to the full note:

When I click through the constituents of the Autonomies section of the Chart Library 3M always comes out first because they are listed in alphabetical order. However, the reason the company is included in the list of Autonomies is because it fulfils every qualification for membership. It is a truly global company with operations everywhere and generates 60% of revenue from outside its home market.

It is also an S&P500 Dividend Aristocrat which means it has been increasing dividends annually for at least 25 consecutive years. The pace of dividend increases picked up in 2014 and grew 6.43% last year. The company also dominates the niche is has carved out for itself as a provider of goods and services to wide selection of businesses.

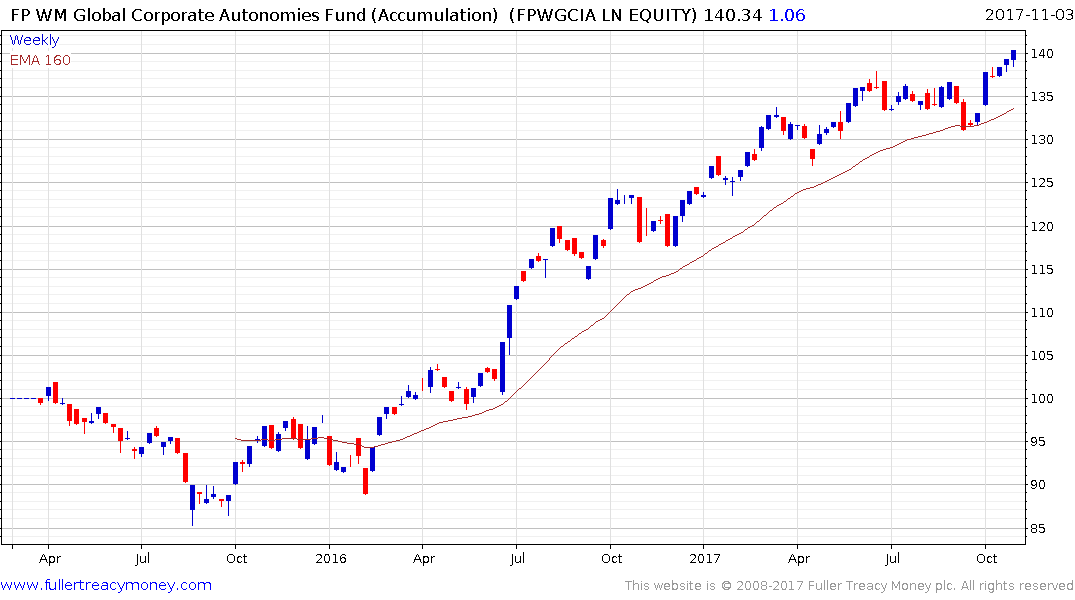

The kinds of companies we describe as Autonomies are the modern equivalent of principalities except they are infinitely more mobile, choosing the most attractive locations to research, manufacture and sell their products as well as where to domicile earnings and pay taxes. That’s ensures they have a great deal of expertise in developing long-term strategies to perform in a range of different economic and political environments. In that regard I agree with Bernard Tan’s proposal which is why I agreed to set up the Autonomies fund two and half years ago and insisted on competitive fees.

