Federal Open Market Committee Dec 18 Statement Full Text

The effect on asset markets of tapering quantitative easing has been debated extensively and we will soon have an answer to how the gradual ending of this period of extraordinary stimulus will be interpreted by investors. Here is a section from the statement:

Taking into account the extent of federal fiscal retrenchment since the inception of its current asset purchase program, the Committee sees the improvement in economic activity and labor market conditions over that period as consistent with growing underlying strength in the broader economy. In light of the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions, the Committee decided to modestly reduce the pace of its asset purchases. Beginning in January, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee's sizable and still-increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative, which in turn should promote a stronger economic recovery and help to ensure that inflation, over time, is at the rate most consistent with the Committee's dual mandate.

There is a link to a side-by-side comparison of Fed statements.

As the US government's fiscal deficit improves, the Treasury has less need to issue new debt. Therefore a reduction in the Fed's asset purchase program is consistent with maintaining its current stance as accommodative but not aggressively inflationary.

The central bank has made clear it is willing to do what is necessary to fulfil its dual mandates, so a schedule of $10 billion in asset purchase reductions would only be appropriate if the economy remains on its modest growth trajectory. While they have intimated that this is their intention we can expect policy to be flexible.

The pace of the increase in the size of the Fed's balance sheet will probably now moderate which is a significant consideration for stock market investors, considering the high correlation between it and the S&P 500's performance. However, investors are likely to continue to give the benefit of the doubt to the upside provided the progression of higher reaction lows remains intact.

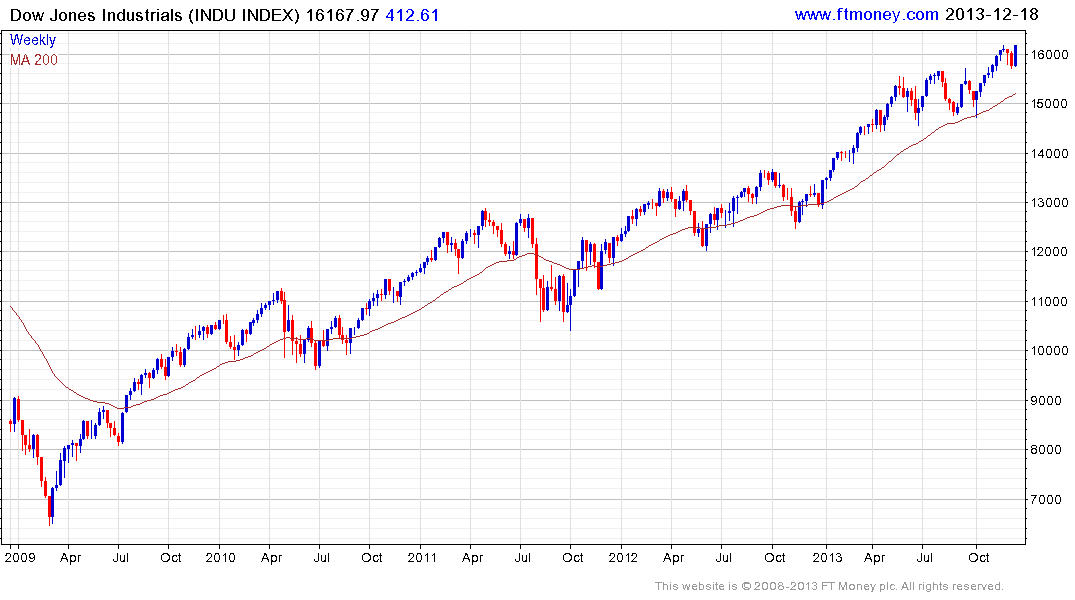

The Dow Jones Industrials Average bounced on the news, led by 3M which has increased its dividend by 35%. The Average is less over extended relative to the 200-day MA than other major indices and found support late last week in the region of the upper side of the June through October range. A sustained move below 15,500 would be required to question medium-term scope for additional upside.

The Nasdaq-100 recouped an earlier decline of approximately 1% and while about 10% overextended relative to the 200-day MA, a break in the progression of higher reaction lows, currently near 3325, would be required to check the consistency of the six-month advance.

US 10-year Treasury yields continue to pause below 3% and a sustained move above that level would be required to reassert medium-term supply dominance.