Email of the day - on gold and the US election

hope you are good? Interesting to hear your views on the US election today. Eoin, am I the only person who is surprised that gold and gold miners are not doing better right now - given the weaker US Dollar and the potential uncertainty surrounding the US election? Also, earlier in the Summer, I think you went on record saying you didn't think there would be a 'second COVID wave.". What is your view now please? BTW, I don't listen to the Audios, I just watch the daily/weekly video commentary. Many thanks

Thank you for this series of questions which may be of interest to subscribers. I did say that there would not be a second larger wave because I do not believe the parallels being made with the Spanish flu a century ago make sense.

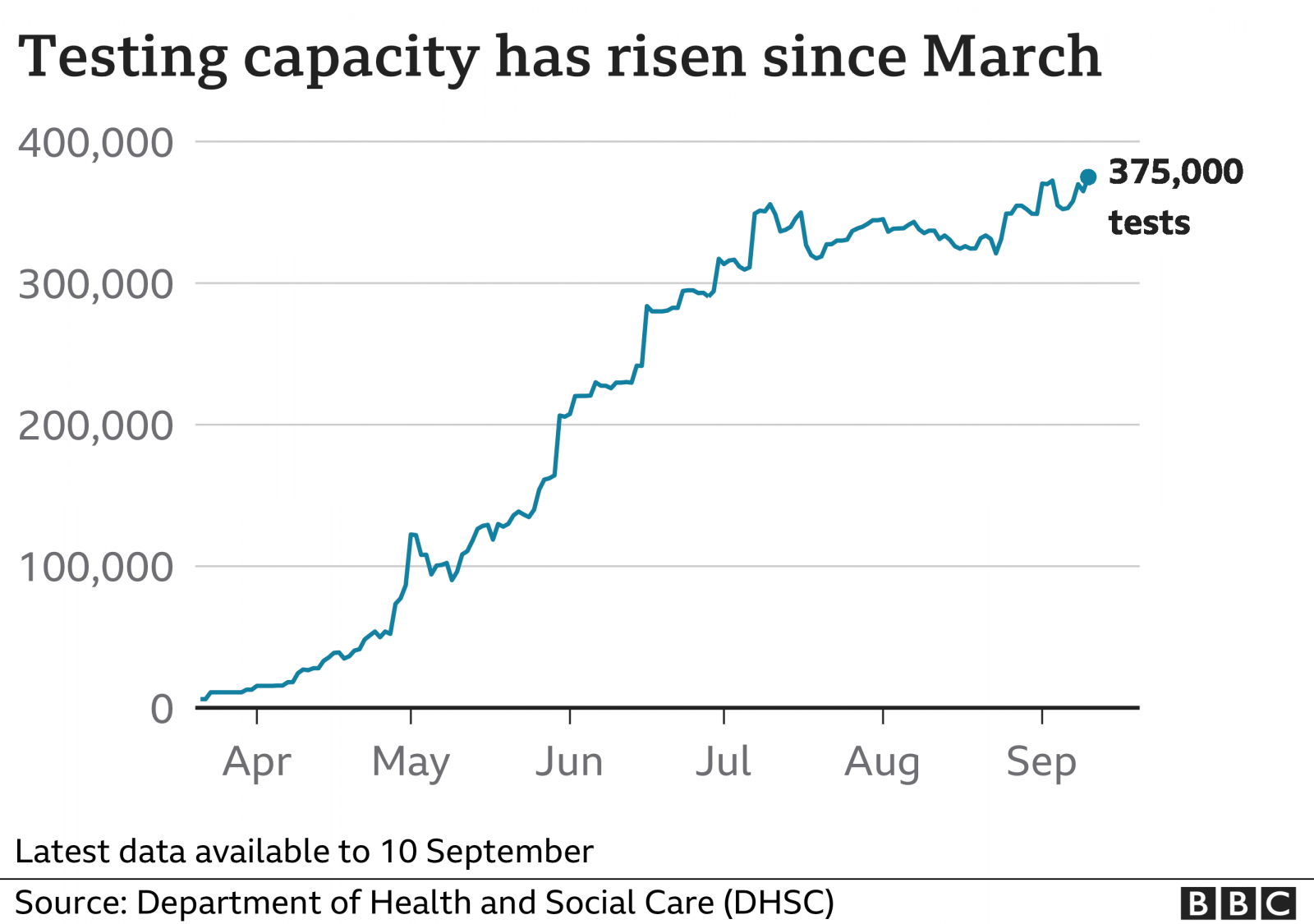

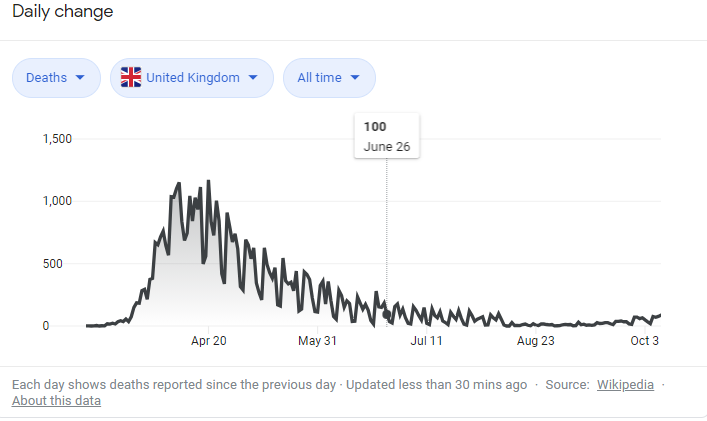

The number of cases has certainly risen but the number of tests being performed has also exploded. That is not a 2nd wave. If we look at death rates there is no 2nd wave.

If we look at hospitalisations, they have ticked higher so some caution is warranted. Concurrently, the range of potential solutions and treatment options continues to expand so survival rates should continue to improve.

The outlook for gold and, by extension, gold miners is tied to liquidity. The Fed’s balance sheet has been static for almost six months and the pace of M2 expansion has been modest at best. Therefore, the onus for supplying additional liquidity has fallen on the fiscal side. Every time it looks like a stimulus deal will be agreed, gold rallies. Whenever enthusiasm for a deal wanes if declines.

.png)

That’s exactly what happened today. It seems unlikely the two parties will agree, while the contentious decision to approve another Supreme Court Justice only three weeks before the election is ongoing. Nevertheless, no one really believes a deal is impossible. The timing, however, has become highly politicised. The Dollar is also highly attuned to the outlook for additional fiscal stimulus.