Email of the day - on gold and asset allocation

It has been a couple of years since I last submitted a question, however the following has been niggling at me for some time and your Big Picture video this week was the final catalyst I need to put fingers to the keyboard.

Traditional guidelines for asset allocation usually vary somewhat depending on the advisor and the client’s age, financial means etc, however they follow a general model of diversifying investable assets into property/shares/international shares/government bonds/corporate bonds/cash, etc in various percentages. Gold, if recommended at all, gets relegated to the 1% - 2% category.

But as you have been pointing out in your audios/videos for some time now, in the current environment of unprecedented fiscal and monetary stimulus, dollar debasement, a looming sovereign debt crisis, geopolitical tensions etc, etc, I feel perhaps the traditional allocation percentages can be detrimental to new wealth creation, and that a more skewed approach, with a much higher conviction to certain asset classes should be considered.

Fortunately, from a personal position, I started moving to overweight shares in gold, silver and other precious metal miners about 3 years ago, starting initially with gold, and then into silver and silver miners about a year ago. Although perhaps a bit early in some instances, I now find these positions in 15 different mining companies and 4 ETF’s in Australia, USA, Canada & the UK are all up between 30% - 300%, and now constitute about 60% of my investible assets. I realise by traditional gauges most financial advisors would say I’m crazy (which is why I haven’t used any for about 20 years), and that I’m too heavily invested in one asset class. But I have always taken a high conviction approach to my investment initiatives. In addition, a good lesson learned during the GFC was to keep 2-3 years cash available to get through any downturn, so in case my timing is wrong or I’m just plain wrong, I will have adequate funds to support myself & family without compromising our lifestyle.

But as you indicate, we are in a different environment, so my takeaway is that a different approach needs to be taken. Consequently, my question/quandary is what to do with the remaining 40% of my investments? Most of these have been invested in the Platinum Asia Fund, which has basically gone nowhere over the past 4 years, and to a lesser extent Platinum Japan, with a similarly dismal performance. Your recent audios/videos paint a rather gloomy outlook for China and correctly highlight the country’s investment risks. Since the Platinum Asia Fund is predominantly China focused, I am feeling more at risk than optimistic for future returns, and am now thinking of selling my entire holding in this fund to take advantage of investment opportunities in other areas.

But outside of the gold, silver & base metal miners, I find little or nothing that inspires me at present. I would never think about putting these funds into Tesla, FAANG or other high-flying technology stocks, and with economic growth looking so precarious in most countries around the world due to Covid-19, I have little appetite to initiate investment in Europe or the USA (other than mining companies). I am already well established in various segments of the market relating to battery technology and perhaps I’ll hang onto the Japan Fund for now. But regardless of where else I look, I keep coming back to gold, silver & base metal miners as representing the best opportunity over the next 2-3 years, especially when one considers that we are only at the beginning of a major secular bull market in gold/silver/platinum, with the miners usually high beta the metal at this stage in the cycle.

The ramification is that my entire investment portfolio would then be even more highly skewed to about 80% gold, silver and other metal miners. At some stage I will obviously need to keep a sharp eye on the charts to look for acceleration and over extension because if my timing is wrong and I sell too late, this happy scenario can quickly turn into a disaster as getting out of 15 - 20 companies quickly, especially in some of the small-mid caps where I am a major shareholder, could be a challenge!

So, considering my age which is now late 60’s, is this crazy & irresponsible? Or should one seize this moment and take full advantage of what can be perceived as a once in a generation opportunity to profit from the unfolding crisis? Over recent days I have begun to see gold & silver mentioned on mainstream media such as CNBC, Bloomberg, the Australian Financial Review etc, and Wall Street firms are starting to take note and provide an outlook on the sector. If metals and miners were not just beginning to break out from their long-term ranges, one could interpret this as a contrarian indicator. But what encourages me is that so far the mainstream media doesn’t seem to fully grasp the reasons behind the recent rise in gold/silver prices, (e.g. one expert telling people to now sell gold as it had reached its peak and was all downhill from here), advisors are still not recommending gold shares in the media or on Q & A sessions, pension funds and private investors are still underweight gold/gold shares or have no holdings at all, and everyone still seems to be in denial or at least not very concerned or vociferous about the debasement of the dollar and other fiat currencies and the wide-ranging impact it will have on all sectors of the market.

Anyway, your comment and insight would be greatly appreciated.

Eoin, I have enjoyed and benefitted from your service since the late 1980’s, when I had zero funds to invest, but still anxiously awaited each edition of the old hardcopy reports! These formed the basis of my acquiring an understanding of the markets and guiding me through my first steps in investing once I eventually had some funds to invest in around 1990! The service has gone from strength to strength, through the addition of the Chart Library, the daily audio and now video where charts can be analysed as you explain them. I continue to learn every day and am grateful to you and the service for facilitating this.

And

Further to my earlier email, I omitted mentioning an important point so add it below as a PS.

