Europe's Stimulus Package Sparks "Mother of All" Market Dreams

This article by Cecile Gutscher and Ksenia Galouchko for Bloomberg may be of interest to subscribers. Here is a section:

There’s no sign yet that the stimulus package is anything more than a one-off response to an unprecedented crisis. Even so, investors are viewing it with a bullish lens. “It’s completely new territory for the European Union,” Michael Strobaek, global chief investment officer at Credit Suisse Group AG, said in a Bloomberg TV interview. “And that would make the European Union as an investment much more attractive for global investors.”

That would represent a shift for European markets, which have been unpopular compared with the U.S. For example, European equity funds suffered from outflows more than any other major region this year, losing about $31 billion, according to data from EPFR Global and Bank of America Corp.

Bond Buyers Toast EU Ambition in Moment They Were Waiting for Gary Kirk, a money manager at TwentyFour Asset Management in London, which oversees 17.8 billion pounds ($22 billion), is sticking with his U.S. bias. “It’s a bit early to get overly excited,” said Kirk, who’s waiting to see how the details are hammered out and whether it will pass muster with more austere governments in north Europe.

The Eurozone’s so-called sovereign wealth crisis arose because investments creditor nations’ pension funds made in private enterprises in the Eurozone’s periphery went bad. That was blamed on lax regulation and egregious behaviour with the result respective governments were forced to absorb private sector debts. That blew out sovereign debt ratios and caused a crisis. The response to the coronavirus could not be more different. Coupled with a willingness to loosen fiscal constraints, there is now also willingness to break the taboo of direct transfers to weaker nations. That is significant development even if it proves transitory in the near term.

The Euro popped back above the trend mean today for the first time in a couple of months and a sustained move below $1.10 would be required to question potential for additional upside.

German Bunds peaked at 180 between August and March and encountered resistance this week in the region of the trend mean. With ebbing demand for safe havens and the likelihood Germany will be picking up much of the bill for assistance, there is clear scope for additional selling pressure.

The broad Euro STOXX Index continues to extend its rebound.

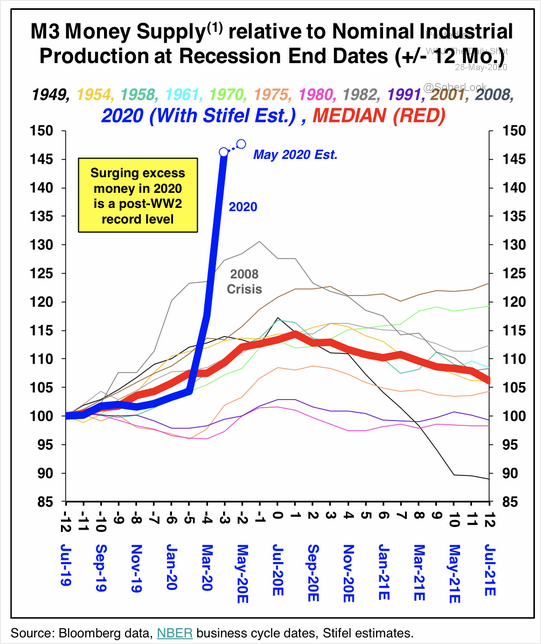

Luxury goods manufacturers continue to be among the best performers in the region. Hermes broke out to new highs today in a robust manner while the sector is generally firm. These companies are benefitting both from the improving domestic European outlook but also from the exceptionally quick expansion of money supply over the last few months. Since the benefits of quantitative easing tend to accrue most readily to the holders of financial assets.

Richemont has been under a great deal of pressure because of the competition smart watches represent. However, it is likely to benefit from the surge in money supply. The share is now back testing the upper side of the short-term range following a very steep decline over the last couple of years.