The Future of Uncertainty

Thanks to a subscriber for this transcript of 3rd Atal Bihari Vajpayee Memorial Lecture delivered by Ambassador Bilahari Kausikan of Singapore in New Delhi yesterday. Here is a section:

First, no country can avoid engaging with both the US and China. Dealing with both simultaneously is a necessary condition for dealing effectively with either. Without the US there can be no balance to China anywhere; without engagement with China, the US may well take us for granted. The latter possibility may be less in the case of a big country like India, but it is not non-existent.

Second, I know of no country that is without concerns about some aspect or another of both American and Chinese behaviour. The concerns are not the same, nor are they held with equal intensity, and they are not always articulated – indeed, they are often publicly denied -- but they exist even in the closest of American allies and in states deeply dependent on China.

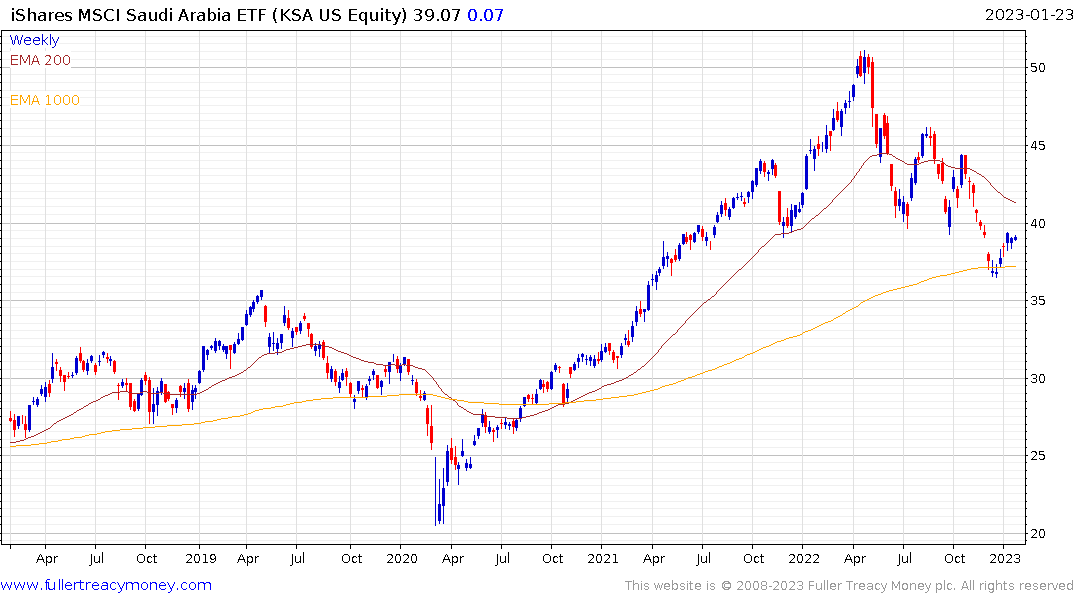

This perspective gels very well with the reality on the ground I observed in Saudi Arabia on my last two visits. The simple reality is China is the country’s biggest customer and the USA the country’s greatest geopolitical ally. There is no way to play favourites the greatest risk for any country is to be taken for granted because that greatly enhances the scope for one’s interests to be trampled.

Every country will need to develop the skill set to manage the national priorities of their biggest trading partners. This is a bigger challenge for Australia than India or Saudi Arabia but the transition is a necessary one.

Saudi Arabia’s response is to enforce improving standards of governance on its neighbours. The aim is to create a sufficiently large power bloc to standup to great power competition.

The iShares MSCI Saudi Arabia ETF continues to steady from the 1000-day MA as it unwinds the short-term oversold condition.

The iShares MSCI Saudi Arabia ETF continues to steady from the 1000-day MA as it unwinds the short-term oversold condition.

