China digital transformation: The Impact of the Internet on productivity and growth

Thanks to a subscriber for this report from McKinsey which may be of interest. Here is a section:

China has posted high rates of labor productivity growth in recent years, but its progress began from a very low base. As a result, its labor productivity remains well below the levels in advanced economies (Exhibit 3). China created $15,500 of GDP per worker in 2013, significantly lower than levels in the United States ($107,200), Japan ($76,700), and Germany ($67,300). A closer look at the sector level bears this out: US labor productivity in the ICT and manufacturing sectors, for example, was 12 and ten times higher than China’s average labor productivity in those sectors, respectively, in 2013.

China faces a growing imperative to continue making strong gains in productivity. The rapid economic growth of recent decades was fueled by an expanding labor force and heavy capital investment, but this model is coming under pressure, particularly as the population ages. In fact, China’s labor force is projected to begin shrinking by 2015. As the dependency ratio doubles over the next two decades, the savings rate is also likely to decline as older Chinese draw down their savings. To avoid a slowdown and continue to improve living standards, China will have to make its existing labor and capital stock more efficient—and wider technology adoption will be central to this effort.

The rapid growth of China’s Internet economy is not yet reflected in its labor productivity performance. From 2010 to 2013, China’s labor productivity increased by 26 percent, while the contribution of Internet-related output to GDP increased by 35 to 60 percent (depending on whether C2C e-commerce is included).

?However, China appears poised to capture large gains as its companies step up their adoption of Internet technologies. According to McKinsey’s latest survey of Chinese CIOs, the typical Chinese company spends 2 percent of revenue on IT, far below the 4 percent international average. These same respondents predict their IT spending will increase to 3 percent of revenue by 2015—and while that still leaves a large gap, it indicates clear momentum.26 As Chinese companies digitize their operations on a wider scale, they will gain the ability to streamline operations, open new sales channels, accelerate the R&D process, and become leaner.

The Internet is likely to usher in disruptive change, but it is also a catalyst for faster productivity growth. We project that the new applications described in this report could contribute 7 to 22 percent of China’s overall labor productivity improvement by 2025. Capturing this potential will be critical for China’s future competitiveness, particularly as the country’s labor costs increase and its demographic dividend diminishes.

Here is a link to the full report.

China has succeeded in transforming its economy by leveraging its low labour costs and enormous population. However as the population ages and wages increase, delivering productivity gains is essential if the country is to succeed in attaining its long-term development goals.

A large number of countries have succeeded in moving from low income to middle income economies but the number that have persisted with their goal of moving into the high income bracket is considerably smaller. Continued zeal for the policy objectives that deliver productivity growth will be worth monitoring as a result. China’s digital economy represents a promising development and suggests that it will succeed in continuing to move up the ranks of GDP per capita.

Alibaba is China’s largest online retailer and its upcoming IPO is generating a great deal of interest among investors which suggests it will be overpriced.

Tencent Holdings signed a joint venture agreement with JD.com in March to merge their online e-tailing operations in an effort to combat Alibaba’s dominance. JD.com IPOed in the USA last month and its share price has been relatively stable since.

Soufun Holdings Ltd. has rallied to break a six-month progression of lower rally highs.

E-commerce China DangDang’s ADR has held a progression of higher major reaction lows for a year and totally unwound its impressive February advance by late May. It continues to rebound from the region of the 200-day MA.

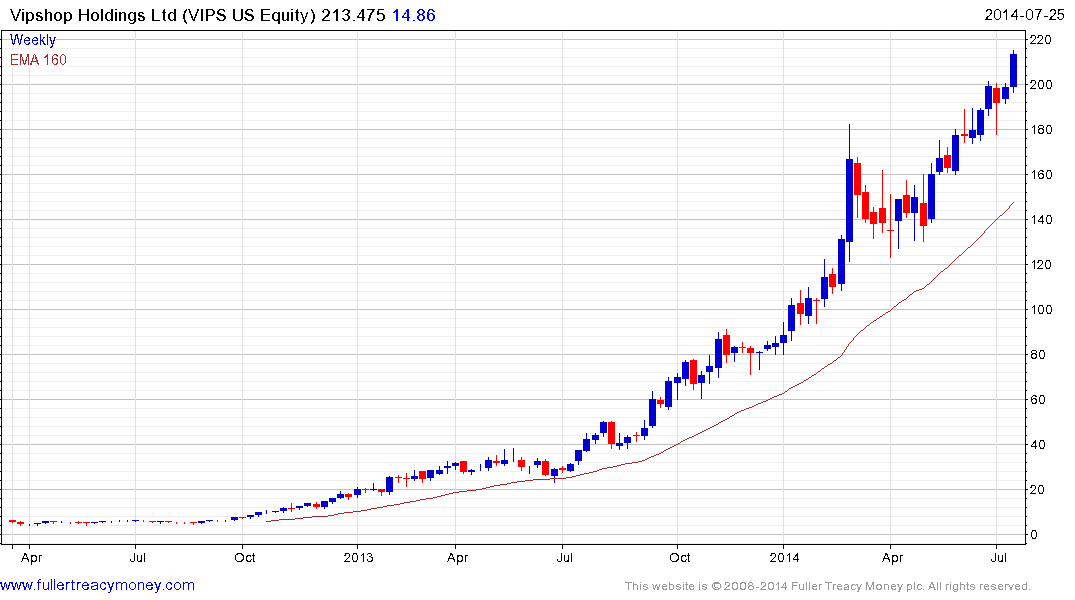

Vipshop’s ADR continues to trend consistently highs. Its estimated P/E of 80 is racey but the uptrend can be given the benefit of the doubt provided it continues to hold the progression of higher reaction lows.

In looking at online retailers outside the USA I spread the net a little wider than China and came across B2W Companhia Global Do Varejo listed in Brazil. The share bottomed in the 2012 and completed its base in January. It continues to hold a progression of higher reaction lows and a break in the sequence would be required to question medium-term recovery potential.

Back to top