High Conviction Calls Amid Cross Currents

Thanks to a subscriber for this report from UBS which may be of interest. Here is a section on Amazon:

Here is a link to the full report and here is a section from it:

Q: Can AWS sustain high revenue growth along with maintaining/expanding OI margins? Yes. AWS has (and will maintain, in our view) the dominant position in the Infrastructure-as-a-Service (IaaS) market and increasingly within Platform-as-a-Service (PaaS) & other IT spending pools. Our estimates assume AWS revs will grow at ~22% CAGR ('19-'24E), while margins continue to stabilize.

We continue to believe that COVID-19 will have a profound impact on consumer/enterprise behavior over the medium-to-long term. In our view, Amazon’s business mix positions the company to be a beneficiary of sustained long-term behaviors that are likely pulling forward prior multi-year industry adoption curves in eCommerce, cloud computing, media consumption, digital ad & AI voice assistants.

3rd party data and Amazon's Q2'20 EPS report (along with forward Q3'20 guidance) point to an accelerating offline to online shift in commerce amid COVID-19. Additionally, the latest UBS Evidence Lab US consumer survey (link) points to a healthy Prime ecosystem with stable to growing usage trends from existing subscribers and an opportunity to increase wallet share in an overall retail environment where eCommerce continues to gain share.

At the current valuation, we think investor expectations for strong topline growth (amid positive COVID-19 "stay-at-home" shopping dynamics) and concerns around forward margin pressure (1P/3P mix shift, COVID-related costs, & AWS investments) are largely priced in.

The fourth quarter is going to bring two strong sales events for Amazon. Prime Day usually occurs in July but was delayed because of the pandemic. It will now take place on the 13th. That might just kick off the beginning of the holiday season. Considering the extent of excess savings this year is likely to deliver a bumper holiday season for Amazon’s retail operation.

Meanwhile, the growth potential of the web services business was boosted by the lockdowns. Few companies are likely to give up on their technological evolution even when after the pandemic abates. That suggests it will be difficult to sustain the pace of growth in coming years.

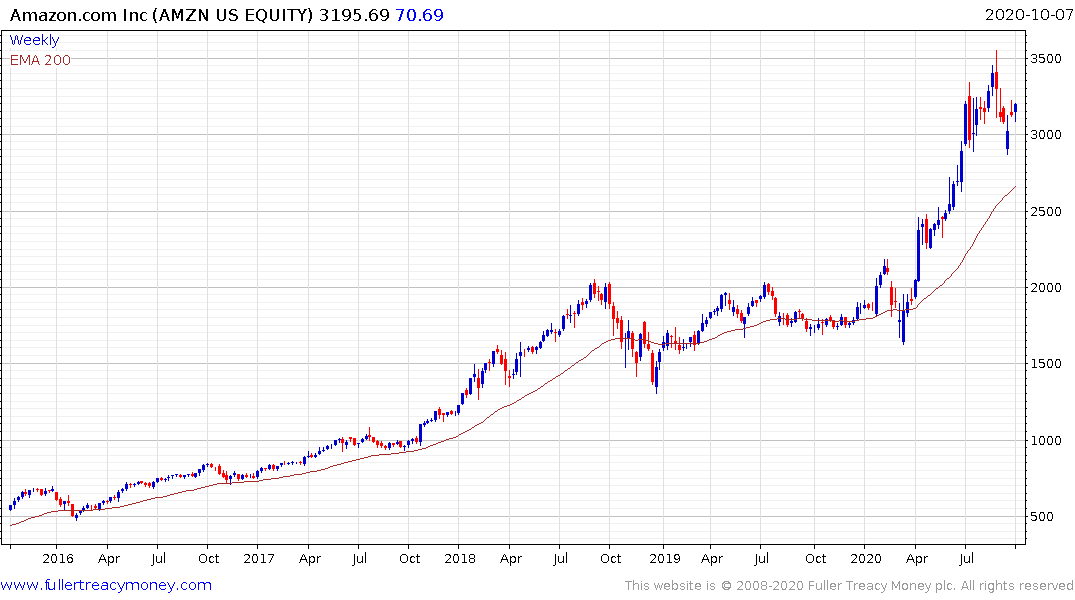

The share has been consolidating for the last couple of months and has unwound about half its overextension relative to the trend mean. It is currently firming from the psychological $3000 level.

The NYSE FANG+ Index remains in a consistent medium-term uptrend and is firming from the psychological 5000 level.

The continued positive outlook on the potential for additional stimulus should contribute to continued support for tech leaders even if evidence of rotation in recovery candidates appears to be picking up.

Back to top