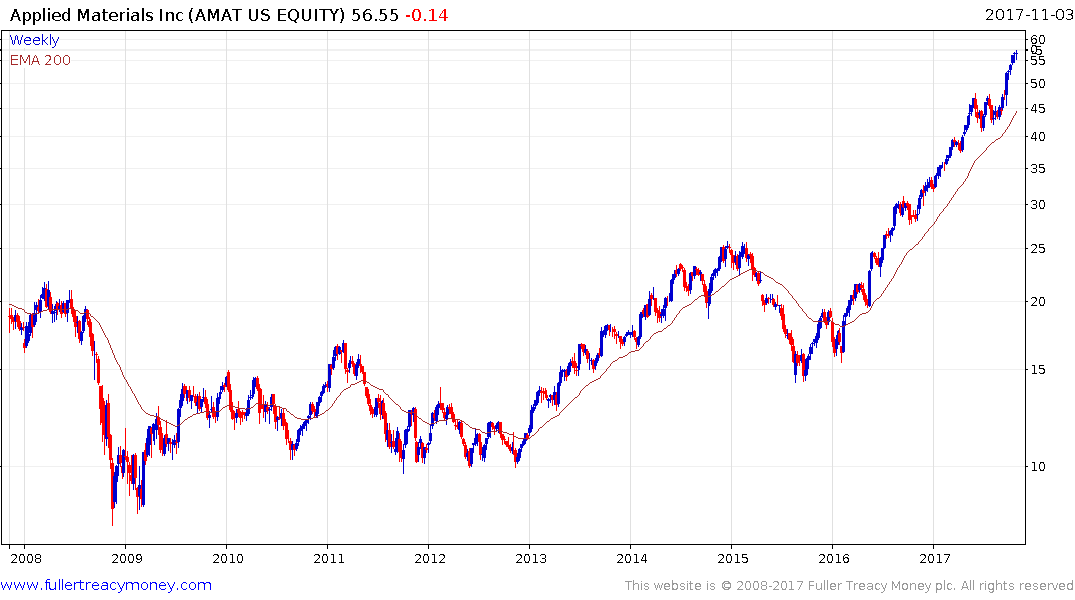

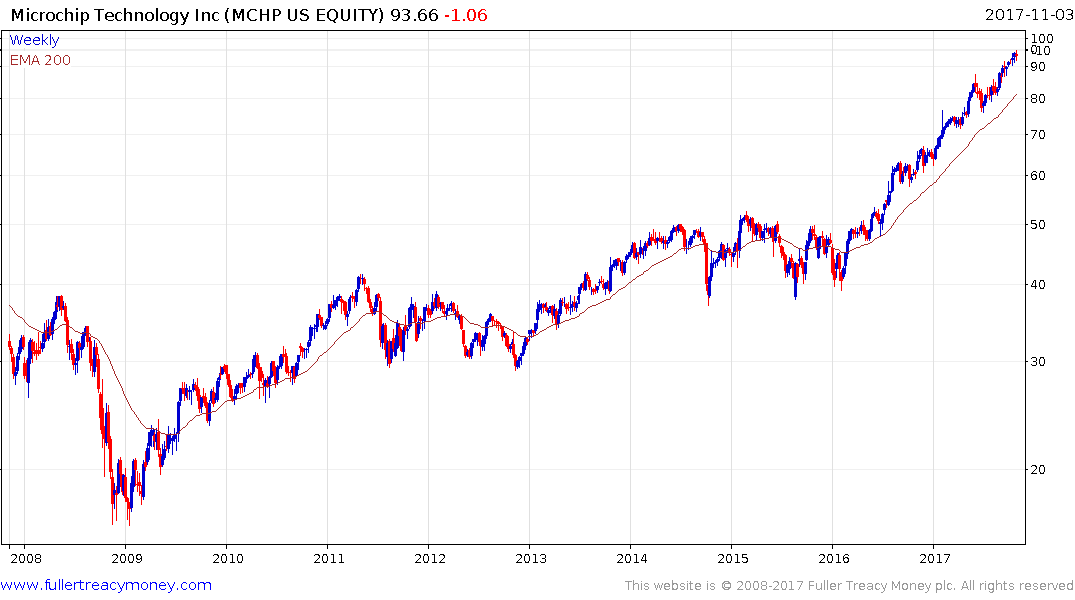

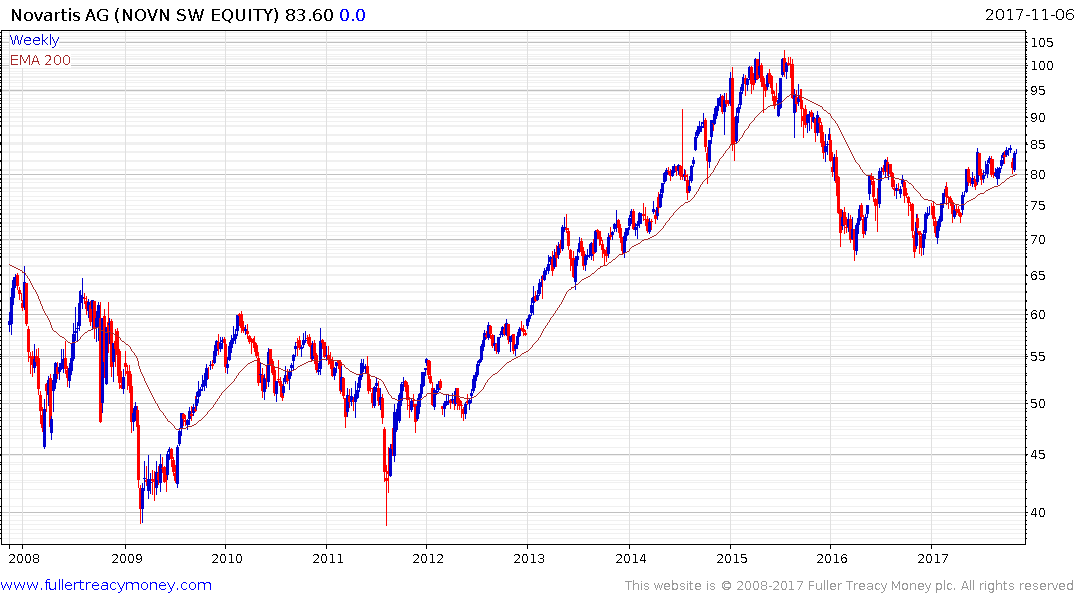

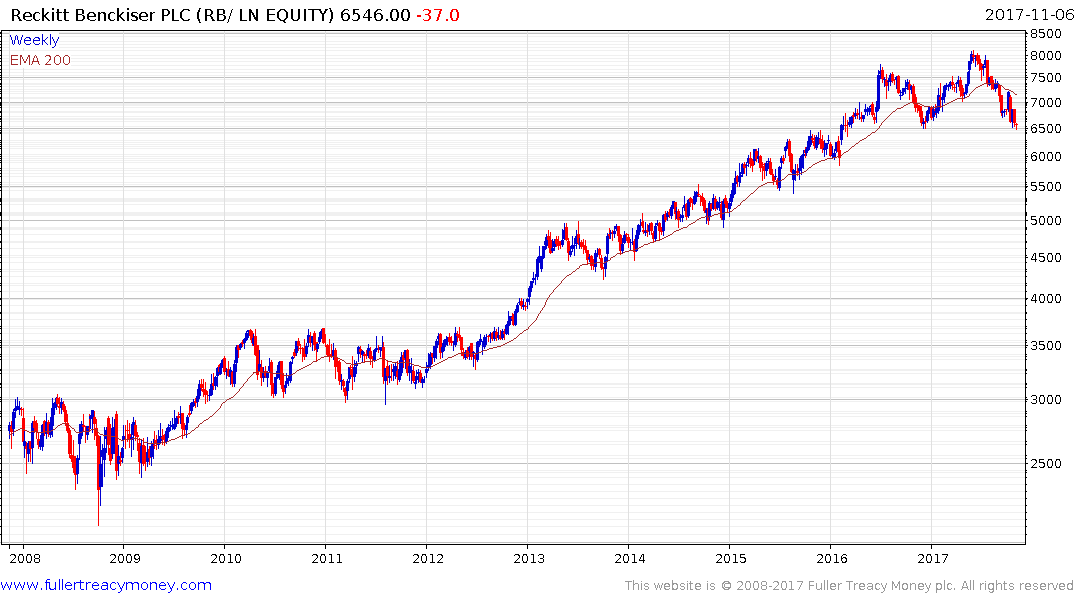

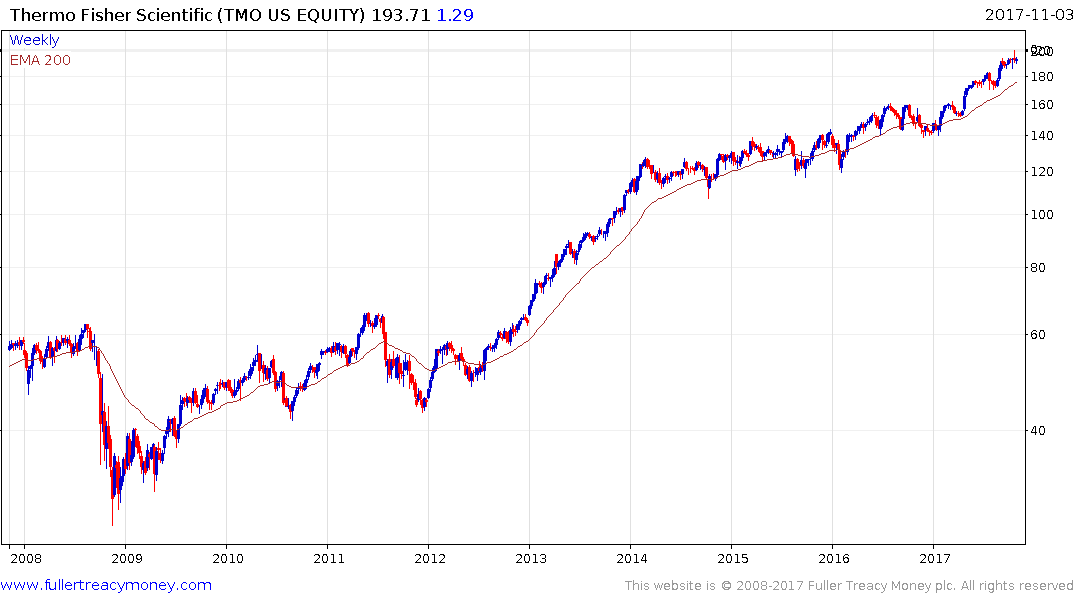

