China Pledges Liquidity, Asks for Rational Investor Reaction

This article by Christopher Anstey and Claire Che for Bloomberg may be of interest to subscribers. Here is a section:

China pledged to provide abundant liquidity for money markets and urged investors to evaluate the impact of the coronavirus objectively, as the nation prepared for a potentially tumultuous resumption of trading next Monday.

Along with a potential sell-off in Chinese stocks, which haven’t traded onshore since Jan. 23, there’s a “large amount of funds” coming due Feb. 3, the People’s Bank of China said in a statement. It will conduct operations “to provide abundant liquidity in a timely manner to maintain reasonable and sufficient liquidity in the banking system,” it said.

China’s top securities regulator separately told brokerages to prepare for off-site trading as the country’s market infrastructure girds for strained conditions as a result of measures aimed at containing the coronavirus epidemic.

The question of what would be required for China to kickstart meaningful stimulus again now appears to have been answered. The coronavirus and the economic shutdown it has necessitated are going to result in a meaningful hit to growth in the first quarter. With the extension of its holiday season into early February, China is taking advantage of the break to announce market calming measures aimed at averting a crash once the market opens up again. That means a significant stimulus infusion to allay growth fears.

Alibaba confirmed near-term support today in the region of the 2018 peak and the psychological $200 level. A sustained move below the trend mean would be required to question medium-term scope for support building.

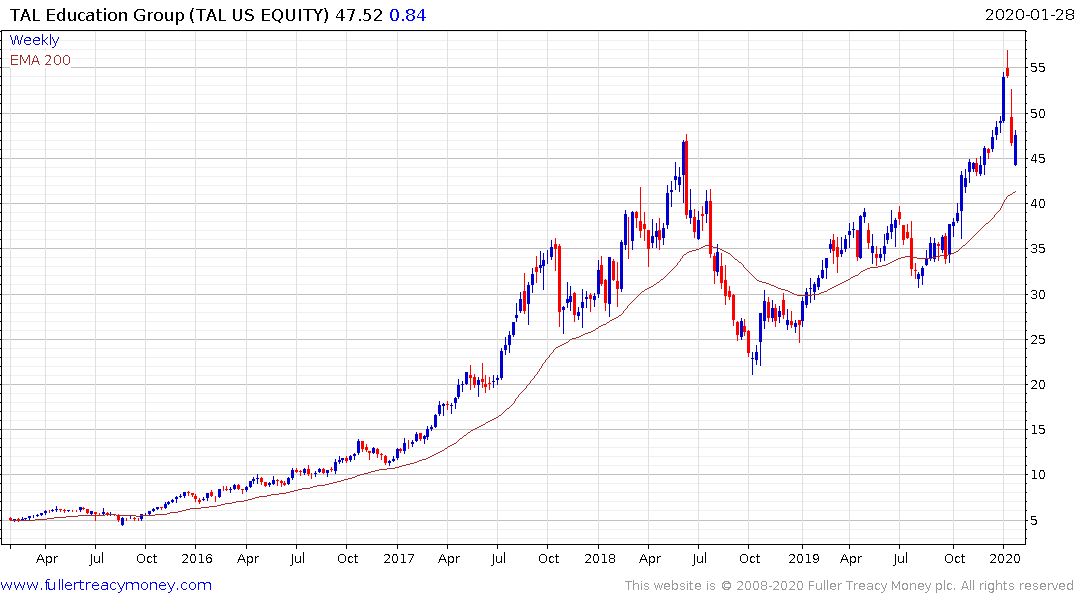

TAL Education also firmed from the region of tis 2018 peak. While some additional ranging is likely, a sustained move below the trend mean would be required to question the demand dominated environment.

The China Fund Inc is trading at a discount to NAV of 11% and is currently testing the region of the trend mean and yearlong sequence of higher reaction lows.