Copper: Staying elevated in 2021

Thanks to a subscriber for this report from UBS which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

Sticking to our consolidation story in 1Q, but… Better-than-expected global manufacturing data (solid industrial production numbers from China, the US, and Europe for November and December) is providing stronger top-down price support for copper than we initially anticipated. On the other hand, China's copper imports are leveling off, as expected. December imports of unwrought copper and copper products continued to be weak, declining to 512kt. As Chinese copper imports are set to slow further in 1Q21, and since second and third waves of the coronavirus pandemic should weigh on US, European, and Japanese copper demand in 1Q21, we do look for some price pullbacks to USD 7,600/mt before prices march higher again.

...prices are set to march higher thereafter Although supply challenges, both mine- and scrap-related, likely triggered a 2.6% decline in refined supply in 2020, these concerns started easing in 2H20. In 2021, mine supplies from Indonesia and the Democratic Republic of Congo are likely to grow. So we forecast copper refined supply will increase by 2.9% in 2021. Meanwhile, we expect global refined copper consumption—driven by manufacturing, housing, and infrastructure—to grow by 4.6% in 2021 (versus –2.9% in 2020). This supply-demand profile leaves us with a market deficit of about 469,000 tons or 2% of annual demand in 2021. The renewed downward pressure on visible inventories could push up the price of copper to USD 9,500/mt by mid-2021, in our view.

Copper has always been leveraged to the traditional drivers of economic growth; infrastructure and communications. The big question for the coming decades is how much of a role will it play in the power generation and transportation sectors. This is a wholly new demand growth avenue for the metal so the growth in demand for green energy and electric vehicles will have a strong influence on investor enthusiasm for the metal.

.png)

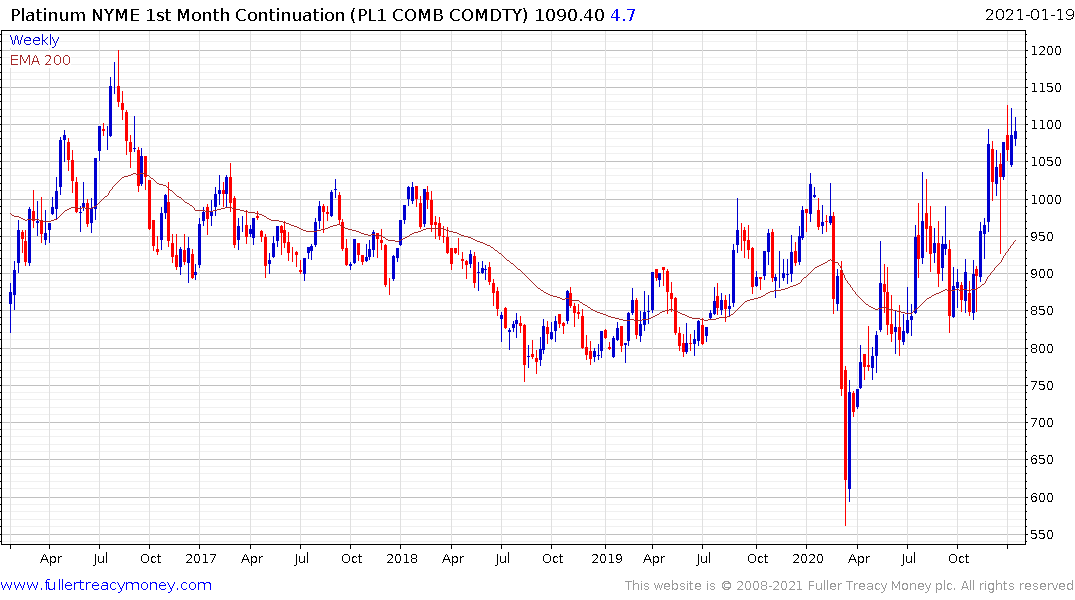

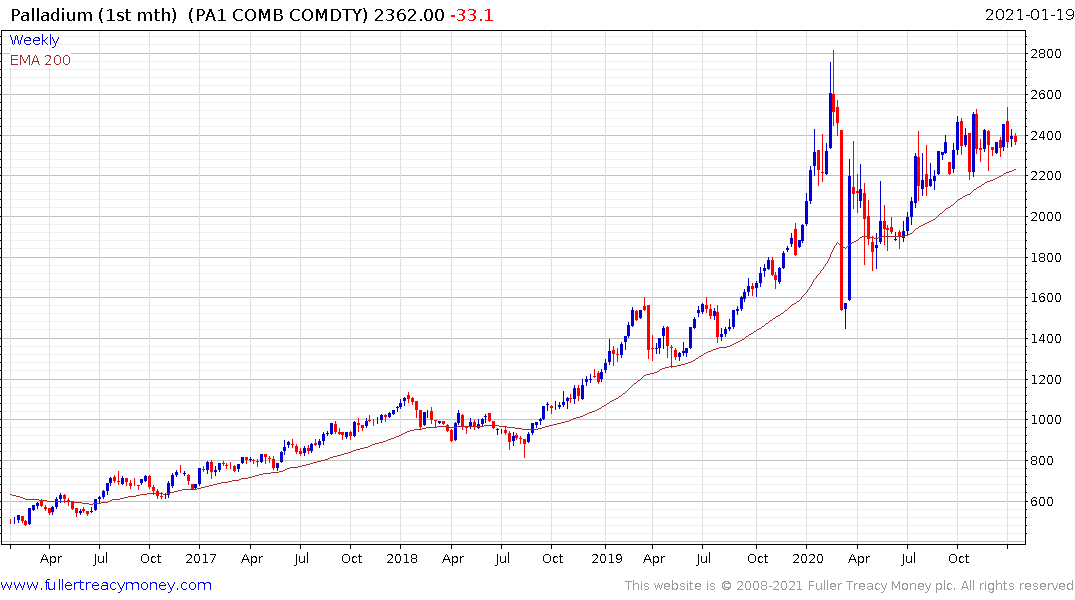

The platinum/palladium ratio is another way of thinking about this question. The palladium price ramped higher as demand for platinum declined. The decline in platinum and nickel mining following the diesel emissions cheating scandal, reduced supply of palladium as a by-product. Concurrently, increased demand for gasoline engines spurred significant price appreciation.

Today’s platinum demand is receiving a boost from the evolution of the hydrogen fuel cell market. Meanwhile, every new EV on the road reduces demand for catalytic converters. The ratio has emerging base formation characteristics.

Platinum has just completed a base formation but palladium has lost momentum in the region of its peak. It has a type-1 acceleration top, followed by the Type-2 massive reaction against the prevailing trend and first step below the top characteristics. A sustained move below $2200 would complete the evolving medium-term peak.

The Copper Miners ETF has completed a five-year base formation.

The FTSE/JSE Africa Platinum Mining Index continues to extend recovery.