Platinum Quarterly Presentation Q1 2020

This report carries a great deal of relevant information for the platinum market. Here is a section:

Automotive demand down only 17% (-132 koz) YoY despite a 24% fall in Q1 light global vehicle sales

Tightening global emissions standards, driving higher pgm loadings, partially counters lower auto sales/production

W. Europe diesel share decline slowed on increased diesel sales

Diesel vehicles still key for automakers to avoid or reduce heavy CO2 fines

German diesel car market share continued to recover (Q1’20 average 35%, up 1.3% over 2019 average)

Here is a link to the full report.

It’s easy to think that diesel is a dead fuel but sales still continue. The damage to consumer confidence may, however, be impossible to overcome. That is creating a new market for transportation alternatives.

Newer electric car battery chemistries are much more nickel intensive than internal combustion engines. The metal remains on a recovery trajectory.

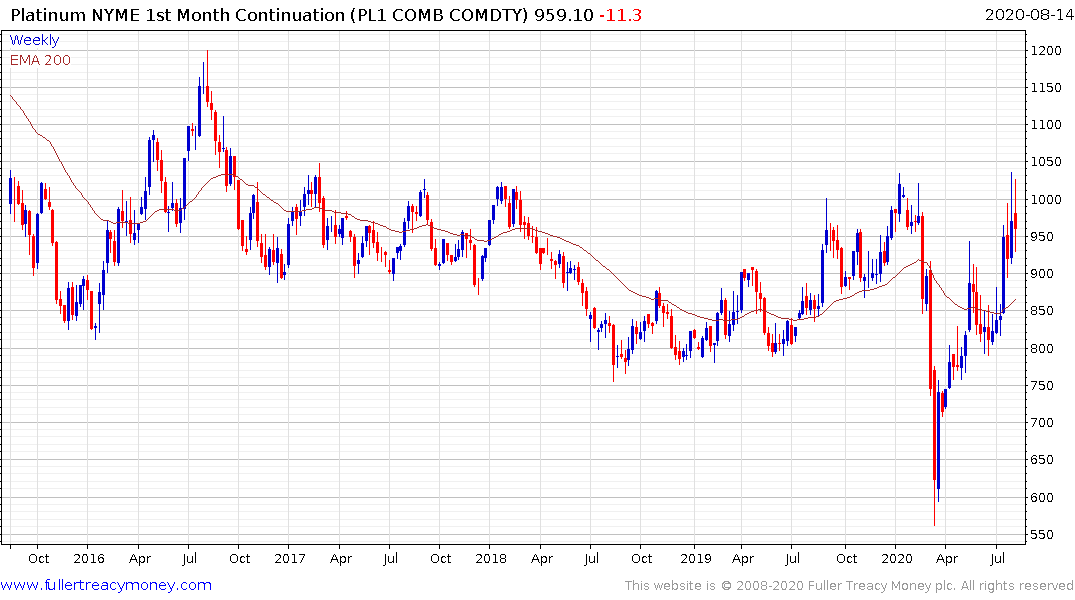

The argument for hydrogen is dependent on battery chemistry not improving any further. If ranges are further extended and that achievement is coupled with swift charging, the rationale for hydrogen fuel cells will evaporate. Where hydrogen has a clear advantage is in flight or in the marine environment. As a catalyst platinum has scope for benefit from that market. The price continues to range below $1000 and will need to sustain a move above that level to confirm a return demand dominance.

The vast majority of hydrogen still comes from natural gas reforming. The price is still relatively depressed but it broke out to new recovery highs today as it rebounded from the lower side of a long-term range.