P.S. I’m not proposing to jump in now and chase the market for additional Gold/Silver shares, but want to have funds available to take advantage of any pullback. In addition, if/when the gold/silver shares take another leg up from here, my plan is to take some profits off the table in anticipation of a consolidation and build up further reserves for the next buying opportunity.

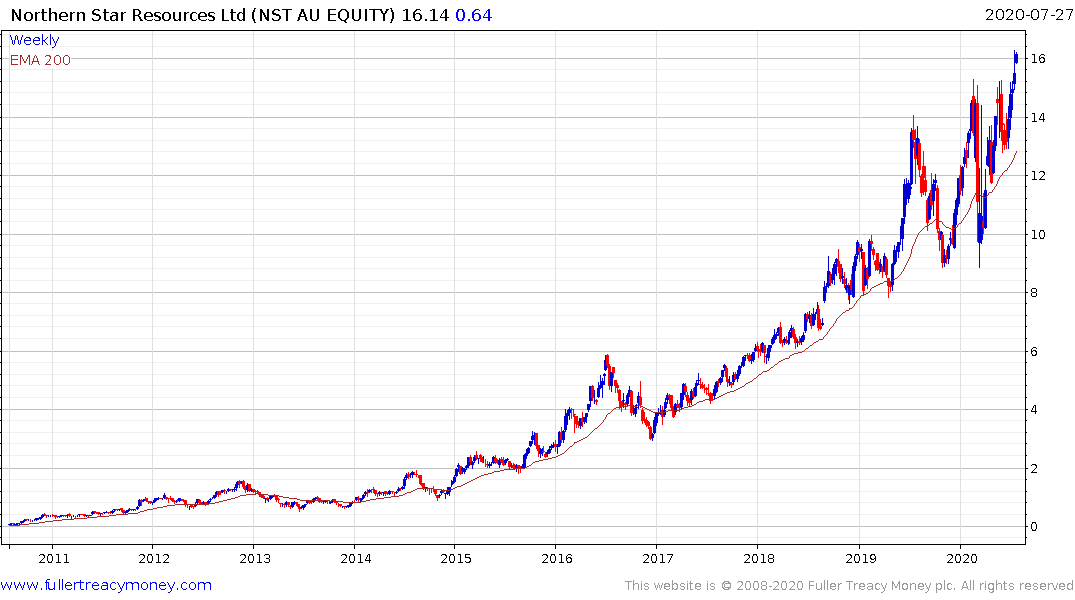

Thank you for this thought-provoking email and your long-term support. At the Melbourne Chart Seminar in April 2018, the clear message was Australian gold miners were breaking out. At the time shares like Evolution Mining, St Barbara, Northern Star and Perseus Mining were on the verge of completing bases and the price of gold in Australian Dollars was testing the upper side of a six-year base.

Since then we have seen significant appreciation in the Australian gold mining sector which was accompanied until quite recently by a downtrend in the Australian Dollar. The weakness of the US Dollar is now creating a global trend toward increasing positions towards gold in portfolios.

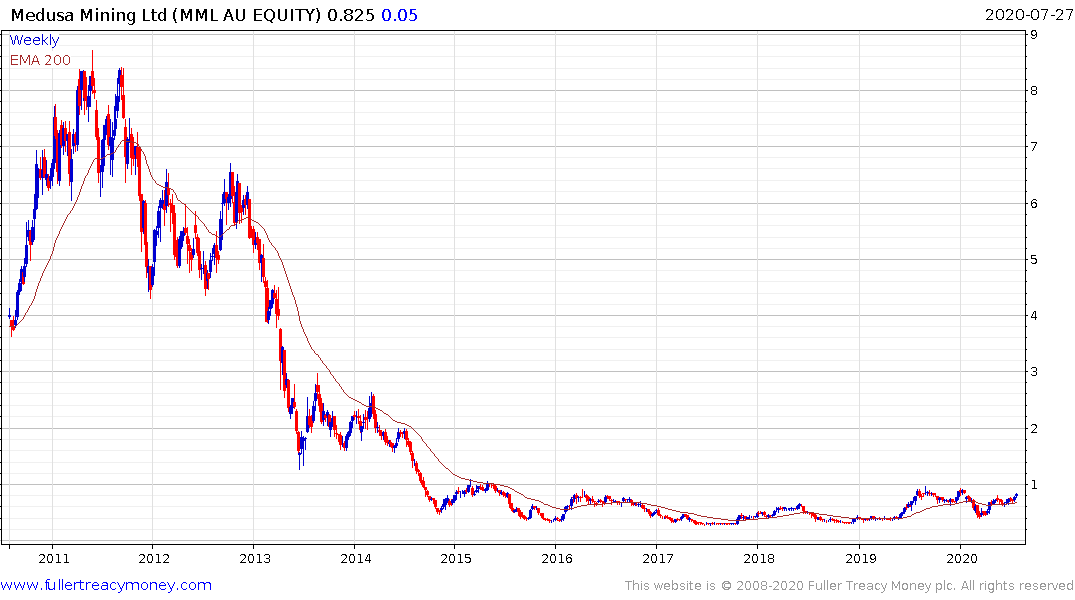

Medusa Mining is now coming back up to test the upper side of its base formation.

