Email of the day - on Asia ex-China

With your comments yesterday on the video commentary about investing in China, I would appreciate some assistance. Bearing in mind your comments, and David's mantra that "Governance is everything", I do have some concerns about my investments in China. They are all through ITs (such as Aberdeen Asian Income and Schroder Oriental Income) but all have high exposure to China + Hong Kong (16% and 30% for those 2 ITs). Do you know of any income funds that invest in Asia excluding China? Many thanks for your continuing excellent service.

Thank you for this question which gets to the root of many of the conflicting arguments around monetary policy, growth prospects and geopolitics. Interest rates have been risible in Europe, Japan and North America or more than a decade. That promoted growth opportunities over value and in the process compressed yields. Hong Kong and the wider Chinese market offer some of the most attractive income opportunities globally and are not easily replicable.

Even if funds do not invest directly in China, the whole region depends on China for trade and business opportunities. An additional consideration is that China represents an outsized influence in regional benchmarks. In much the same way that Asia-ex Japan funds evolved as Japan’s influence increased, that may also occur with China. If subscribers know of Asia Ex-China income funds, I’m sure they would be of interest to the Collective.

It is worth considering that the majority of the income opportunities in China are from semi-state sector like banks and insurance. These kinds of companies are already under the control of the government and are less likely to be adversely affected by measures to enforce single party control over more of the economy. The clearest overt risk resides with the high growth sector which relied on regulatory arbitrage to capture market share. That window for growth now appears to be closed. Going forward the application of artificial intelligence and big data will focus on government-approved priorities.

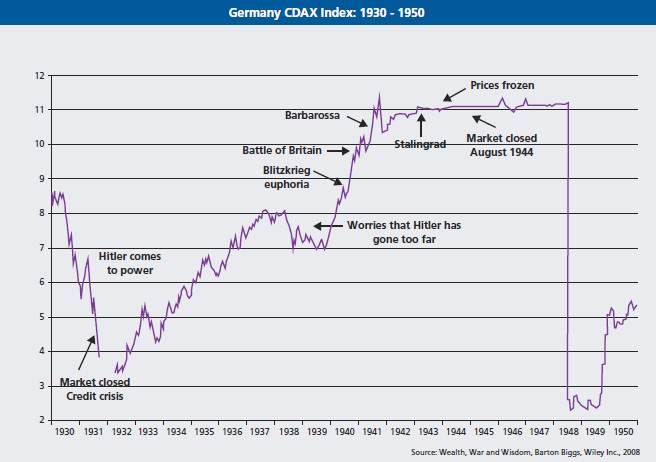

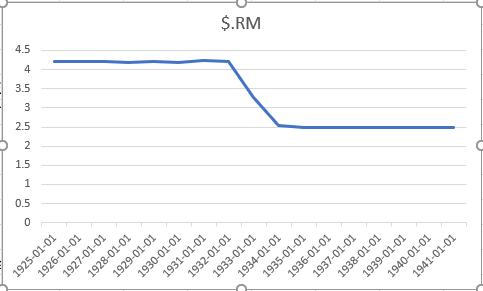

The German CDAX Index rallied from 3 to 11 between 1930 and 1940. The Reichsmark appreciated from 4.2 to 2.5 versus the Dollar between 1925 and 1940. Around the same time the USA was enduring the great depression. The Dow Jones Industrials Average experienced great volatility and the Dollar was devalued. At the time there was a great deal of admiration for what a nationalistic top-down administration could achieve and Nazism had plenty of apologists in other governments. That has all been forgotten now because of World War II.

Therefore, the big question now is whether China is on a similar trajectory? Is it a proto-fascist state? Investors have so far been willing to look past the mass sterilisation of the domestic Muslim population, reneging on treaties over Hong Kong and the threat of annexing Taiwan because they are being rewarded. Everyone is dependent on trade with China. Decaying social fabric in the West, a rising sense of entitlement, inequality and political polarisation only embolden ambitious nations to take advantage.

The primary strength of democracy is it is self-correcting. It’s messy and chaotic, but it is flexible. Self determination means we have scope to change and solve our problems. Democracy is often described as an experiment and that is true. It’s the political equivalent of the move quickly and break things methodology pioneered by Silicon Valley. It’s tempting to conclude that history must repeat itself but we don’t have examples of democratic empires falling over.

The primary weakness of command economies is they are not flexible, and their flexibility deteriorates the stronger they become. Eventually, they also succumb to entitlement and that’s when expansionism takes over.

From an investment perspective we have to weigh the potential benefits versus the risks. China ticks a lot of boxes in terms of currency strength, yield and growth. It falls down badly on governance and minority shareholder interests. That latter point argues against an overweight position.

Back to top