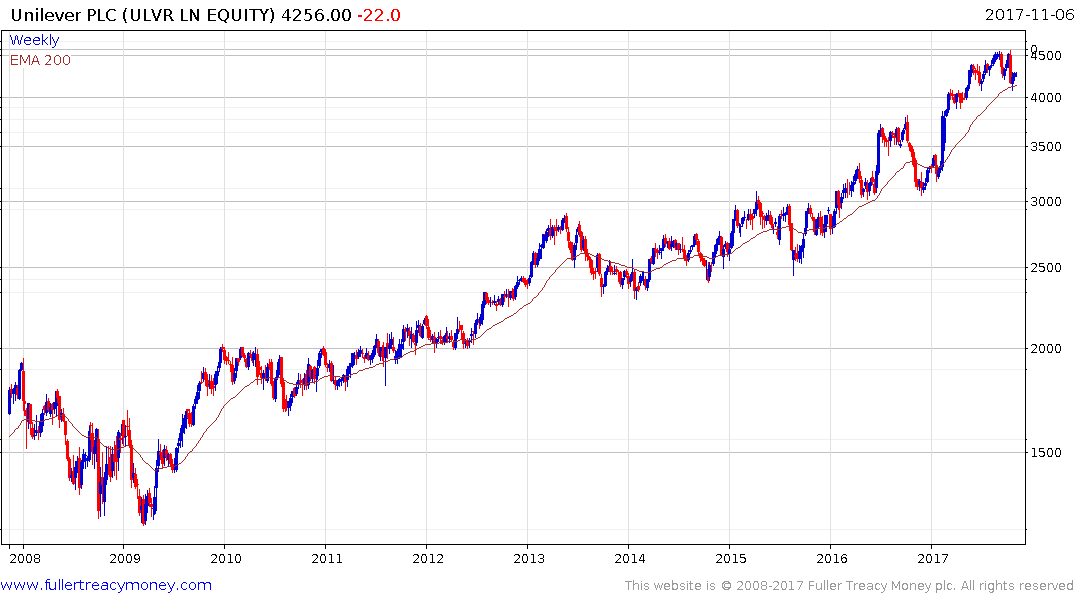

If we focus on the deep physics, chemistry and material science sector Applied Materials, Thermo Fisher, LAM Research, Microchip Technology, Novartis, Nestle, Shimadzu, Reckitt Benckiser, Unilever and similar companies all conform to the argument laid out in the above report. A casual perusal of the below charts highlights the fact they are best bought following periodic reversions back towards the mean.