Exxon to Buy Denbury for $4.9 Billion in CO2 Pipeline Push

This article from Bloomberg may be of interest. Here is a section:

Carbon capture is the bedrock of Exxon’s climate strategy, which targets net-zero emissions by 2050 from its operations, and buying Denbury would give the oil giant critical and hard-to-replicate infrastructure as it pursues that goal. Exxon has pledged to spend $17 billion on lower-carbon investments through 2027. Capturing carbon from its own operations and third parties in hard-to-decarbonize sectors is a priority.

Denbury’s Rocky Mountain assets are connected to Exxon’s Shute Creek gas facility near LaBarge, Wyoming, which has captured more carbon than any other asset in the US.

The only way decarbonization works in oil and gas is if it is profitable. That’s a big ask since capturing it is an additional cost. That’s why carbon trading programs put a premium on the commodity.

Since the disruption of war in Ukraine, most of the large oil and gas companies have walked back their commitments to decarbonize on practical grounds. Instead, they are boosting investment and those are decade-long plans. The fact Shell is talking about selling a stake in its renewable power venture on the same day that Exxon is buying a carbon dioxide pipeline is a clear indication of the direction the energy sector is taking.

The efforts to mitigate emissions are laudable but progress will be slow because in many cases there is no useful alternative. By acquiring Denbury, Exxon Mobil is tapping into the commercial market for carbon dioxide which is a vital industrial gas. That might lead to carbon sequestration but only time will tell.

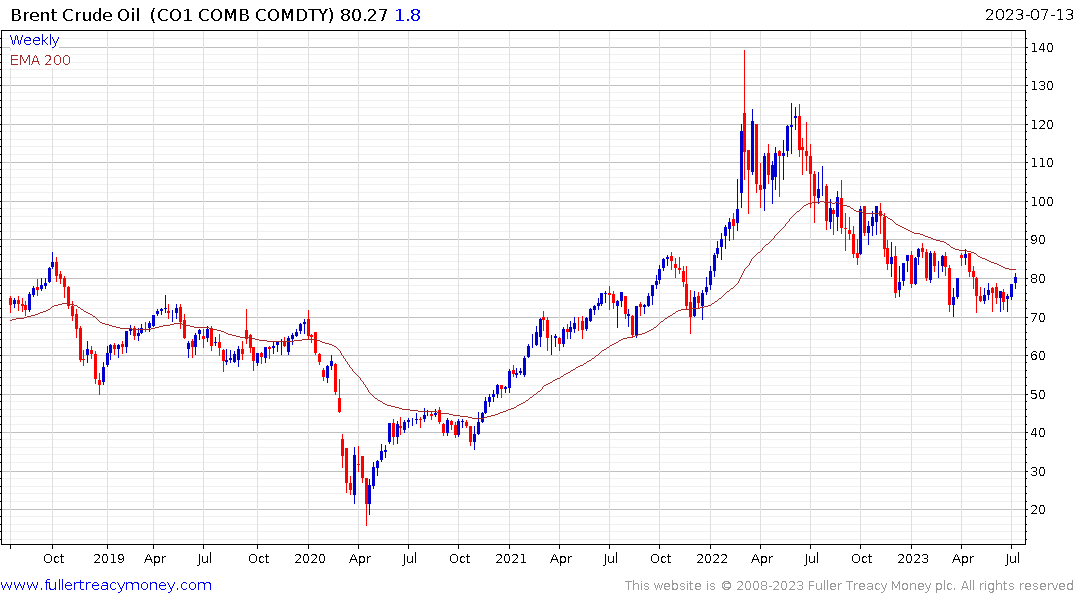

Brent crude has broken out of the short-term inert range. It is now testing the 200-day MA and the yearlong sequence of lower rally highs. We at least have evidence of support in the $70 area but a sustained move above the MA will be required to confirm the signal.

Brent crude has broken out of the short-term inert range. It is now testing the 200-day MA and the yearlong sequence of lower rally highs. We at least have evidence of support in the $70 area but a sustained move above the MA will be required to confirm the signal.

Natural gas prices appear to be in the process of developing a base formation as it eases back from the $3 level.

Both Exxon and Shell have spent the last year ranging and holding their respective sequences of higher reaction lows. Those recent lows will need to continue to hold if potential for higher to lateral ranging is to be given the benefit of the doubt.

The KraneShares Global Carbon Strategy ETF is testing the lower side of its six month range and will need to hold the $35 level if support building is to be given the benefit of the doubt.

The KraneShares Global Carbon Strategy ETF is testing the lower side of its six month range and will need to hold the $35 level if support building is to be given the benefit of the doubt.