Musings from the Oil Patch March 22nd 2016

Thanks to a subscriber for this edition of Allen Brooks’ ever interesting report for PPHB. Here is a section on savings:

Mr. Burns, a long-time financial journalist and the creator of the “Couch Potato” investment portfolio, authored a column recently pointing out the dilemma faced by retirees who wished to finance their retirements without assuming any risk, or as he titled it, “How to cope with the great yield famine.”

The column, published about two weeks ago, pointed out that the last time anyone earned 6% on a six-month certificate of deposit (CD) was December 2000. The lowest yield on a six-month CD immediately after the dotcom market crash was 1.01% in June 2003. The highest yield on a six-month CD since June 2003 was 5.22% in July 2006. Today, according to Bankrate.com, the highest yield on a six-month CD nationwide is 1.10%, but the vast majority of banks offer less than 0.15%.

He then went on to figure out the retiree’s needs and how much capital was required to meet those needs risk-free. The monthly premium for Medicare Part B is $121.80, or $1,461.60 a year. To earn that much money from a 0.15% CD you would need to keep $974,400 on deposit. For most Americans that is a large sum, but it is not a problem since Social Security deducts the payment from your monthly check.

The official federal poverty level income for a family of two for 2016 is $15,930. To generate that income from a risk-free CD at 0.15% interest, you need to deposit $10,620,000. To finance a poverty-level retirement with a risk-free investment portfolio means you have to maintain $11,594,400 of your assets on deposit in those low-yielding CDs, which would place you among the top 1% of wealthy Americans. Think about that. If you don’t want to accept financial risk in your retirement, you must be in the top group of Americans in terms of wealth. The rich are poor! In order to keep our world spinning and boost its growth rate, there are no risk-free avenues available for ordinary Americans. Recognition of this condition, coupled with the stock market’s volatility, may be fuelling a portion of the anger we are seeing among the electorate today. This situation will also be an anchor on how fast our energy needs grow.

Here is a link to the full report.

The impact on savers of the near zero and increasingly negative interest rates we are now presented with represents a major challenge for savers. A subscriber left this comment on a piece I posted Friday and I believe it is well worth repeating here:

“I find it very concerning that central bankers, like finance ministers, never discuss the distortions produced in the future savings markets by the NIRPs.

“Pension funds and insurance companies are suffering even more than banks, but no one is discussing this. It seems to me that in the medium term the dysfunction of markets under NIRP will continue to produce counterproductive effects on risk appetite, which will negate the aim to increase risk acceptance by investment in business assets (as opposed to just paper).”

I agree that the issues you discuss represent serious issues for individual savers and pensions have a whole series of problems because they do not have the same number of workers paying into schemes they had previously. However it is worth keeping in mind that pension funds and insurance companies have to employ a mark to market valuation metric. Yields are risible right now for new bond investors but legacy holders of this debt have benefitted enormously from the momentum fueled rally that drove yields to these levels. Right now momentum has compensated them for the decline in yield. That won’t always be the case but until the status quo changes they are unlikely to come under the kind of pressure you describe.

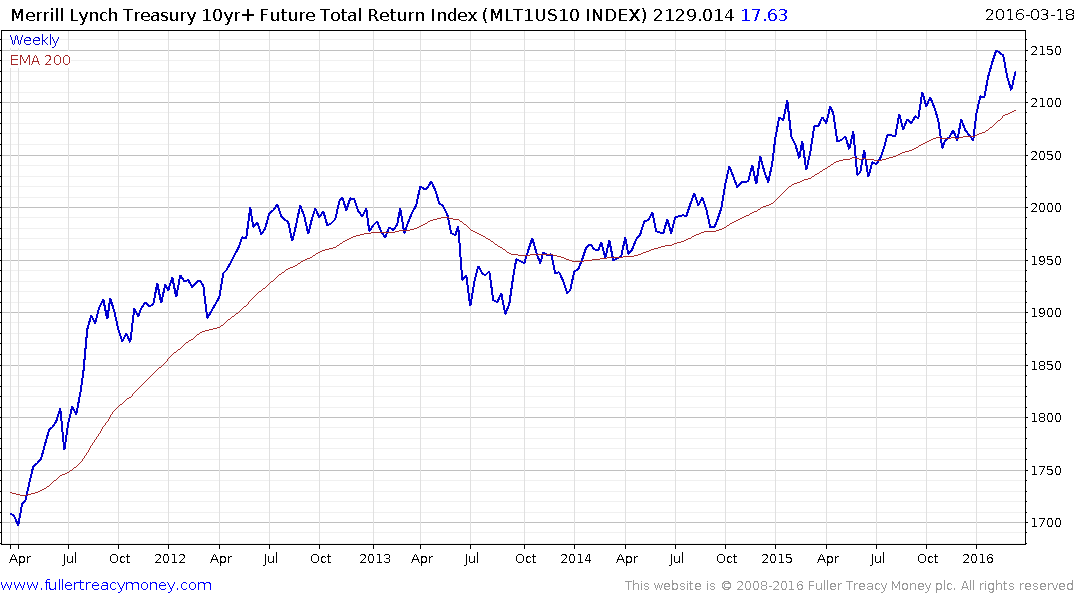

The Merrill Lynch 10yr+ Total Return Index is one of the best barometers of that momentum trend and it found support last week in the region of the upper side of its underlying range.

The Bloomberg World Insurance Index is highly diversified with Berkshire Hathaway, China Life and Allianz in its top 3 holdings. The Index has not been immune to the regulatory issues that have assailed the global banking sector. As you mention all fixed income investors have been forced to move out the risk curve to capture yield so the underperformance of high yield is also likely to have been a factor in the underperformance of insurance shares. The Index has rallied for five consecutive weeks to challenge the region of the declining trend mean and will need to sustain a move above it to demonstrate more than near-term steadying.

Back to top