Gordhan Wins Reprieve as S. African Prosecutors Drop Charges

This article from Bloomberg News may be of interest to subscribers. Here is a section:

The announcement Monday by National Prosecuting Authority head Shaun Abrahams signaled a dramatic turnaround in the legal pursuit against Gordhan, who was under investigation over the early retirement of a former colleague at the national tax agency that resulted in 1.1 million rand ($80,149) of allegedly wasteful expenditure. Gordhan was scheduled to appear in court on Wednesday. He’s still being probed for overseeing the establishment of an allegedly illegal investigative unit when was the head of the revenue service.

Gordhan and two former colleagues “did not have the requisite intention to act unlawfully,” Abrahams told reporters in Pretoria, the capital. “I have decided to overrule the intention to prosecute. I have directed the summonses to be withdrawn with immediate effect.”

Gordhan, 67, has been a key driver of a campaign to maintain South Africa’s investment-grade credit rating, which is up for review over the next two months. He called the allegations a political stitch-up, and he’s clashed with Zuma over the affordability of nuclear power plants the president wants to build, and the management of state companies and the national tax agency.

“It is certainly ratings-positive,” Rian le Roux, chief economist at Old Mutual Investment Group in Cape Town, said by phone. “I still think there is some chance we may get a reprieve. It is fairly evenly balanced as to whether we get a downgrade.

This is a positive development from the perspective of South African institutional governance remaining resilient in the face of quite intense political pressure. The clashes, often public, between Gordhan and Zuma are a healthy sign that a debate is ongoing on how best to manage the largest economy on the continent. It is to be hoped that Zuma’s influence is contained and he loses the next election.

The Dollar fell back to test the lower side of an almost three-month range against the Rand and a sustained move above ZAR14.25 would be required to question potential for additional underperformance.

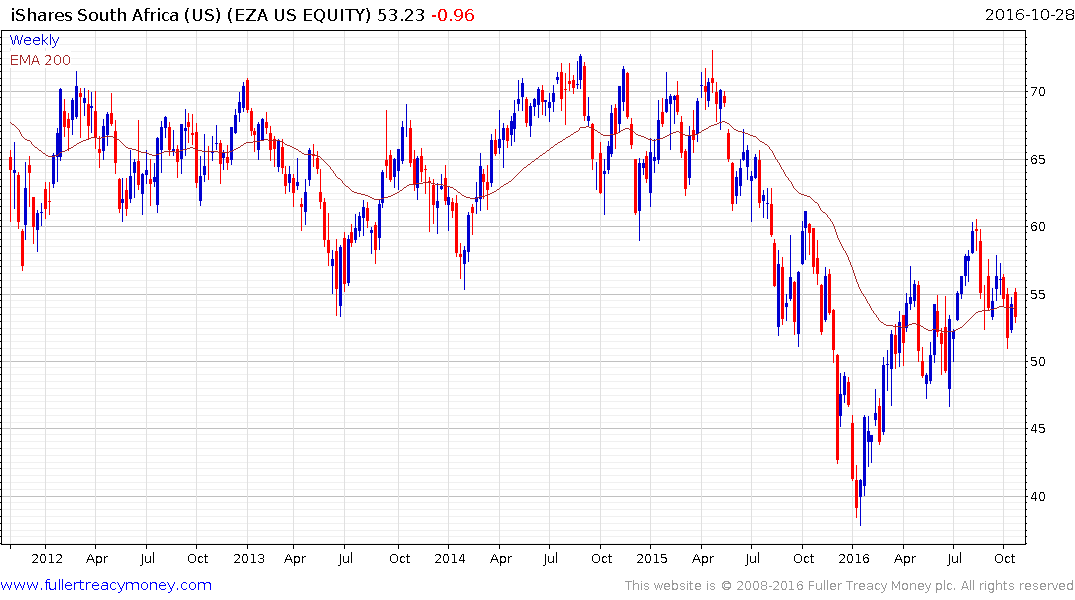

The iShares MSCI South Africa ETF has held a progression of higher reaction lows for most of the year and most recently bounced from $50. A sustained move below that level would be required to question potential for continued higher to lateral ranging.