BHP left with $2.8bn of reject assets after spinoff

This article by David Stringer for Bloomberg may be of interest to subscribers. Here is a section:

Despite BHP Billiton’s spin off and sale of about $15 billion of unwanted assets over the last three years, the biggest miner remains saddled with a portfolio of even harder-to-shift rejects.

A total of nine assets — from a US thermal coal mine to UK oil and gas platforms — haven’t made the cut for a new slimmed-down parent or the demerger company South32.

The unloved operations, valued at more than $2.8 billion according to RBC Capital Markets, are hampering Chief Executive Officer Andrew Mackenzie’s quest to halve the size of BHP’s core portfolio to focus on big ticket earners including crude oil, iron ore and copper.

“They did the big clean up with South32 and these are what are left,” said Michelle Lopez, a Sydney-based investment manager at Aberdeen Asset Management Ltd., which holds BHP shares. “I’m sure they’ve been on the sale slate for a long time. It’s a disappointment.”

Global mining companies are trimming portfolios to focus more closely on their most profitable operations as commodity prices have tumbled and amid a drive to reduce costs.

BHP, Rio Tinto Group and Glencore Plc have agreed the sales of $14.3 billion of assets since 2012, according to data compiled by Bloomberg.

An attempt to sell one of BHP’s reject assets, the Nickel West unit of mines and facilities in Australia, ended in November after it failed to attract a suitable bid. BHP has taken $1.8 billion in writedowns on the operation since 2012.

BHP Billiton has a market cap of approximately £78 billion. South32, which represents the spin-off of industrial metal businesses not least alumina, has a market cap of over £6 billion so the additional assets the company could neither sell nor spin-off represent a comparatively small proportion of the overall business. I have added both the UK and Australian listings of South32 to the Chart Library.

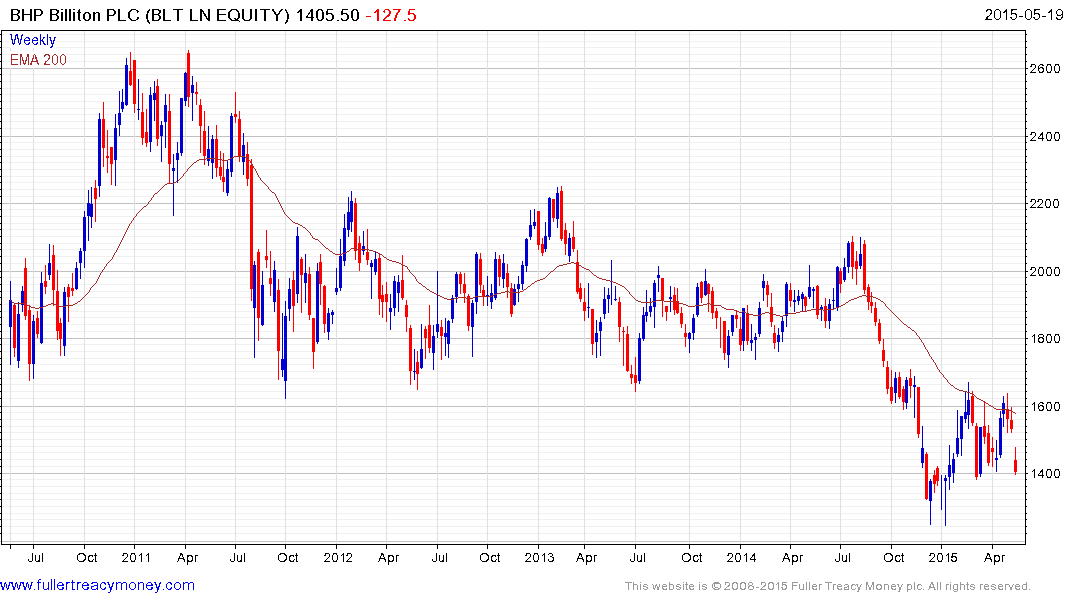

With somewhat slimmer operations BHP Billiton may be in a better position to weather the volatile commodity price environment that we can anticipate for the foreseeable future. However, the company’s position as the only miner in the S&P Europe 350 Dividend Aristocrats is open to question as iron-ore prices languish and oil prices remain well below the levels seen over the last few years. The share encountered resistance in the region of the 200-day MA and the lower side of the overhead trading range last week. The yield of over 6% should act as a support provided investors believe it can be sustained but a move above 1600p will be required to signal a return to demand dominance.

Back to top