The biggest challenge for medium-term investors is the discount rate, against which the potential for all other investments is measured, is zero. Cash returns are close to zero and 90% of all bonds have yields below 1%. This is not conjecture. These are the facts everyone managing money are dealing with.

This represents a clear tailwind for growth and for zero coupon asset (gold) appreciation. The mega-caps are expensive but still steady. Gold shares are low relative to their peaks and have improving profitability. Therefore, they are the cheaper value asset with growth potential.

An important point which I do not think gets enough attention is that it is often as important to avoid the laggards as it is to bet on the leaders. The compression of yields in the fixed income markets is a problem. We might yet see even more bonds move into negative yielding territory but nothing has occurred to question the conclusion we are in the latter stages of a secular trend. In the corporate sector, there are a large number of companies whose intangible values exceed their market cap. They represent significant laggard risk.

From an asset allocation perspective, there is an argument to be made for devoting fixed income weightings to precious metals. They are much more volatile than bonds but offer the same kind of hedge against misfortune as bonds without the negative exposure to inflation that negative yielding bonds do. Allocations of anywhere from 5% to 10% are conservative in my view. I am in full agreement that a disaster fund of at least a year of expenses is advisable and that should not be included in one’s investment cash allocation.

The most important thing to remember about gold is it is volatile and subject to occasional swift and deep pullbacks. The most recent of those was in March and it helped to highlight the fact that the best time to buy, particularly for investors, is following pullbacks.

The massive monetary and fiscal response to the coronavirus will likely be seen as the tipping point for the Dollar. The USA’s interest rate differential, supply deficit and exceptionalism have all been eroded or questioned and the upcoming election represents a massive uncertainty. Meanwhile, extraordinarily low interest rates represent a strong incentive to borrow aggressively to fund infrastructure development. That is a global phenomenon fuelled by need, geopolitics and realpolitik. Moreover, industrial resources are cheap.

Commodities and gold tend to share a lot of commonality but they are separate asset classes. Gold continues to benefit from the clear intention of just about every government to print their way out of trouble. Meanwhile the bull market outlook for industrial resources is predicated on infrastructure development.

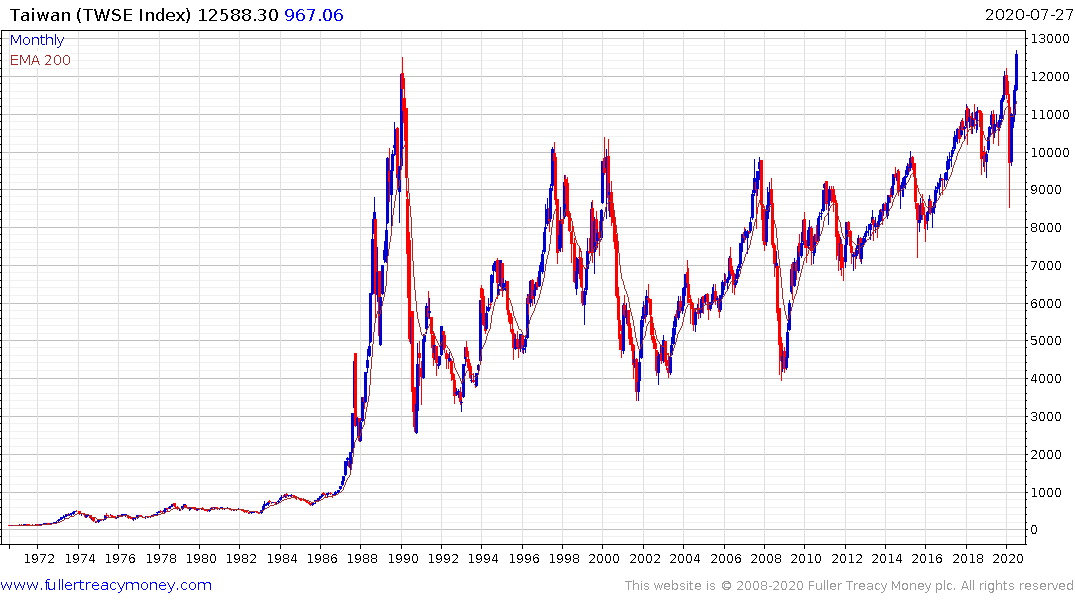

The weakness of the US Dollar bolsters the argument for global investing, in just the same way it did in the early 2000s. The geopolitical risk from China represents a significant headwind from a medium-term investor’s perspective in my opinion. India, Indonesia, Philippines and other high young population countries continue to represent growth opportunities. Rather than focus on expensive US technology, the recent long-term base formation completion of Taiwan is a promising alternative.

The biggest risk from concentration is when it becomes a popular idea.