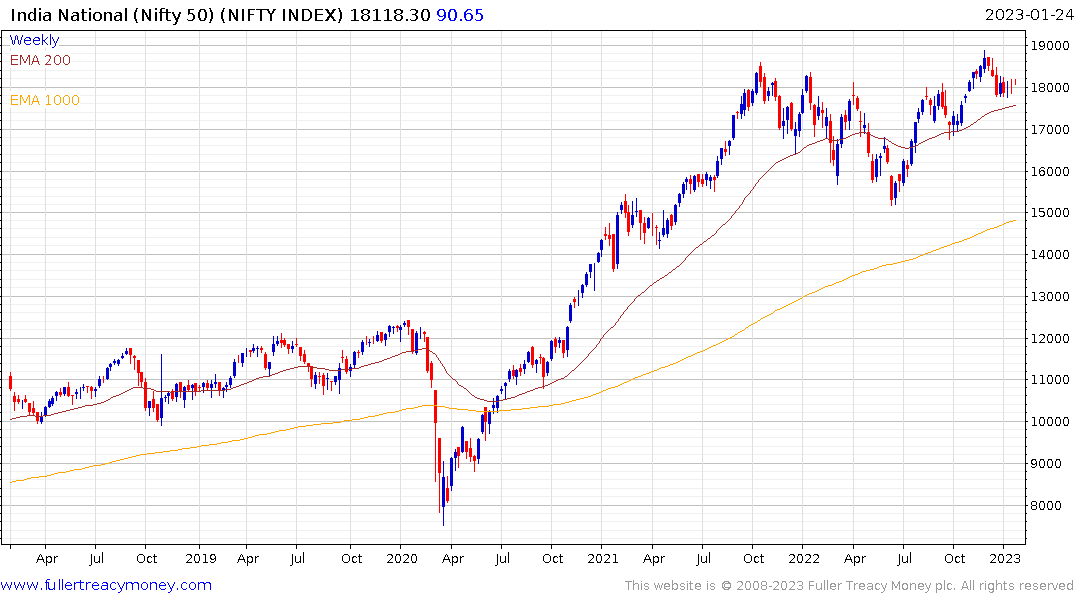

India is investing heavily in the China +1 strategy with the clear aim of being the destination of choice for outsourcing risk.

The Nifty Index remains susceptible to underperformance as the focus on investor attention remains focused on China’s reopening.

The Nifty Index remains susceptible to underperformance as the focus on investor attention remains focused on China’s reopening.

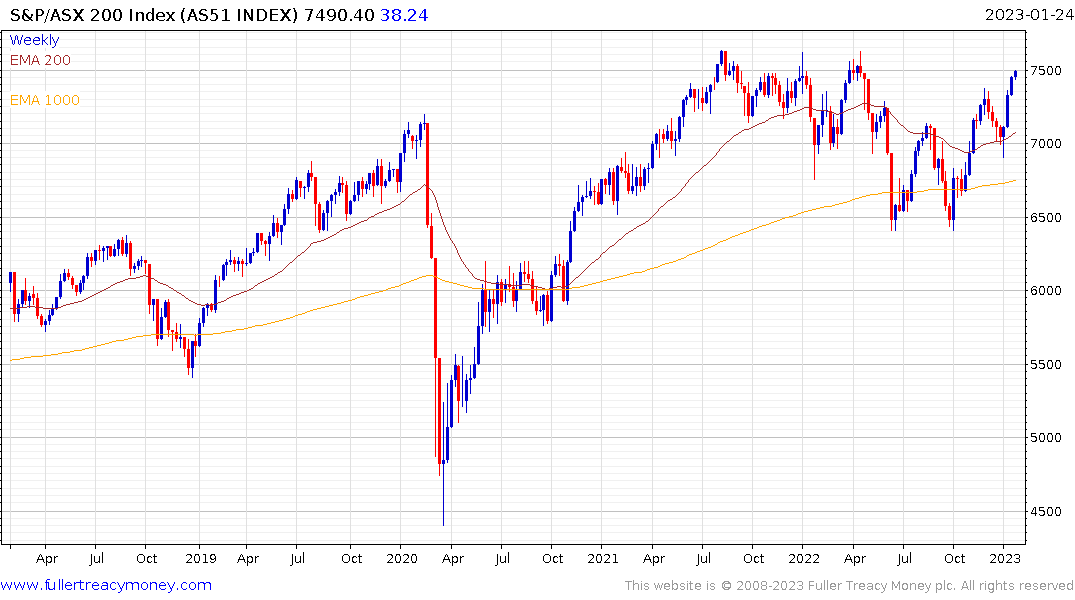

Australia is politically and culturally aligned with the Quad but China is its biggest customer for exports. I imagine Canberra would like nothing more than China to make fewer headlines so they can quietly export as much as possible to them.

The S&P/ASX 200 continues to extend its rebound and is back testing the peaks from 2021.

The S&P/ASX 200 continues to extend its rebound and is back testing the peaks from 2021.