OPEC Considers 2019 Oil Production Cuts in Yet Another U-Turn

This article by Grant Smith and Javier Blas for Bloomberg may be of interest to subscribers. Here is a section:

Earlier in the summer, prices began to surge as the risk of production shortfalls from sanctions on Iran and Venezuela’s economic collapse rattled the market. Losses from those two OPEC members threatened the biggest supply disruption since the start of the decade and Brent crude eventually peaked above $86 a barrel last month.

Since then, big things have happened on the other side of the supply equation. OPEC has been in “produce as much as you can mode” to reassure consumers, according to Saudi Energy Minister Khalid Al-Falih. The kingdom has lifted output close to record levels, while Libya is pumping the most in five years. Unexpected waivers for buyers of Iranian crude have blunted the impact of U.S. sanctions.

Then there’s the small matter of American production growing at the fastest rate in a century, just as fuel demand is at risk from the slowdown in emerging economies and the U.S.-China trade war.

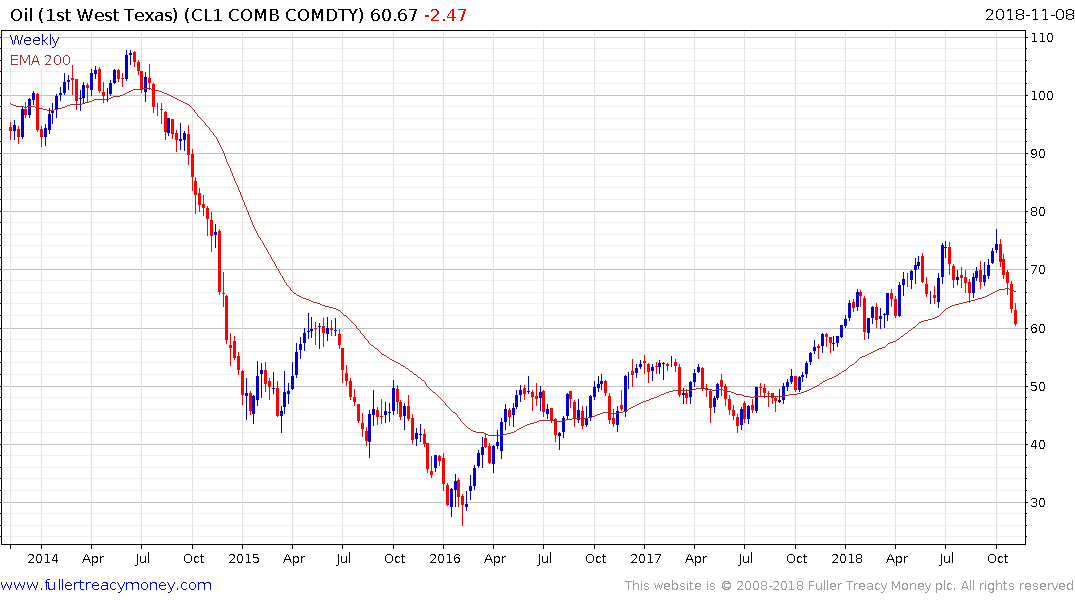

The Brent Crude price trended higher in a consistent manner for more than half of 2017 with each $5 range being one above another. Then the price pulled back by $10 in 2018 before rallying $20 from the low, pulled back by $10 and if consistent would have been expected to rally $20. However, the rally did not quite manage to extend its breakout by that much and has now experienced a much larger reaction. Additionally, the price is back below the trend mean. A deep short-term oversold condition is now evident but a clear upward dynamic will be required to check supply dominance.

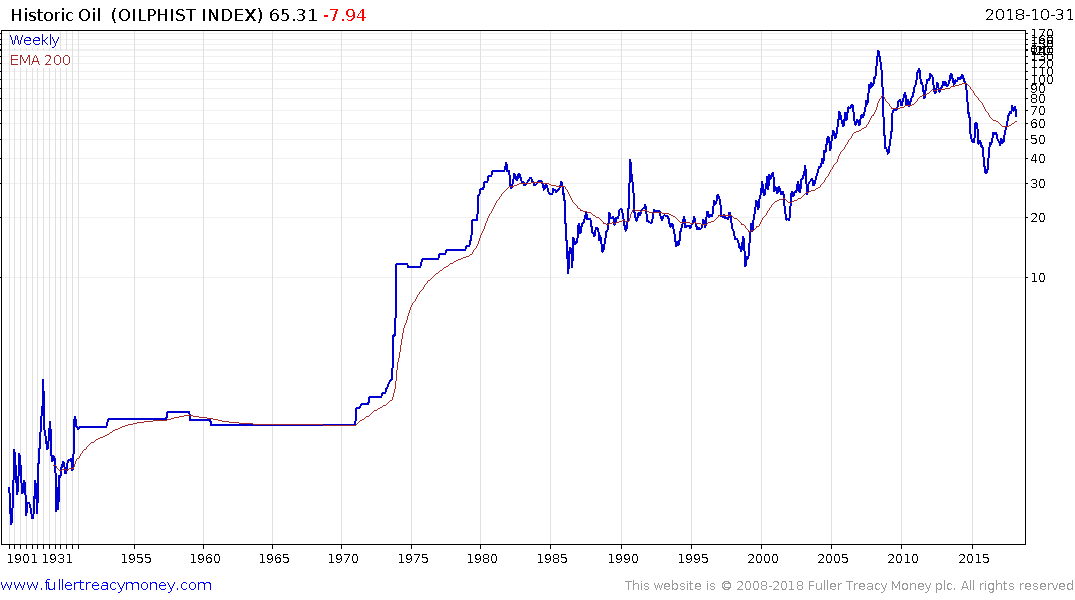

Oil prices tend to move in long-term cycles, with multi-decade ranges giving away to decade-long bull markets. The peak in 2008 marked the top of the last major bull market and the extraordinarily volatile ranging since represents a typical format for what we can expect from a secular bear market. If the lower side of the evolving range is close to $40 the big question is, where is the upper side of the range?

It is abundantly clear that a lot of new supply becomes economic around $70. If OPEC and Russia do in fact reduce supply in an attempt to inflate prices, that will only encourage more drilling in North America and other higher cost production regions like tar sands or deep water. What this discussion indicates is there is no shortage of oil. The fact Russia and Saudi Arabia are already talking about reducing supply highlights just how sensitive they are to any fall in the price of oil below $75. That is setting up a volatile environment where a consistent trend is less likely to evolve.