Copper and Iron Ore Climb as China May Relax Key Property Rules

This article from Bloomberg may be of interest to subscribers. Here is a section:

Copper and iron ore extended gains on a report that China may ease curbs on borrowings by developers, adding to a raft of measures to bolster real estate which is brightening the outlook for metals.

Beijing may allow some property firms to add leverage by easing borrowing caps, and pushing back the grace period for meeting debt targets, said people familiar with the matter. The moves would relax the stringent “three red lines” policy that had contributed to worsening the country’s real-estate meltdown and hit demand for steel and copper used in construction.

Copper rose as much as 1.5% and was 0.8% higher at $8,437 a ton on the London Metal Exchange as of 11:02 a.m. local time. Iron ore futures in Singapore rose 2.1% to $118.60, reversing a earlier decline.

China’s flurry of stimulus is aiding sentiment, and boosting confidence that the economy is stabilizing, Everbright Futures said in a note. But the optimism is being tempered by a severe wave of Covid-19 across China, which is crimping activity and worsening the seasonal weakness in manufacturing.

China’s three-year quarantine has helped to contain speculative interest in the commodity markets. Now that China is finally stepping in with aggressive measures to support growth and the property market, industrial resources are playing catch up with energy.

A big late-stage run in commodities, where prices accelerate, has been the missing ingredient in this cycle. That now appears to be unfolding as investors reassess the low valuations attached to miners in a rising commodity price environment.

Copper is firming through the trend mean today and testing the upper side of its two-month range. A clear downward dynamic would be required to question scope for additional upside.

BHP Billiton (Est P/E 11.25, DY 13.85%) is on the cusp of breaking out to new all-time highs.

Rio Tinto (Est P/E 8.16, DY 8.72%) is also testing the upper side of its range.

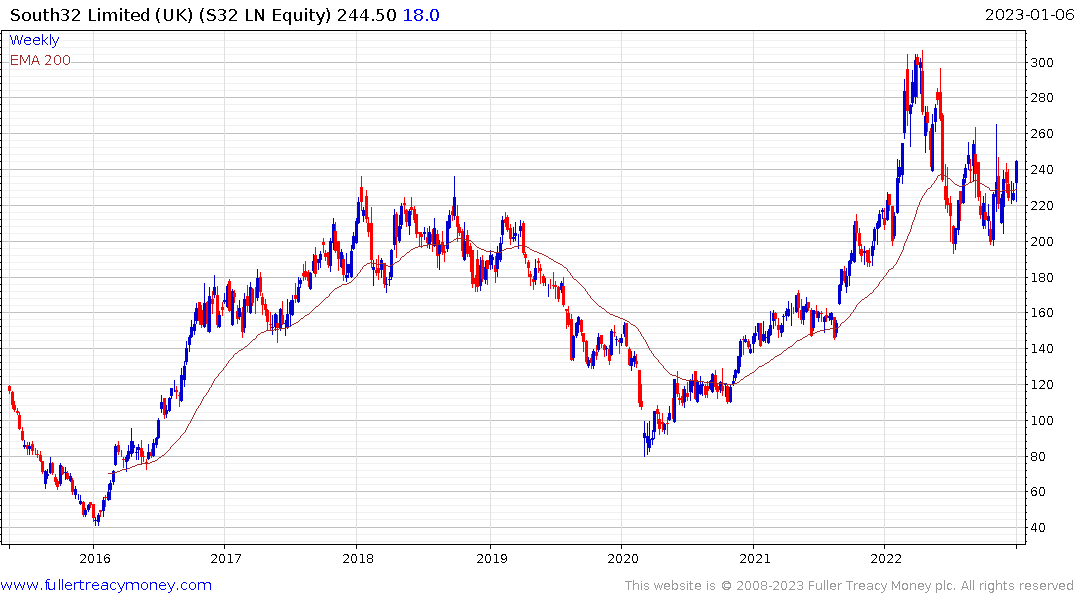

South32 (Est P/E 9.94, DY 11.01%) has lagged but is now firming from the region of the trend mean. It’s a major producer of manganese which is increasingly used in new battery chemistries.

South32 (Est P/E 9.94, DY 11.01%) has lagged but is now firming from the region of the trend mean. It’s a major producer of manganese which is increasingly used in new battery chemistries.

Southern Copper (Est P/E 23.02, DY 2.95%) is a more leveraged play on copper and continues to rebound.

Southern Copper (Est P/E 23.02, DY 2.95%) is a more leveraged play on copper and continues to rebound.